4 0

XRP Price Jumps 12% Amid Growing Institutional Interest and Options Trading

XRP Surge

- XRP has increased by 12% in the last 24 hours, reaching $3.32.

- This marks its highest price since July 28, outperforming BTC and ETH.

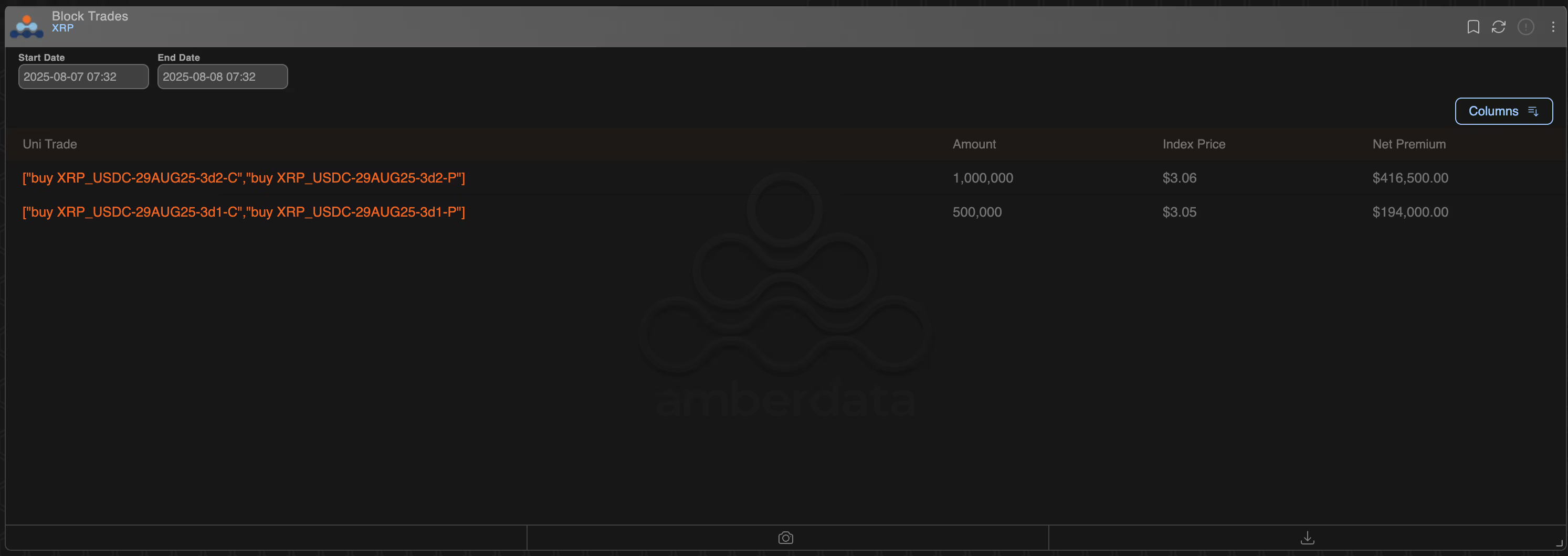

- The price increase is linked to anticipatory block option trades on Deribit, indicating bullish bets on volatility.

- A notable trade included the purchase of 100,000 contracts of Aug. 29 expiry call and put options at the $3.20 strike, costing over $416,000 in premiums.

- Another large straddle was also executed at the $3.10 strike.

- Growing institutional interest in XRP is suggested by these non-directional trades, according to Lin Chen from Deribit.

- The SEC and Ripple ended their legal appeals, concluding a lengthy court case involving XRP's use in cross-border transactions.

Long Straddle Strategy

- The long straddle strategy involves simultaneous buying of call and put options.

- Maximum loss is limited to the total premium paid, while profit potential is unlimited.

- Traders anticipate significant volatility events without clear directional bias.