36 5

Bitcoin Whales Withdraw Over $160M From Binance and FalconX

Bitcoin is currently trading slightly above $110,000, with bulls defending key support levels following last Friday's sharp decline. The market remains tense, with divided sentiment on recovery prospects.

- BTC shows signs of consolidation after a volatile week, but uncertainty persists as traders assess stabilization versus further sell-off risks.

- Onchain data reveals significant whale activity, indicating potential accumulation or strategic repositioning as large amounts are withdrawn from major exchanges.

Whale Activity and Strategic Accumulation

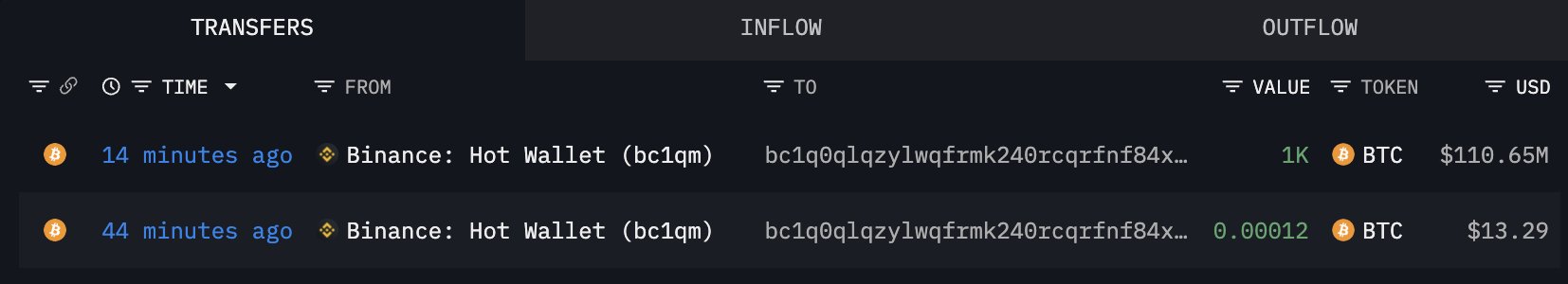

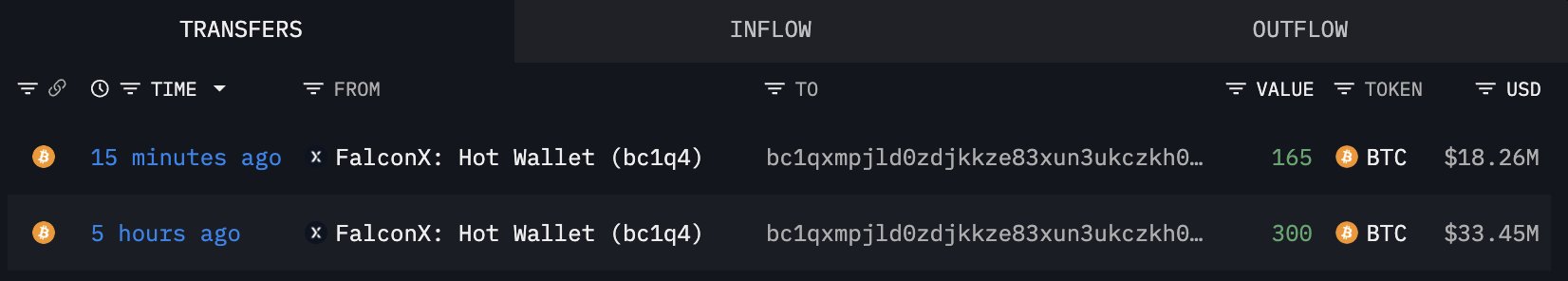

- A newly created wallet withdrew 1,000 BTC ($110.65M) from Binance, and another withdrew 465 BTC ($51.47M) from FalconX, totaling over $160 million.

- Such movements typically signal reduced selling intent and a bullish long-term outlook despite short-term market fragility.

Despite these developments, volatility may persist as the market remains fragile. Bitcoin could continue to trade within the $108K–$115K range during this consolidation phase.

Bitcoin Bulls Defend $110K Support Amid Consolidation

- Bitcoin is around $111,300, showing resilience post-crash. It consolidates above the $110K support zone, a key area for past corrections.

- The 50-day moving average acts as resistance near $115K, while the 200-day average provides structural support at $107K, indicating a neutral-to-bearish short-term phase.

- The $117,500 level is crucial for confirming a recovery, while a drop below $109K could lead to further correction towards $106K.

Market sentiment remains cautious but stable, with current consolidation critical for determining the next major price direction.