[toc]

Detailed Information on Margin Trading of Cryptocurrencies

Маржинальная торговля криптовалютами позволяет трейдерам занимать средства для увеличения своих позиций на рынке. Это может привести к более высоким прибылям, но также и к большим убыткам.

Что такое маржинальная торговля?

Margin trading is a method that allows traders to borrow funds to trade larger positions than they could with their own capital alone. This practice amplifies both potential profits and potential losses.

Как работает маржинальная торговля?

Трейдер открывает маржинальный счет у брокера или на бирже, внося первоначальный депозит, который называется маржей. Затем он может занимать деньги для торговли, используя свои активы как залог.

Преимущества маржинальной торговли

- Увеличение потенциальной прибыли

- Доступ к большему количеству торговых возможностей

- Гибкость в управлении капиталом

Риски маржинальной торговли

- Высокие потери из-за увеличенного плеча

- Маржин-коллы, когда брокер требует дополнительный капитал

- Волатильность рынка может привести к быстрому закрытию позиций

Заключение

Маржинальная торговля криптовалютами может быть выгодной, но требует тщательного анализа и управления рисками. Трейдерам следует быть осторожными и осведомленными о возможных последствиях.

Margin trading in cryptocurrencies is a type of trading that allows you to trade borrowed funds from a cryptocurrency exchange. The use of leverage opens the door to trading an amount exceeding your initial deposit.

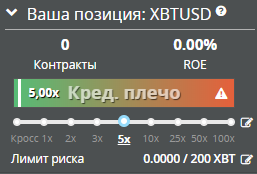

For example, let's take trading with leverage on Bitmex exchange. The switches 1x, 2x, 4x - 100x tell us how much we plan to borrow in relation to our initial deposit.

When choosing 5x, for entering a trade with our own 1 bitcoin, 4 bitcoins will be borrowed. As a result, you will enter the trade not with the initial amount of 1 bitcoin, but with a total of 5.

What does this mean? It means that if the asset appreciates, in our case bitcoin by 10%, your profit will not be 0.1 BTC (as it would be without using leverage) but 0.5 BTC.

We are not in a fairy tale. Along with the opportunity to gain multiple profits come increased risks.

In another case, if the hypothetically purchased bitcoin falls in price by 10%, you will lose the same 0.5 BTC. That is, effectively half of your actual funds.

Margin trading in cryptocurrencies in simple words

In simple terms, margin trading is when you borrow funds and use them for trading.

This includes borrowing from a cryptocurrency exchange at a relatively high interest rate. You get the opportunity to use more funds than you currently have. Thanks to leverage, of course.

The use of this tool will allow you to increase your profit in the event of a positive outcome. And if the market moves against you, then losses will also be higher when using margin trading.

Where is margin trading in cryptocurrencies available?

Most sites (platforms) do not provide the option to use margin trading for US citizens. This is because any trading platform used by US citizens must comply with SEC requirements, which is not very easy to do.

However, for Russian citizens, the doors to almost all major platforms for margin trading in bitcoin and its derivatives are open.

Exchanges that use margin trading in cryptocurrencies:

- Binance.com - Since 2020, allowed margin trading using bitcoin futures. Verification is required for trading.

- Bitmex.com - Initially, the exchange was intended for trading crypto derivatives. Verification is not mandatory.

Today, in addition to the exchanges mentioned above, Kraken is a reputable exchange that offers US citizens the option to use margin trading. The exchange's website is not available for residents of New York and Washington state. Moreover, there is no certainty that US citizens will be able to use this platform's services in the future.

Leverage

To understand margin trading as such, you first need to understand leverage. What is it?

Leverage is the increase in purchasing power when trading cryptocurrencies using margin trading tools. The maximum leverage value you can access varies depending on the exchange. Typically, this value is shown as a ratio of 5:1 or 20:1.

For example, if the platform offers leverage of 2:1, you can open a position worth twice the amount of funds in your account. In simple terms, if you have $10,000 in your account, you can place an order for up to $20,000. If the maximum leverage is 20:1, then you can place an order for an amount that is 20 times your funds.

As a result, if the market moves in your favor, your profit will increase by the amount of leverage you chose. Conversely, losses will increase in the same proportion if the market moves against you.

How to trade on margin: long vs. short

You can choose one of two options for margin trading:

- Long (opening or entering a long position): this is when we buy cryptocurrency expecting its growth.

Here we aim to make a profit from the expected price increase while using leverage.

- Short (opening or entering a short position): this is when we sell cryptocurrency expecting its decline.

Our goal is to buy the same cryptocurrency but at a lower price since the price has decreased, and profit from the price difference (spread).

Differences between margin and traditional cryptocurrency trading

The traditional method of trading cryptocurrency involves buying and selling using your own funds. You buy coins or tokens at the current price and then simply wait for the price to rise in the short or long term before selling for a profit.

The main difference in margin trading is that you borrow funds from the exchange to increase your purchasing power in order to achieve greater profits. Usually, trading with leverage is conducted in separate sections of cryptocurrency exchanges.

What are the advantages of margin trading in cryptocurrency?

The most significant advantage of margin trading is the potential for greater profits. If the market moves in such a way that you correctly predict prices, then thanks to the use of 2:1 leverage, your profit will be twice as much as without leverage.

If you are already an experienced trader with a good understanding of the cryptocurrency market and manage risks well, then margin trading can become an effective trading tool that helps you accelerate your earning pace.

Liquidation of a trade

Yes, of course, with margin trading you can increase profits, but you should not forget that in the event of a negative outcome, losses will also increase. The most important aspect of margin trading is liquidation.

Liquidation is the process of automatically closing a trade by the exchange. This occurs to preserve the borrowed funds from the exchange. When opening a trade in the cryptocurrency market using credit, a liquidation price is set for the trader. The price point of the asset, reaching which will lead to the closure of the trade, regardless of whether it's a long or short.

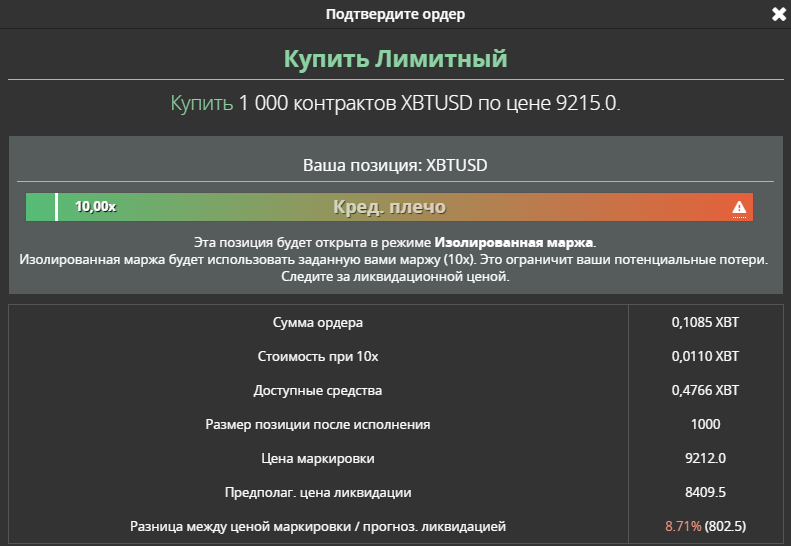

In the screenshot above, it can be seen that in the opened trade for $1000 at a bitcoin price of 9212 BTC, and with a leverage of 10x, 0.0110 XBT (BTC) of my funds will be used, however, the total volume of the trade amounts to 0.1085 XBT (BTC). We also see the price at which liquidation will occur - $8409 for 1 bitcoin.

The liquidation price depends on the following parameters of the trade:

- Deposit size or amount of funds in the balance

- Leverage size

Therefore, to change the liquidation price, you need to either increase the deposit size (this can be done after opening the trade), or increase the balance size (when using Cross Margin, more on this below), or initially choose the most optimal leverage.

Liquidation leads to the complete sale of your asset in the trade. If before reaching its level you can close the trade and recover part of your funds, liquidation will lead to the loss of your entire deposit or account balance.

Yes, there is a risk of losing your entire balance. For example, on Bitmex exchange, there are two types of margin:

- Isolated Margin - only the deposit is used as collateral

- Cross Margin - the entire balance on the exchange is considered as collateral.

Also, remember that any funds you borrow for margin trading are NOT given for free. You will have to repay the entire loan amount and pay interest. Also, pay attention to the fees charged by the platform for executing trades.

Before using the margin tool, you must ensure that you fully understand the principle of trading with borrowed funds, where both profits and losses increase.

Tips for margin trading

To protect yourself from the most common mistakes in trading, when using margin tools, consider the following tips:

- Think twice if you are an inexperienced trader. Margin trading is not for beginners. It is a highly risky tool used by experienced traders;

- Start small. To minimize risks, novice traders should not jump into battle immediately. It is recommended to start with low leverage and avoid using all funds in one transaction;

- Manage risks. Use stop-loss and take-profit. This will allow you to set clear boundaries for closing orders and save you from many problems;

- Study the criteria of exchanges. Some exchanges offer margin trading only to clients who meet certain criteria, such as identity verification (KYC) or the ability to access a specified amount of capital; Don't forget to study all the criteria present on the exchange.

If you are already an experienced trader and would like to try your hand at margin trading in cryptocurrency, start with research. Compare fees, pros and cons, features of various platforms that offer margin trading to find the one that suits your needs.