2 0

New Whales Drive Bitcoin Below $90,000 Amid Market Volatility

Bitcoin has dropped below $90,000 due to rising macroeconomic tensions between the US and EU, alongside geopolitical issues in Greenland. This decline highlights Bitcoin's sensitivity to global uncertainty.

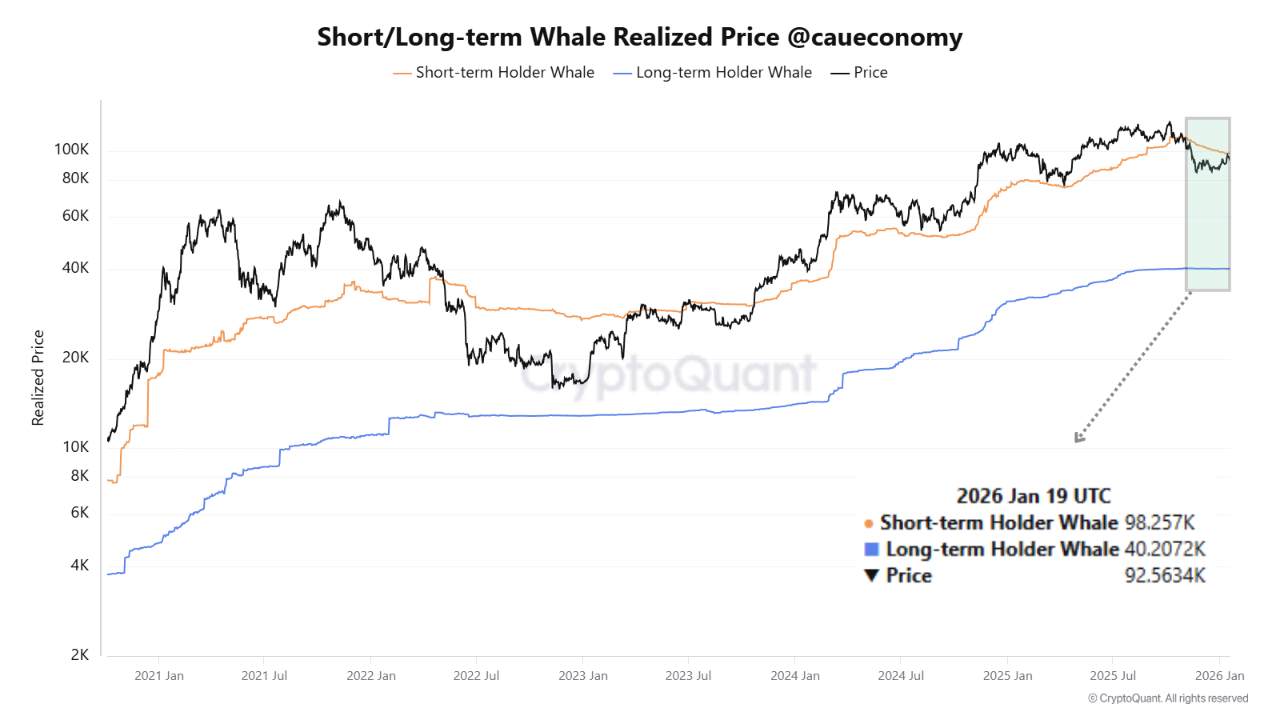

- On-chain data reveals a market shift with "new whales" now holding a larger share of Bitcoin's Realized Cap than long-term holders. This indicates that a significant portion of BTC supply recently changed hands at higher prices.

- The dominance of new large holders influences short-term supply dynamics, making the market more reactive and sensitive to volatility.

New Whales Influencing Bitcoin's Trajectory

- Realized Cap shifts toward new whales, indicating market control is moving from experienced holders to newer investors.

- The realized price for new whales is near $98,000, with current spot prices below this level, resulting in approximately $6 billion in unrealized losses.

- New whales have driven most realized losses since the market peak, often selling during downturns.

- Long-term whales remain profitable with a realized price around $40,000, showing limited activity compared to new whales.

Bitcoin Breaks Below Key Support Levels

- Bitcoin trades near $88,300 after losing the $90,000 psychological level, reflecting a downtrend from late-2025 highs.

- BTC remains below major moving averages, which serve as dynamic resistance. Recent rebounds faced strong rejections, indicating heavy overhead supply.

- Volume spikes during selloffs suggest forced activity, while recovery attempts show weaker participation.

- As long as Bitcoin stays below the $90K–$92K zone, downside risk remains if fear intensifies in the crypto market.