Bitcoin Accumulation Addresses Receive $4.16 Billion in Inflows Since November 3

The price of Bitcoin has reached successive all-time highs recently, alongside significant increases in other large-cap assets like Ethereum, Solana, and Cardano. On-chain data indicates that the crypto market, particularly Bitcoin, may continue this upward trend as investors are accumulating rather than selling for short-term gains.

Bitcoin Investors Continue To Load Their Bags

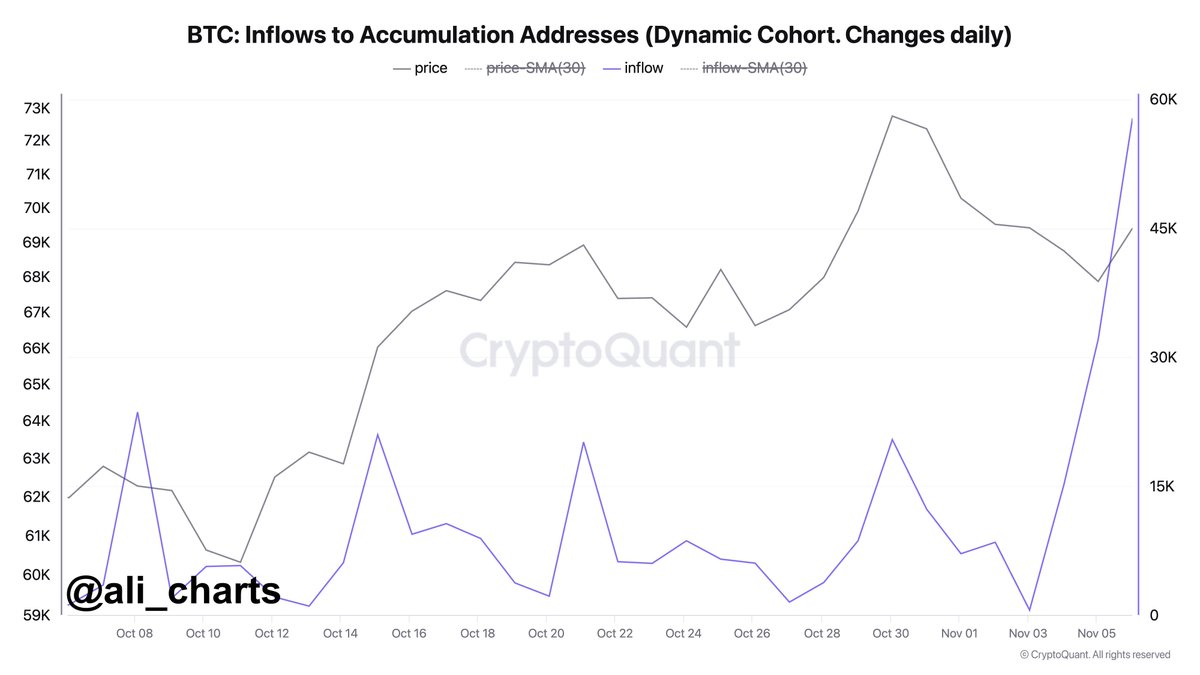

Crypto analyst Ali Martinez reported on the X platform that Bitcoin accumulation addresses have seen substantial inflows. This observation is supported by a spike in CryptoQuant’s “Inflows to Accumulation Addresses” metric.

Accumulation addresses are defined as those with zero outgoing transactions or minimal spending over time, receiving at least two incoming transfers and holding more than 10 BTC. These addresses are typically controlled by major entities such as whales and institutional players.

Data from CryptoQuant shows that 57,800 BTC (approximately $4.16 billion) has flowed into these accumulation addresses since November 3. The chart below illustrates the rising inflows into Bitcoin accumulation addresses.

This trend is generally positive for BTC's price, which has experienced notable growth recently. The decision to hold rather than sell reflects increased confidence in Bitcoin's long-term potential, suggesting major investors anticipate further price increases.

As of now, Bitcoin is priced around $76,550, marking a 1% increase in the last 24 hours and over 10% growth weekly.

USDT Netflow On Exchanges Surpasses $2 Billion

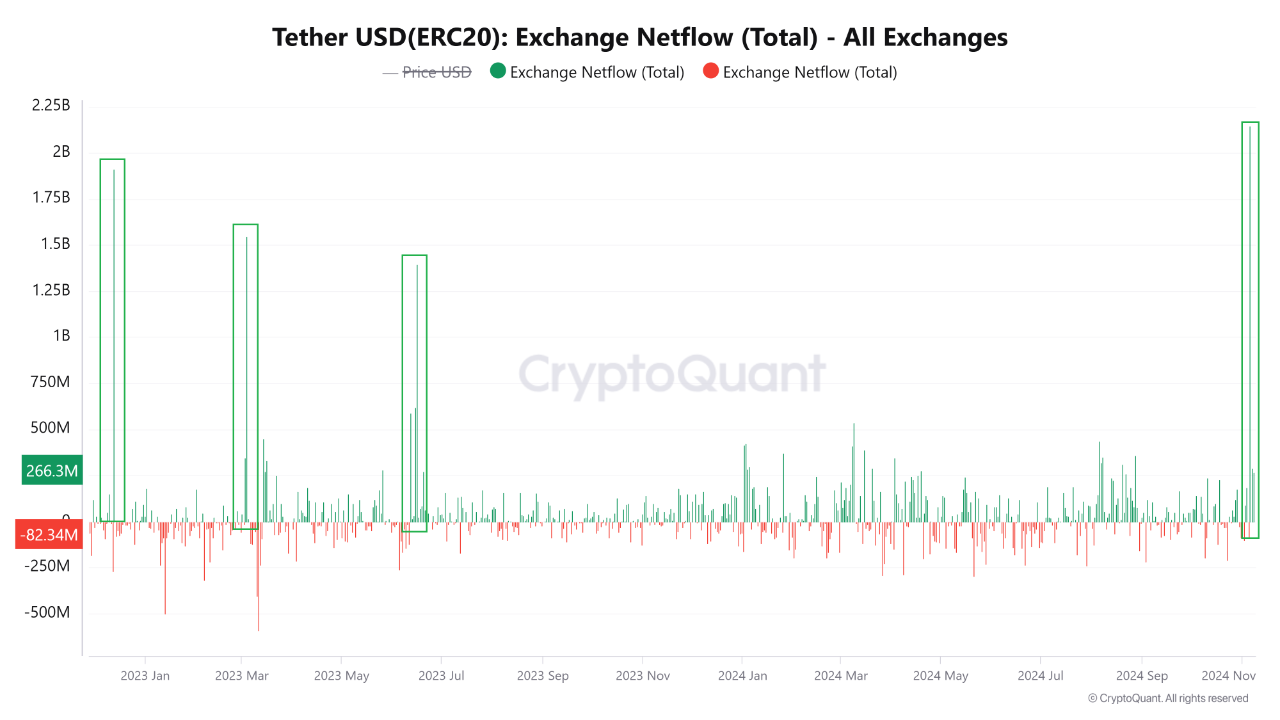

A recent report from CryptoQuant highlights significant inflows of USDT stablecoin into centralized exchanges, with net inflows exceeding $2 billion, the highest since December 2022.

Increased balances of stablecoins indicate heightened liquidity, suggesting greater buying power among investors. If this growing liquidity aligns with the accumulation trends, it could positively influence Bitcoin's price.