125 6

Trends in blockchain and WEB3 startups: analysis based on data from 2021 to 2024

Based on internal data about startups and blockchain technologies for the period 2021-2024.

Table of Contents:

1. Blockchain

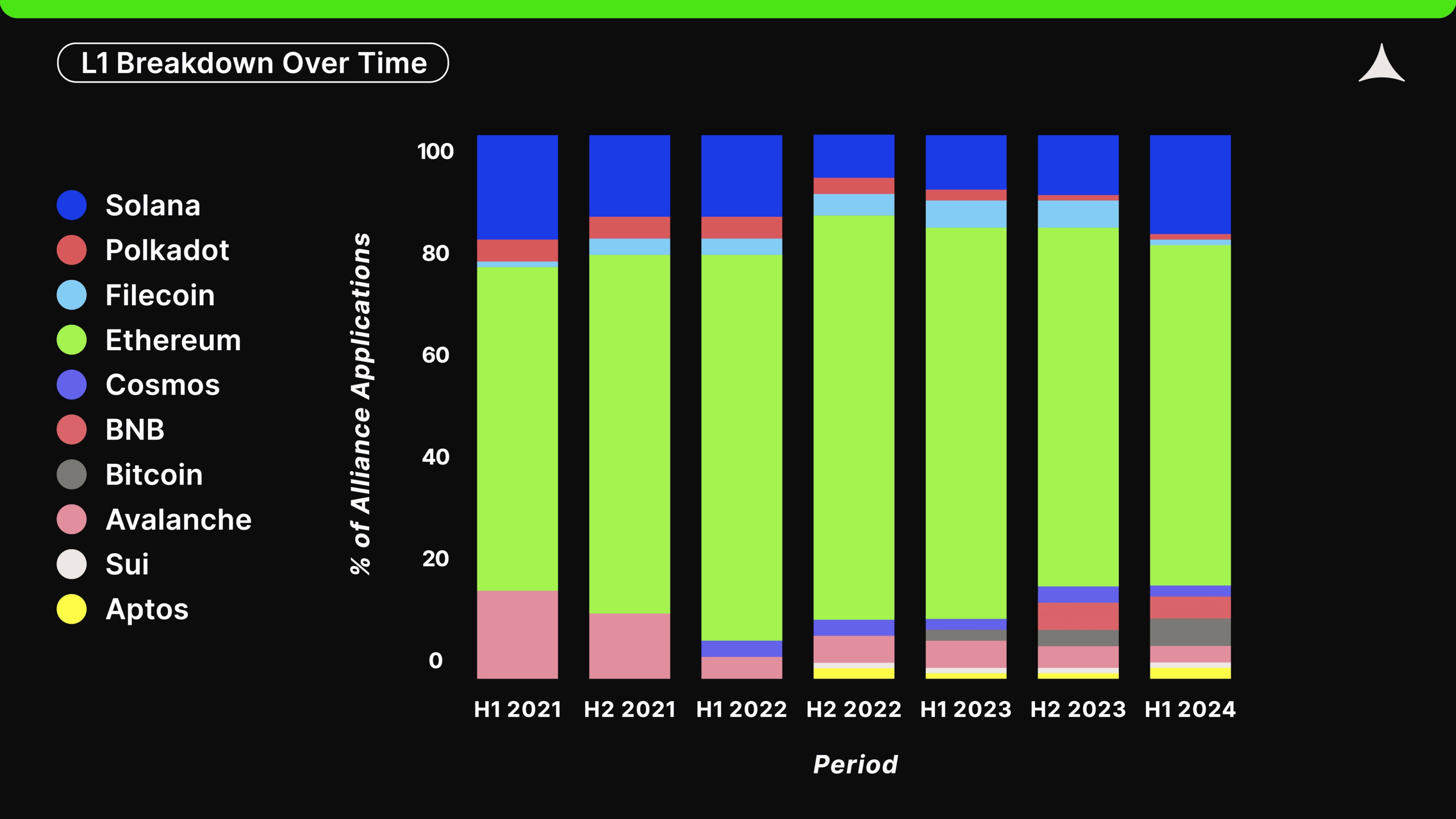

Which blockchains do startups choose?

- Ethereum remains the key platform for most startups — about two-thirds of all projects are built here. This is due to the wide range of possibilities and the ecosystem that provides various solutions for decentralized applications.

- Solana occupies 18% of the market after recovering from the FTX collapse, when its share dropped to 8%. Confident growth indicates the prospects of this network for further development.

- Bitcoin attracts the attention of startups — currently, 5% of all projects operate on its base. The growth over the past 1.5 years is explained by interest in its security and resilience.

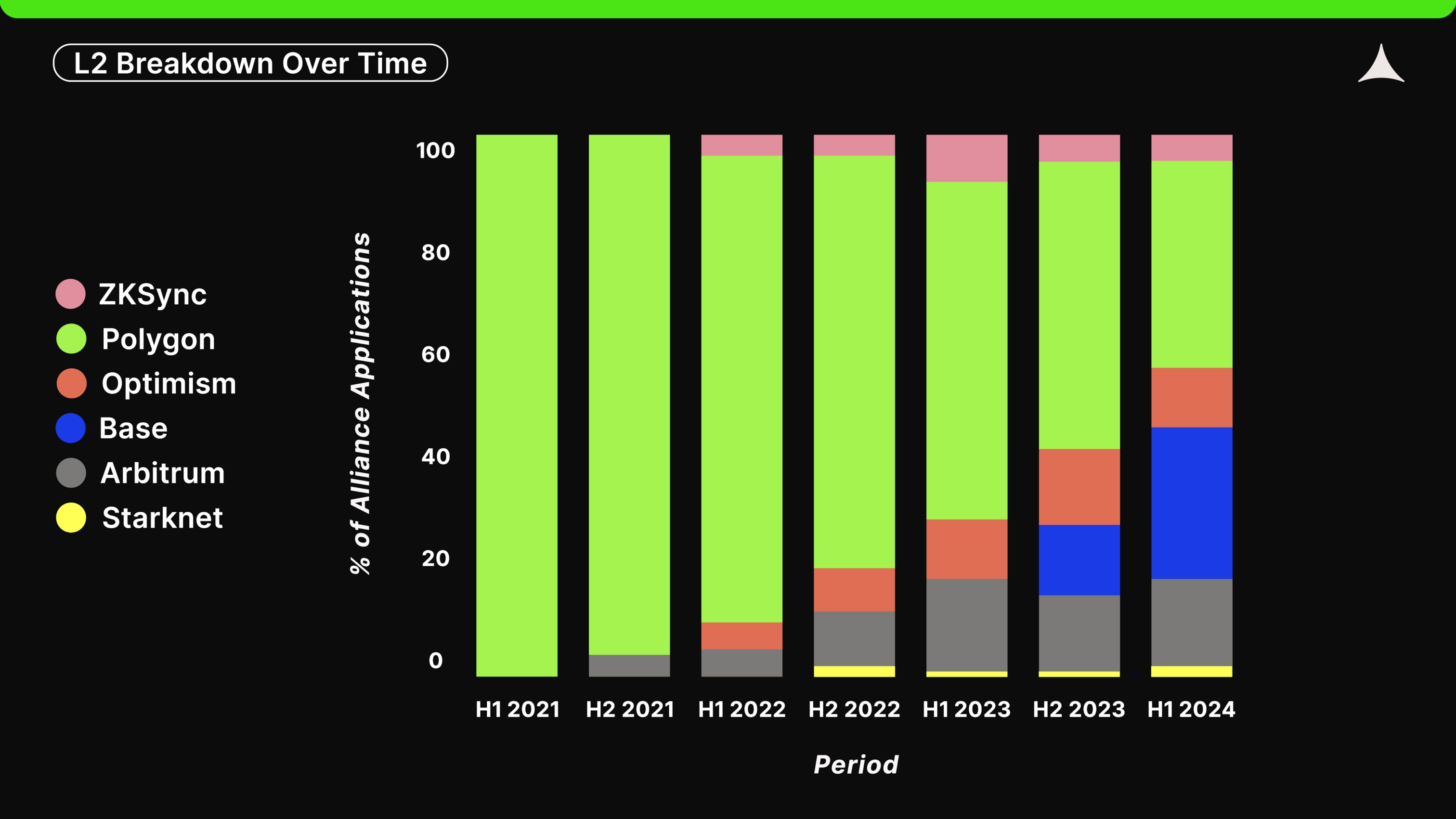

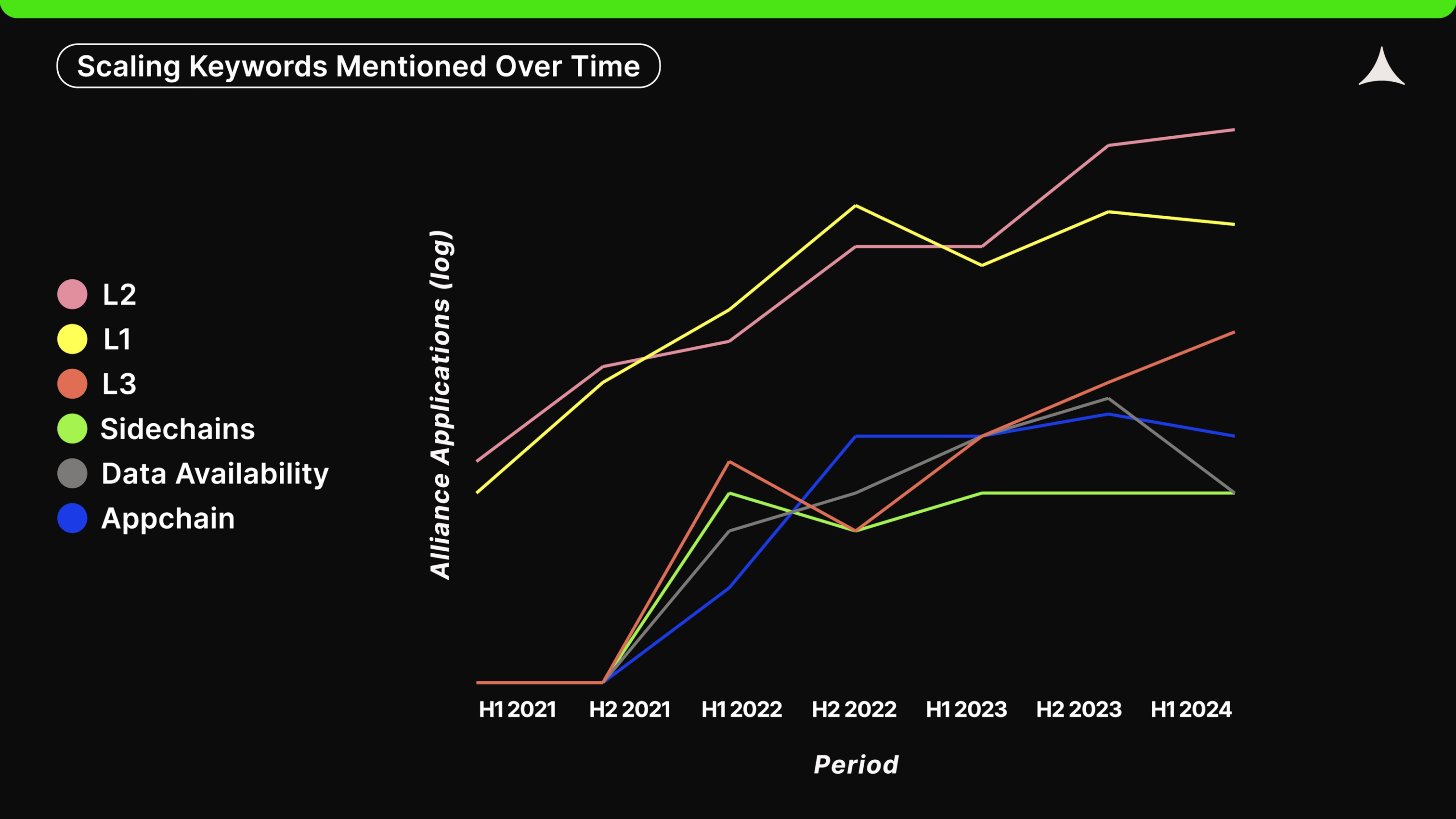

- Within the Ethereum ecosystem, there is a dominance of Optimistic rollups. About 59% of startups choose solutions like Optimism, Base, and Arbitrum to build their projects.

- Polygon is losing ground. In particular, its zkEVM solution lags behind Optimistic competitors, which reduces interest in the platform.

- Base, a new layer two solution for Ethereum, shows explosive growth, capturing 28% of startup activity in just one year.

2. Product Verticals

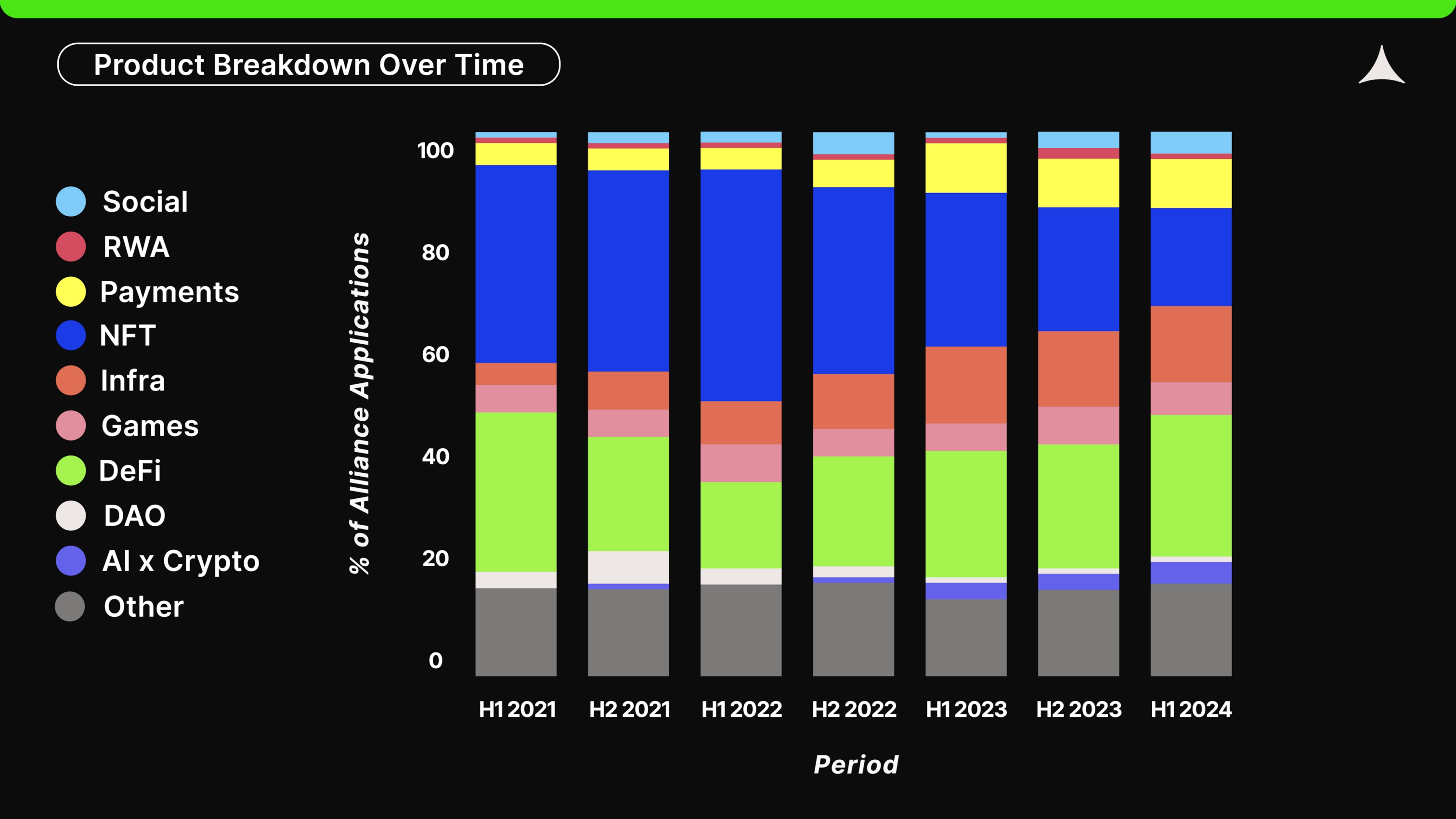

What directions do teams choose?

- The following directions are gaining popularity:

- Infrastructure — an increase in the number of startups working on fundamental solutions for blockchain ecosystems.

- DeFi — decentralized finance remains in the spotlight due to potential opportunities to replace traditional financial systems.

- Payment Solutions — growing interest in platforms that provide fast and cheap transactions in cryptocurrencies.

- AI x Crypto — the intersection of artificial intelligence and cryptocurrencies is becoming a new trend, opening up new horizons for automation and decentralization.

- Directions that are losing popularity:

- DAOs (Decentralized Autonomous Organizations) — interest in this concept is gradually fading.

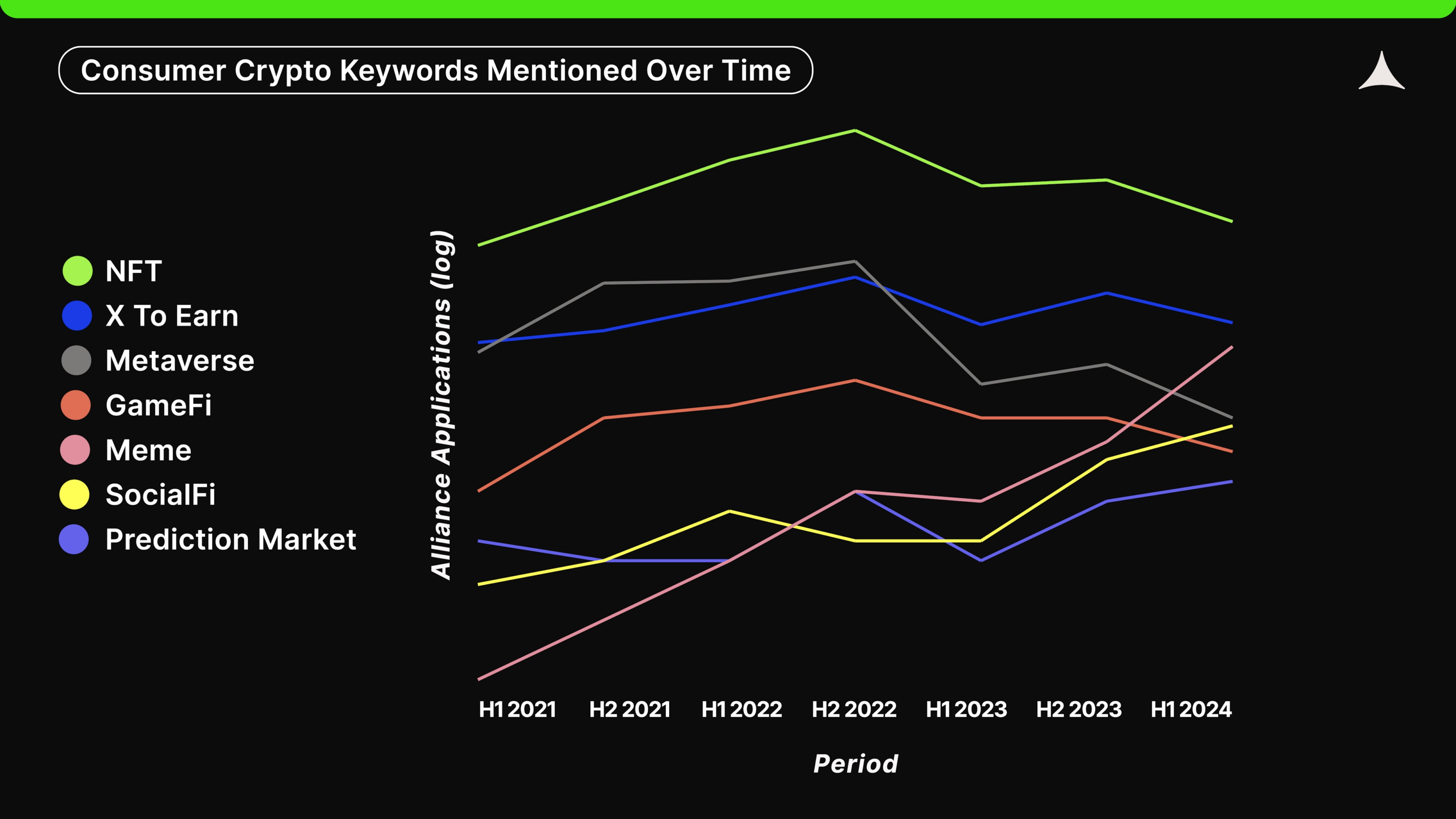

- NFT — the non-fungible token market is losing its former activity, and startups are increasingly choosing other paths for development.

3. Geography

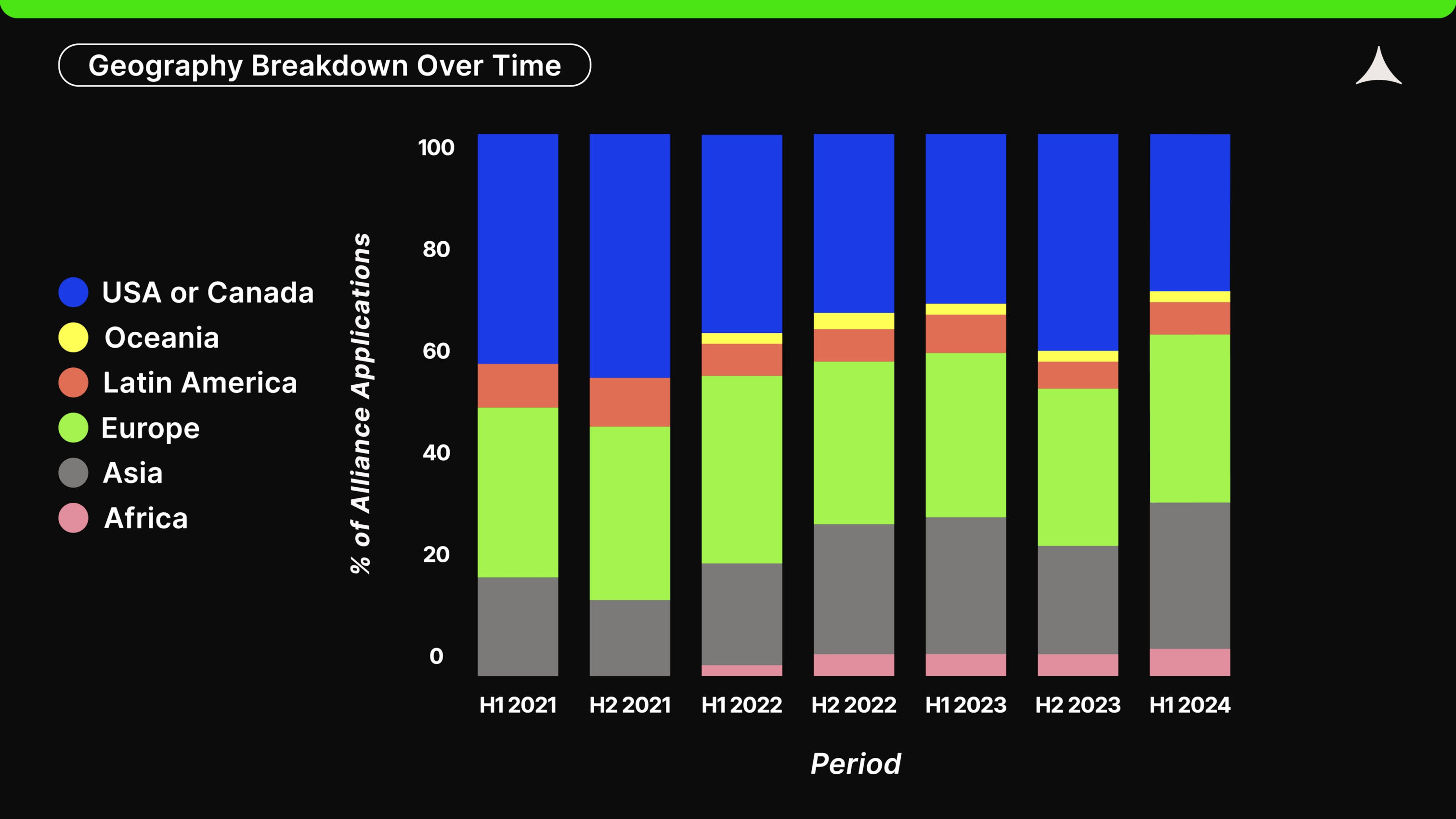

Where are startup founders based?

- Europe — leads with 31% of all startups. The continent is becoming a hub for blockchain developments due to a favorable regulatory environment and access to talent.

- USA and Canada — occupy 29% of the market. However, their share is gradually decreasing due to tightening regulations and competition from other regions.

- Asia — is rapidly gaining momentum, occupying 27%. Countries such as Singapore, South Korea, and China stand out particularly.

- Africa — another region where there is steady growth of blockchain projects, thanks to improved access to technology.

4. Popular Keywords

What terms are most frequently mentioned in startup pitch decks?

- Keywords that are becoming increasingly popular:

- Homomorphic Encryption (FHE) — a concept that allows computations to be performed on data while it remains encrypted.

- Chain Abstraction — the idea of simplifying interaction between different blockchains.

- SocialFi — the combination of social networks and decentralized financial solutions.

- Restaking and liquid staking — popular concepts in the Ethereum ecosystem related to increasing yield for network participants.

5. Origin of Founders

From which companies and universities do founders come?

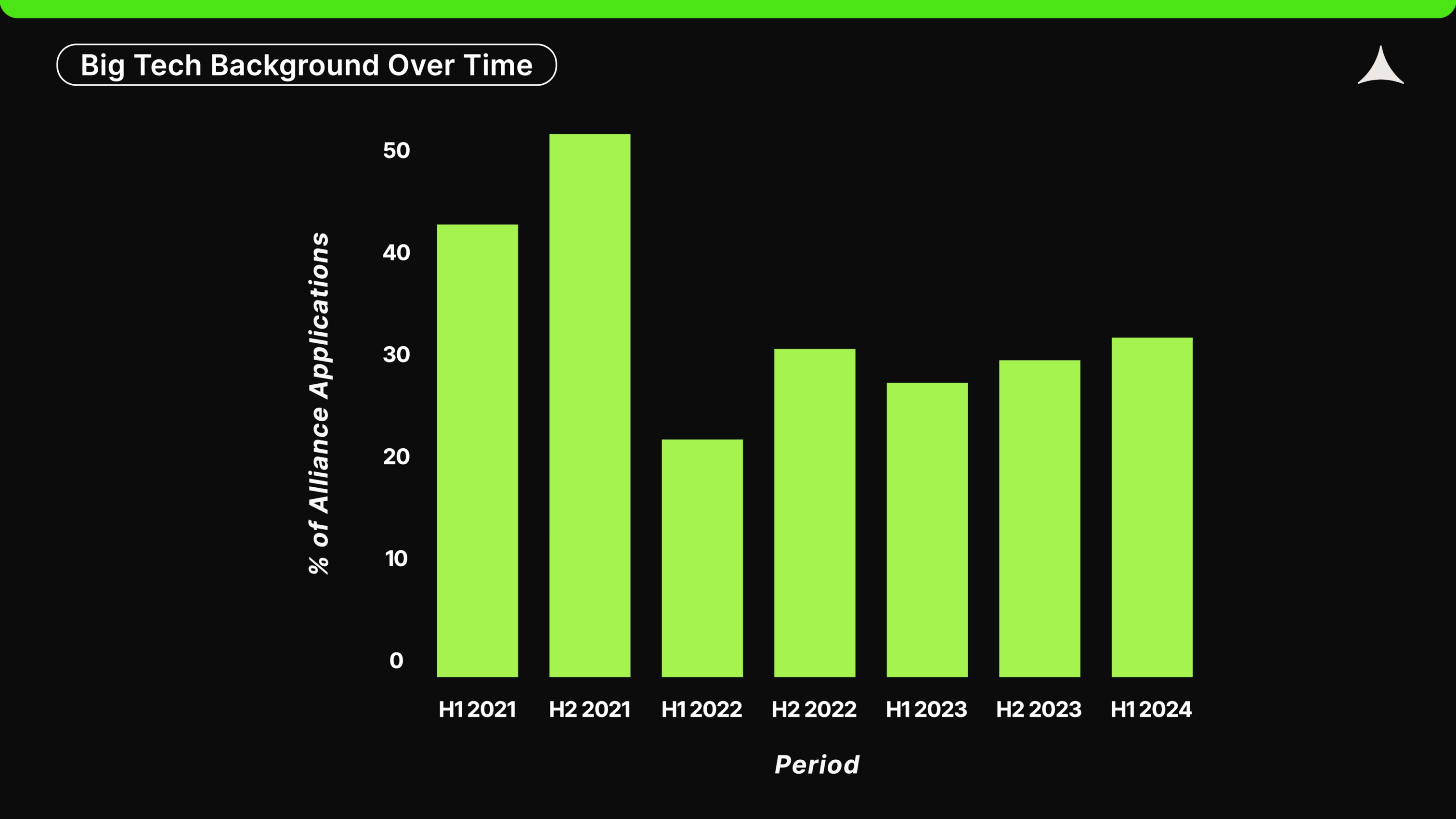

- Today, 30% of startup founders have experience working in large tech companies listed in the S&P500.

- 12% of founders graduated from leading universities ranked in the QS top-100.

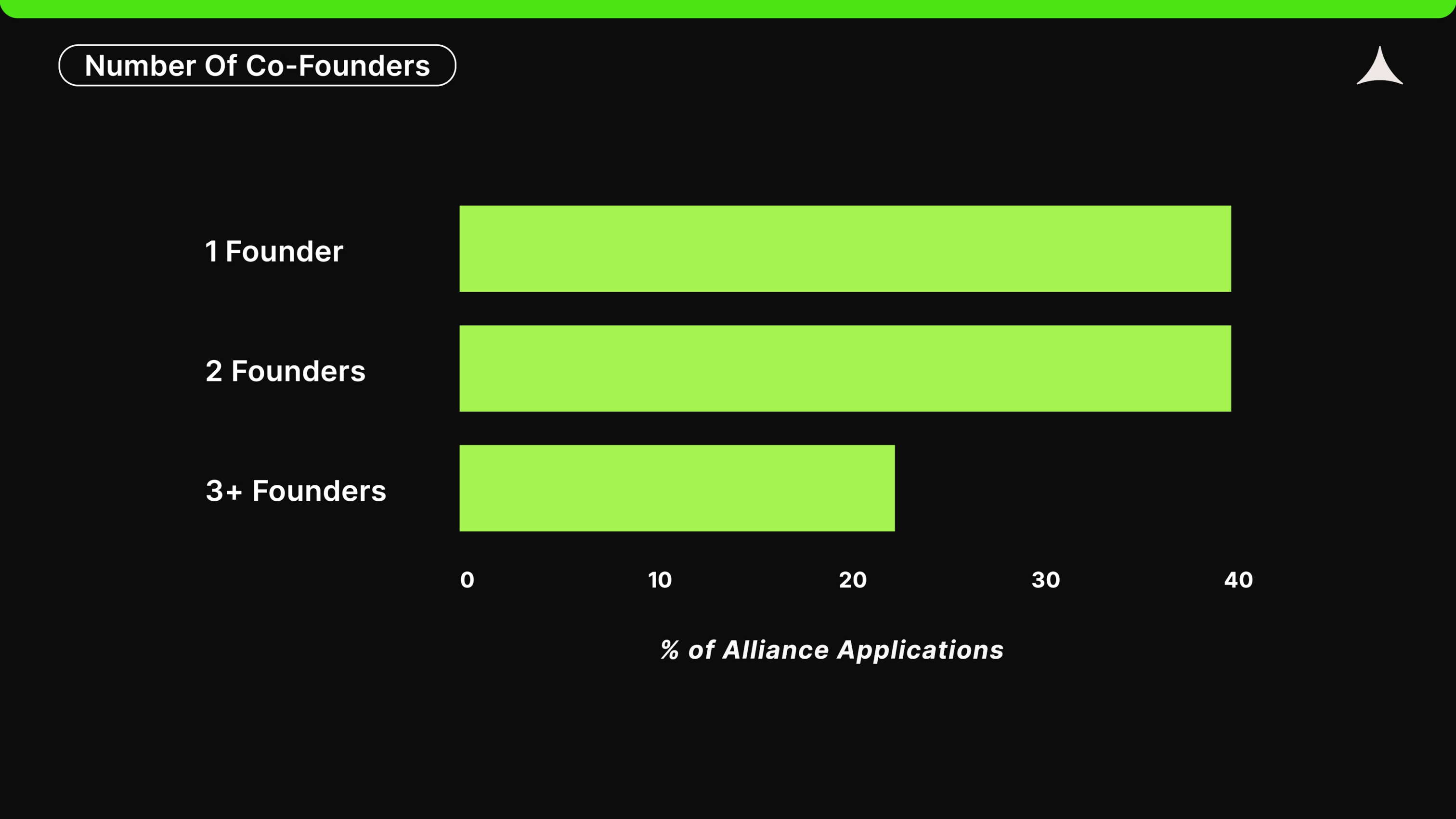

6. Team Composition

How are startup teams formed?

- 39% of startups have only one founder, indicating a rise in the number of individual developers and entrepreneurs in the blockchain space.

- In startups with multiple founders, in 50% of cases, the share is evenly distributed among them.

- 72% of startups operate fully remotely, which is becoming the norm in the blockchain sector.

This overview shows that the blockchain ecosystem continues to evolve, with a focus on Ethereum, new trends in product verticals, and changes in the geographical distribution of startups.

This material is a free translation of the research from Alliance