8 0

XRP ETFs Experience First Outflows Amid Broader Crypto ETF Market Downturn

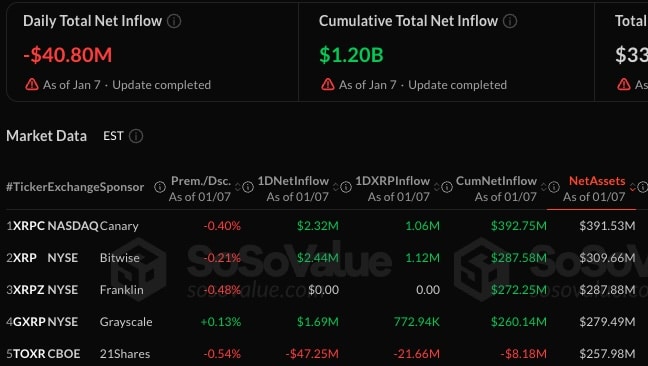

On January 7, spot XRP ETFs in the US reported their first outflows of $40.7 million since launch, following 6-7 weeks of consistent inflows. This coincides with a broader downturn in the crypto ETF market, with both Bitcoin and Ethereum ETFs experiencing significant outflows.

XRP ETF Outflows Begin

- The initial outflow for XRP ETFs occurred after steady accumulation starting mid-November 2025.

- Total inflows for XRP ETFs remain robust at $1.2 billion despite recent outflows.

- The 21Shares XRP ETF experienced an outflow of $47.25 million, while other ETFs showed stable or positive inflows.

Despite the outflows, XRP ETFs maintain strong performance with total net assets above $1.5 billion, indicating continued investor interest. XRP began 2026 strong, reaching $2.4 with a 13% increase earlier this week but has since decreased by 6.27%, trading at $2.10.

Overall Crypto ETF Market Trends

- Spot Bitcoin ETFs saw inflows early January but reversed with $243 million and $486 million outflows on January 6 and 7, respectively.

- Spot Ether ETFs also shifted to negative with $98 million outflows on January 7 after initial inflows earlier in the month.

- Smaller crypto ETFs like Solana continued to see inflows, while Chainlink ETFs recorded flat flows on January 7.