4 0

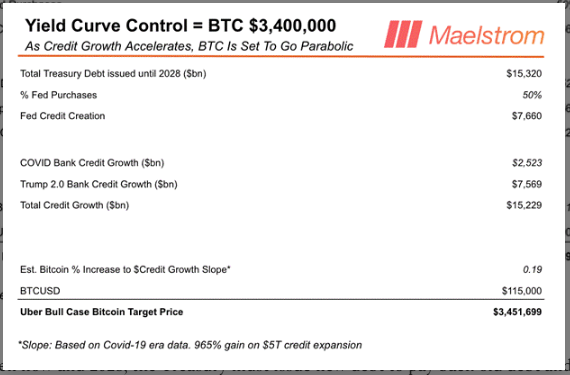

Arthur Hayes Predicts Bitcoin to Hit $3.4 Million by 2028

Arthur Hayes, former BitMEX CEO, predicts Bitcoin could reach $3.4 million by 2028 based on significant credit growth and policy changes.

- Hayes anticipates $15.3 trillion in Federal Reserve and commercial bank credit growth, with the Fed buying half of new Treasury debt and a $7.57 trillion increase in bank credit.

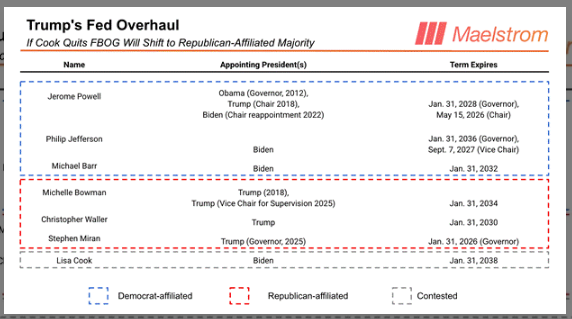

Federal Reserve Policy Shift

- Hayes suggests President Trump's administration may influence Federal Reserve policies through strategic board appointments and regulatory pressure.

- A plan is proposed to gain control over short-term rates by altering Interest on Reserve Balances rules via Board of Governors' votes.

- Potential allies include Governors Bowman, Waller, and Stephen Miran, while pressure on Governor Lisa Cook may alter the board's composition by 2026.

- The administration might replace regional Fed presidents around February 2026 elections.

Stablecoin Flows and Eurodollar Impact

- Hayes estimates $10-13 trillion could shift from offshore dollar deposits due to potential withdrawal of US support during crises.

- This forms a $34 trillion pool of non-dollar deposits that stablecoin firms, such as Tether, could target.

- Social media apps like WhatsApp might facilitate retail deposits in Global South using dollar-pegged stablecoins.

Stablecoins and Treasury Demand

- If depositors switch to stablecoins holding Treasuries and bank deposits, demand for US short-term paper may become less price-sensitive.

- Approximately $16.74 trillion in European bank deposits could contribute to a $34 trillion market for stablecoin conversion.

- This may allow the Treasury to offer lower yields than the Fed Funds rate, impacting central banks globally and giving Washington leverage over short-term rates.