1 0

XRP ETFs Suffer $53M Outflow Amid Market Weakness

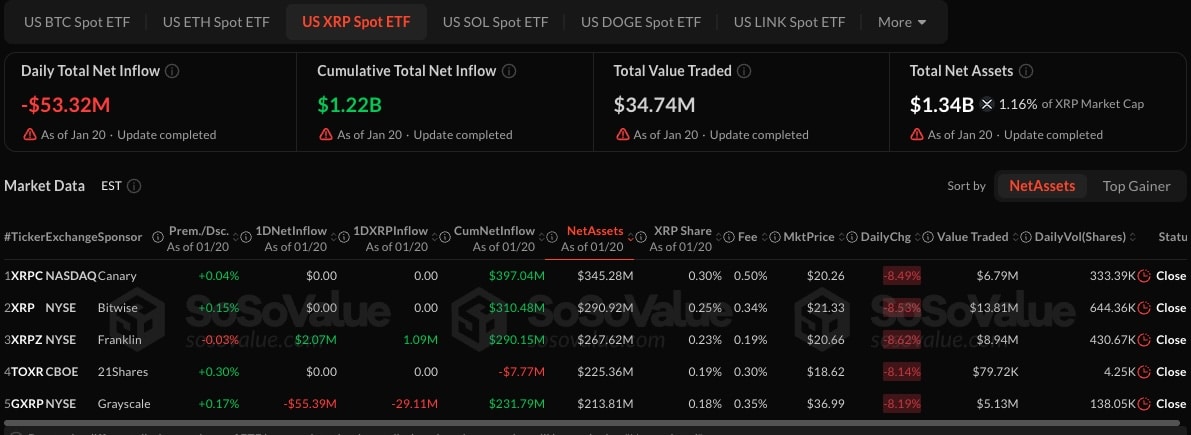

Spot XRP ETFs in the U.S. faced their largest single-day outflow, totaling $53 million, amid significant selling pressure in the crypto market.

- The funds, which launched in mid-November, recorded only their second net outflow on January 20.

- XRP's price is currently around $1.90, struggling due to market weakness.

Spot XRP ETF Outflows

- Total outflow on January 20 was $53.31 million, primarily from Grayscale’s GXRP ETF with $55.39 million in redemptions.

- Franklin’s XRPZ ETF saw $2.07 million in net inflows.

- No inflows were reported for XRP ETFs from Canary, Bitwise, and 21Shares.

- This marks the second net outflow event this month, following a previous $40.8 million outflow led by the 21Shares XRP ETF.

Other crypto ETFs, including those for Bitcoin and Ethereum, also experienced significant outflows on the same day.

The broader crypto market turned bearish due to geopolitical tensions and macroeconomic uncertainties.

Price Analysis: XRP Needs to Reclaim $2

- Crypto analyst Cilinix warns that XRP is vulnerable while trading below $2, indicating a potential breakdown from a 14-month trading range.

- If XRP doesn’t reclaim $2, further downside levels to watch are $1.60, $1.25, and $1.00.

- XRP previously rallied by 31% to a high of $2.41 but has since retraced, trading near $1.91, down 20.7% from its peak.

XRP briefly fell to $1.84 on January 19 before rebounding to achieve a year-to-date performance of roughly 3.8%.