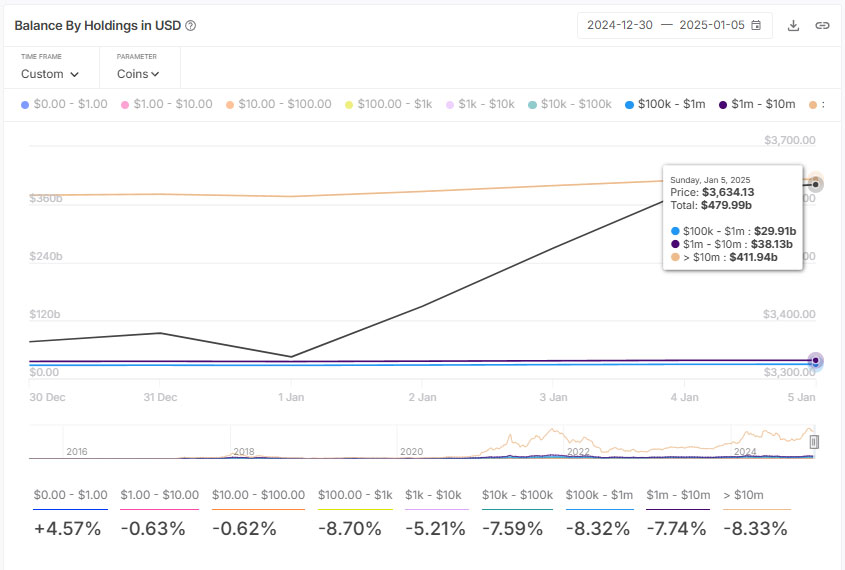

Whales Increase Ethereum Holdings to Nearly $480 Billion

As Bitcoin approaches $100,000, Ethereum has surpassed $3,600, driving its market cap close to $450 billion. The Ethereum price increased by 8.5% over the past week, indicating a bullish recovery and projecting a potential rise to $4,000.

Ethereum Price Trajectory to $4,000

The 4-hour price chart shows Ethereum's bullish recovery, exceeding the $3,500 supply zone. The price remains above the 50% Fibonacci level at $3,604. Increased buying pressure has pushed the 4-hour RSI line into the overbought zone, and a golden crossover is observed between the 50 and 200 EMA lines.

Currently trading at $3,666, Ethereum faces resistance from the 61.80% Fibonacci level at $3,723. A potential short-term pullback may occur as bulls struggle to surpass $3,700, leading to consolidation between the 50% and 61.80% Fibonacci levels. A breakout beyond these levels will dictate future price movement, with a bullish breakout targeting the previous swing high of $4,109. Support remains at $3,500.

Major Ethereum Balance Holdings Rise to Almost $480 Billion

In the last week, whale holdings in Ethereum surged, with total balances between $100,000 and over $10 million rising from $442.67 billion to $479.99 billion, an increase of $37.32 billion. Notably, the category for investments exceeding $10 million grew from $379.07 billion to $411.91 billion, while the $100,000 to $1 million band rose from $27.81 billion to $29.91 billion. The $1 million to $10 million band reached $38.13 billion, up from $35.79 billion a week prior.

Ethereum ETFs on a Rocky Road

On-chain data indicates renewed institutional support, with daily net inflows for U.S. Ethereum spot ETFs reaching $58.79 million on January 3. However, weekly inflows recorded a net outflow of $38.20 million, leaving total net assets at $13.03 billion, significantly up from $6.94 billion in the past two months.

Conclusion

Ethereum's bullish trend is supported by technical indicators and on-chain data reflecting increased investor confidence. A breakout above $3,700 could lead to a target of $4,109, with support at $3,500 providing stability. Institutional inflows and whale activity further enhance the recovery outlook.