The CTO Phenomenon: From Noble Purpose to Speculation. And How to Profit from It

Over the past year, some of the highest trading volumes have been shown by meme coins, reaching a market capitalization of $70 billion.

While Layer-2 tokens are down 80% from their ATH, memes continue to grow. We keep our finger on the pulse of yet another market.

About the meme market

All markets go through their phases of development. From DOGE on its own blockchain, we moved to launching thousands of meme coins daily in already existing networks.

This mainly happens through launchpads that became popular six months ago. For example, Pumpfun. Because:

- It's convenient. You upload an avatar, links to social media, set the number of tokens, and click Deploy. No need to set up a development environment and write token contracts.

- It's safe. Meme coins and scams go hand in hand: either the developer pulls out liquidity, or they blacklist buyers or freeze their assets. Launching through a launch pool eliminates manipulations with the token code.

The next branch of development became CTO.

What is CTO

It stands for Community Takeover - the transition of a failing project into the hands of the community, which:

- Creates separate social media accounts: Telegram, Twitter

- Purchases advertising on top scanners: DexScreener

- Starts shilling on social media

- Hires callers who signal to buy the coin to their audience

The most vivid example of CTO is POPCAT.

It's just a meme with a cat opening and closing its mouth. After the launch, the developer saw how the token grew to a market cap of $100k. Greed kicked in, and he sold all his tokens.

The community saw this, and apparently, everyone liked the meme, and launching another token was not the same - there would be no OG status. The community conducted a CTO. The token was pumped to a market cap of $1 billion.

The developer made attempts to regain control and even created POPCAT 2.0 from the same wallet. Nothing worked.

From nobility to speculation

About six months ago, the purpose of using CTO shifted from reviving projects to Pump&Dump strategies.

Ironically, CTOs are often carried out by the developers themselves, selling tokens and simply buying them back from another wallet.

CTO using the example of the $ratio token

$ratio launched six months ago and lay forgotten for several months. Then, for some reason, a powerful trading surge began, sending the token price sky-high. Perhaps it was a CTO or some strange news event. I want to show where the fact of CTO is more clearly defined.

The same token, but in our time. Suspected CTOer: FBoewbsRyUhZyDWsvkw8XjaQArcvmige57zgJgrBVjmQ

The chart marks: B - where he bought; S - where he sold. Nothing suspicious?

All price spikes for some reason started after he bought. And they can pull off such tricks 5-10 times a day.

How to make money on CTO

Look for wallets of particularly crafty individuals and copy them.

High risk. If a CTOer notices that many eyes are watching him, he will simply start entering and exiting tokens. All liquidity from copy traders will go to him.

How to find CTO wallets

The main indicator is abnormal behavior of tokens.

For example, high volumes, price jumps, and a small number of traders. You can monitor this on DexScreener.

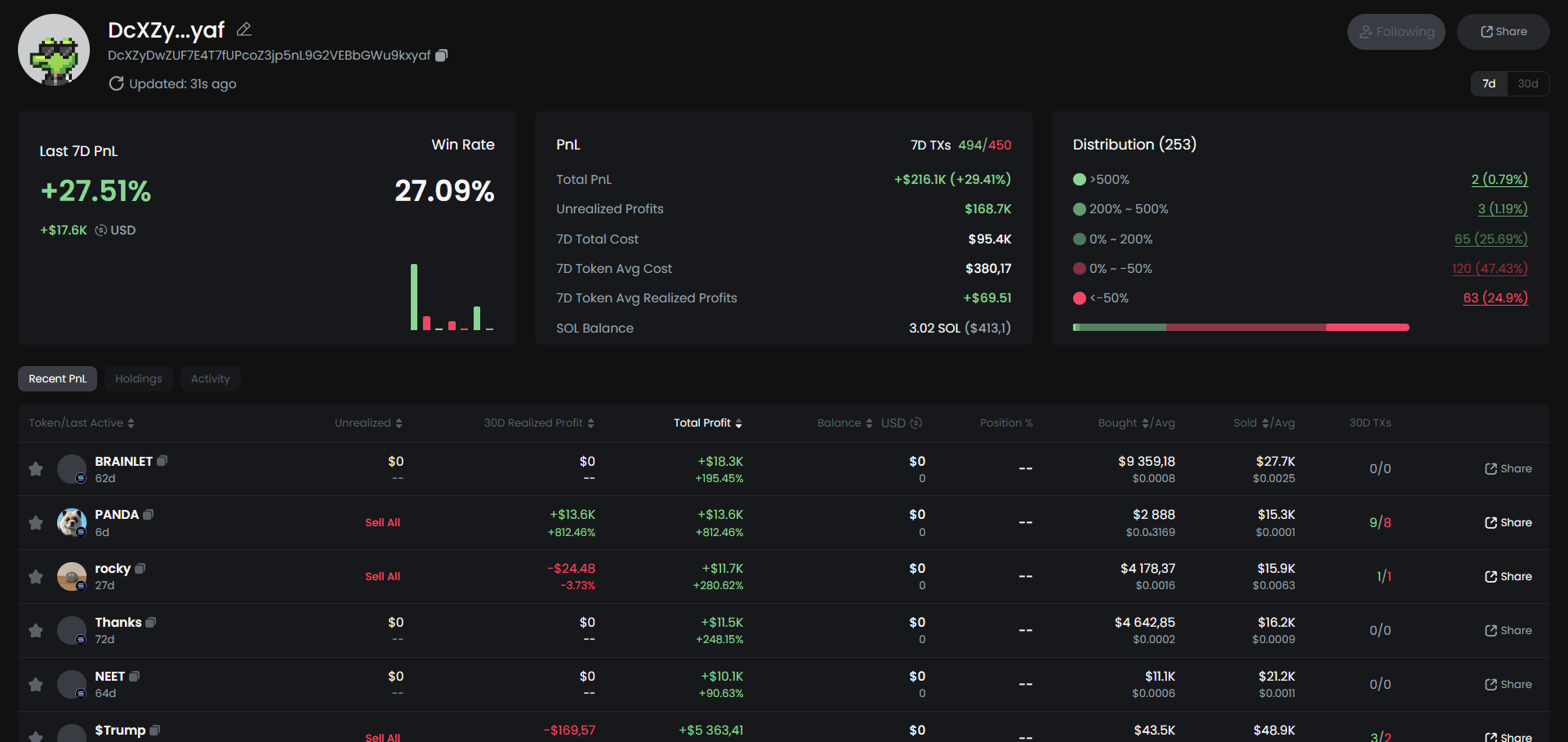

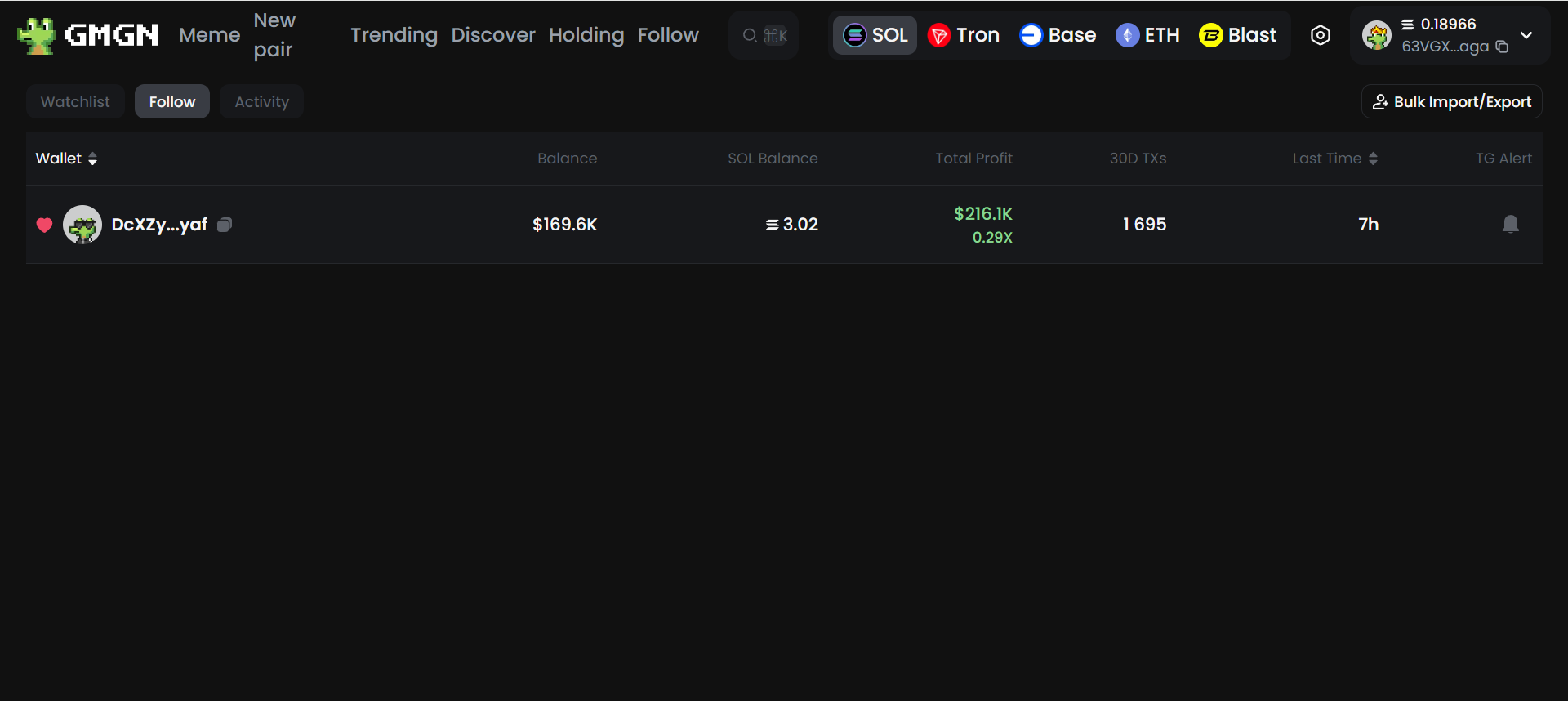

Suspicious wallets can be conveniently checked through the service GmGN. Enter the address and view all transactions.

You can also subscribe to interesting wallets and even set up transaction alerts in Telegram.

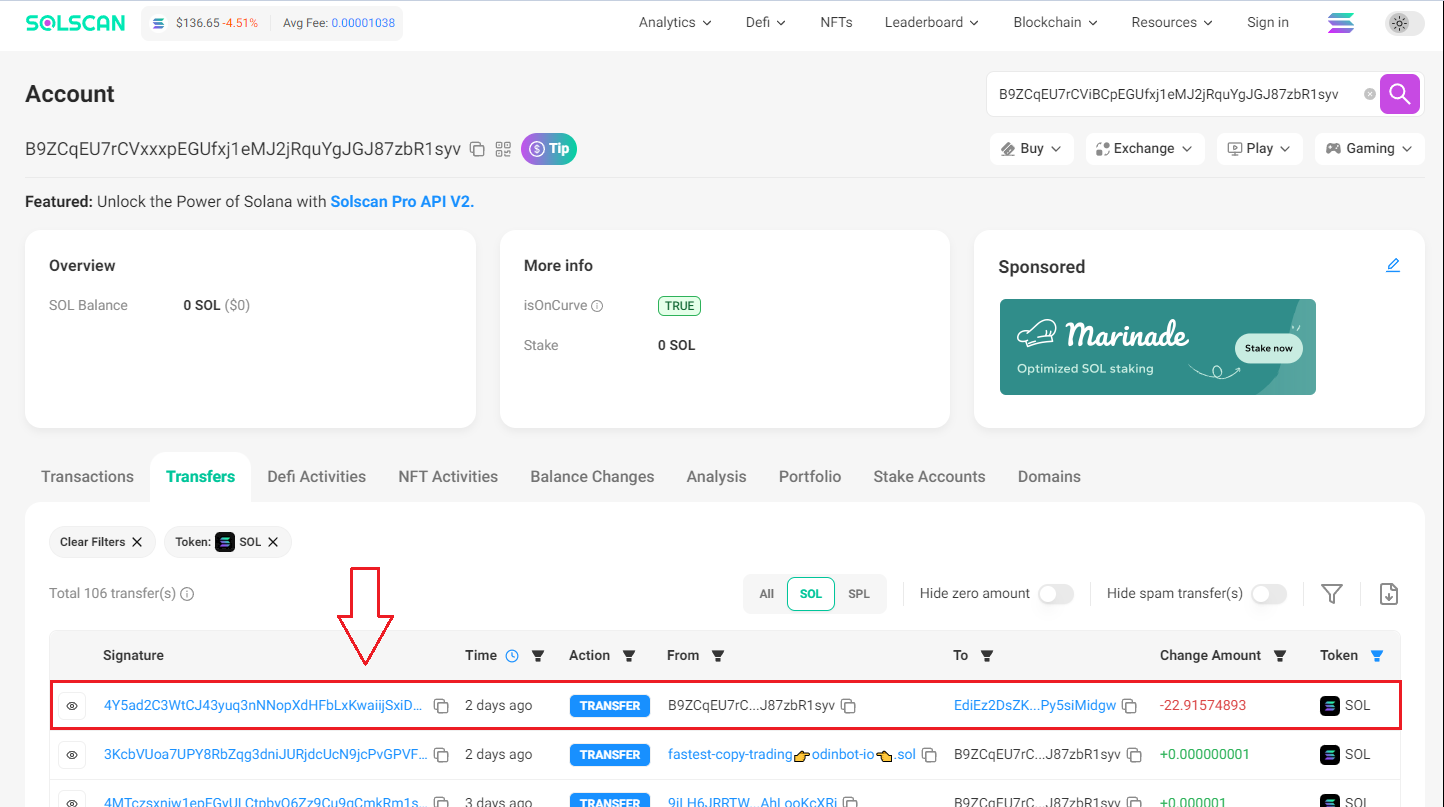

If a CTOer sees that he is being watched, he often transfers money to another wallet. This can be tracked through Explorers. For Solana, it's Solscan.

This is the basics; you'll have to come up with advanced search patterns yourself.

In conclusion

Most open copy trading tools are very slow, so it's better to focus on constant monitoring and manual trade openings. For example, through GmGn. This way, you can fully control the situation.

If you think about getting into this, start with small amounts. In such matters, experience is key.