5 February 2025

Updated 6 February

Updated 6 February

0 0

Over 70 Companies Now Hold Bitcoin on Their Balance Sheets

Corporate treasuries are facing challenges due to inflation, devaluation of fiat currencies, and low interest rates. A shift towards using BTC as a reserve asset is underway.

BTC as a Corporate Reserve Asset

- Corporations traditionally held cash reserves for stability.

- Michael Saylor of MicroStrategy compares cash to a melting ice cube due to its diminishing purchasing power.

- Bitcoin offers fixed supply, global liquidity, and potential upside.

- Since 2020, MicroStrategy has acquired 257,000 BTC, transitioning into a quasi-BTC bank funded through convertible debt and equity.

- Shareholders gain exposure to BTC via MicroStrategy's stock $MSTR.

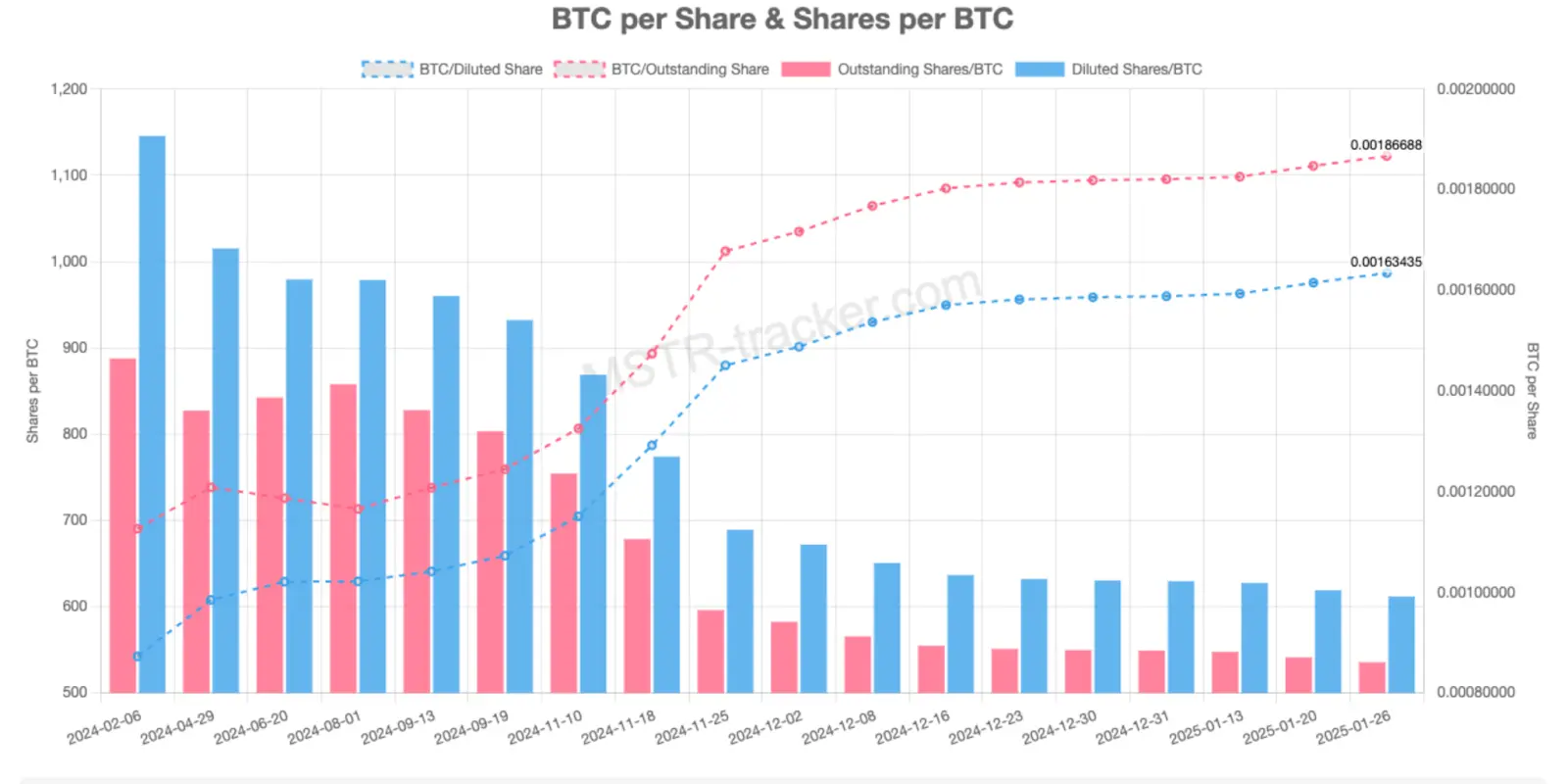

Key Metrics: BPS and BTC Yield

- Bitcoin per share (BPS) indicates the number of BTC held per outstanding share, reflecting indirect BTC exposure.

- BTC yield measures the percentage change in BPS over time, indicating acquisition efficiency.

The Corporate Supercycle

- Over 70 publicly traded companies now hold BTC, including Tesla and Coinbase.

- This trend signifies a transformation in creating shareholder value.

- Regulatory changes support this shift:

- SAB21's reversal enhances BTC's utility for custody services.

- FASB's accounting changes allow companies to recognize BTC appreciation in earnings.

- The proposed Bitcoin Act 2024 signals institutional acceptance.

- Companies can achieve earnings growth through strategic BTC accumulation.

- This reflects classic investment principles of generating current returns while reinvesting capital.

A new era in corporate finance is emerging, emphasizing digital scarcity and unique asset properties that offer opportunities for value creation and preservation. Early adopters may significantly benefit from these changes.