6 0

Whales Acquire Bitcoin at Record Levels Amid Exchange Outflows

Large investors are significantly increasing their acquisition of Bitcoin, purchasing three times the daily supply produced by miners. This activity suggests a potential price surge ahead.

Whale Activity and Exchange Outflows

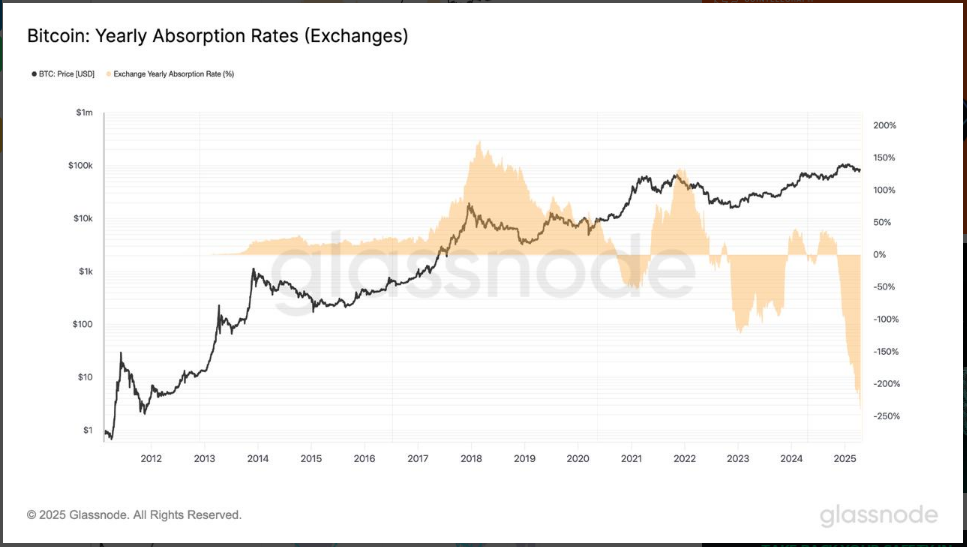

- Investors holding 100 to 1,000 Bitcoins are buying aggressively, absorbing over 300% of Bitcoin's annual supply.

- Exchanges are experiencing steady outflows of Bitcoin as large holders move assets into long-term storage.

- This trend indicates growing confidence in Bitcoin's long-term value.

- Many large investors view price drops as opportunities to increase holdings rather than sell.

Technical Resistance Levels

- Bitcoin is testing resistance at its 50-day and 200-day exponential moving averages, around $85,500.

- A pullback may occur if these levels are not breached; support is expected at approximately $80,000.

- The price range has been between $75,000 and $85,000, suggesting accumulation may be happening before a significant price movement.

Current Market Correction

- Bitcoin has corrected nearly 30% since reaching highs close to $100,000 earlier this year.

- This correction aligns with typical trends observed in previous bull markets, where a 25-35% drop occurs midway through the cycle.