Bitcoin Breakout Drives Market Gains in AI and Memecoins

Bitcoin's decentralized nature allows peer-to-peer transactions, gaining attention as President Trump considers removing Federal Reserve Chair Jerome Powell. This speculation prompted dollar selling and a drop in U.S. stock futures, with the Dollar Index at a three-year low of 98.00. Bitcoin rose above $87,000, indicating bullish momentum.

- Gold reached new highs above $3,400 per ounce.

- Smaller tokens like ENJ and MAGIC gained over 50% within 24 hours.

- On-chain analysis suggests potential volatility as prices approach $90,000.

Charles Schwab's CEO anticipates supporting spot crypto trading within a year, responding to client interest. Slovenia proposed a 25% tax on crypto capital gains starting in 2026. Ethereum co-founder Vitalik Buterin suggested replacing the Ethereum Virtual Machine with RISC-V to enhance efficiency.

In terms of market activity:

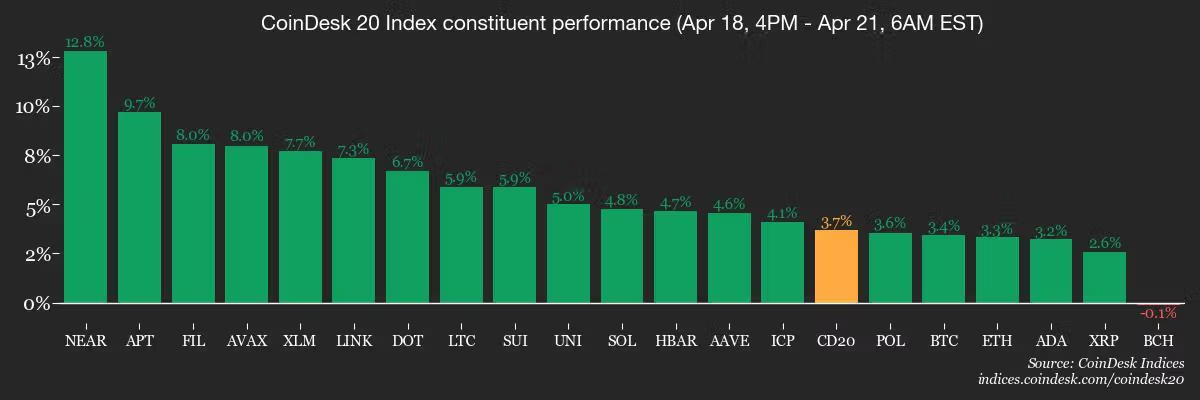

- BTC is up 3.19% at $87,270.44.

- ETH is up 2.54% at $1,631.90.

- Total crypto market cap has risen significantly.

- Futures open interest reached $37.22 billion, the highest since March.

Upcoming events include:

- April 21: Coinbase Derivatives plans to list XRP futures.

- April 30: ProShares expects an XRP ETF to begin trading on NYSE Arca.

- April 29: BNB Chain will activate a mainnet hard fork.

Market movements highlight a shift towards Bitcoin as a hedge against dollar depreciation, while macroeconomic tensions continue to influence trading patterns.

Current Bitcoin statistics include:

- BTC Dominance: 64%

- Hashrate: 858 EH/s

- Total Fees: 5.48 BTC / $479,045

- CME Futures Open Interest: 141,280 BTC

Technical analysis indicates potential for Bitcoin to reach $90,000, though low trading volume may indicate a short-lived rally.