6 0

Bitcoin Falls Below $122K Amid Overheated Crypto Market

The crypto market experienced a downturn as Bitcoin (BTC) retreated from record highs above $126,000, dropping below $122,000 and losing 2.4% in 24 hours. Other cryptocurrencies like XRP, Dogecoin (DOGE), Cardano (ADA), and Avalanche (AVAX) fell by 5%-7%.

- Recent BTC price movements mirror past trends of swift sell-offs after reaching new highs.

- Analysts suggest potential for BTC to revisit the $118,000-$120,000 range, offering a buying opportunity if macro conditions favor further gains above $130,000.

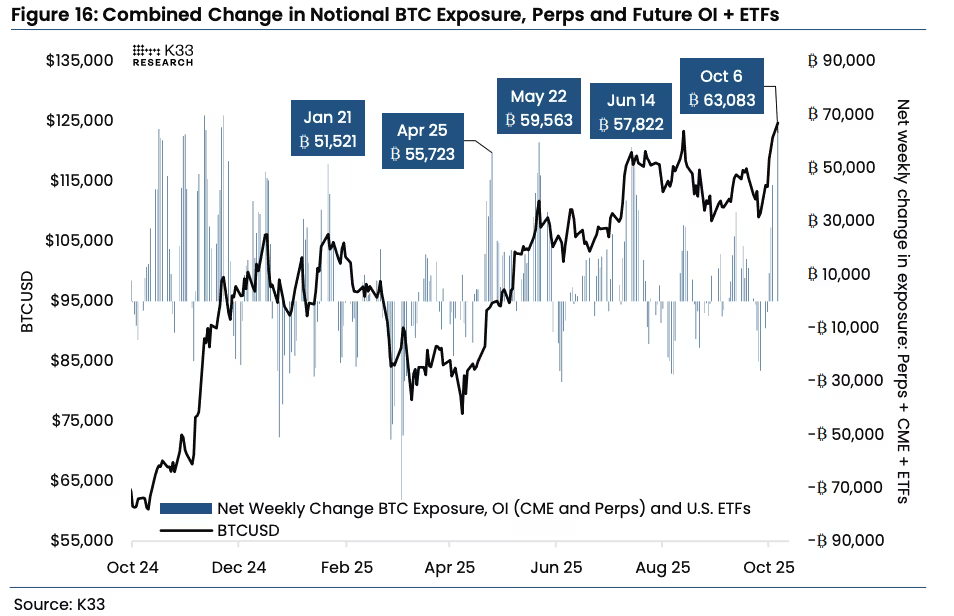

- Derivatives markets and ETF inflows surged, with 63,083 BTC accumulated, marking the highest accumulation this year.

- This influx indicates an overheated market, potentially leading to short-term consolidation.

Fed's Neutral Rate Comments

- Federal Reserve Governor Stephen Miran suggests the neutral interest rate should be 0.5%, influenced by tighter immigration restrictions and federal deficit expectations.

- His comments reflect changes in long-term U.S. economic forces, impacting growth and fiscal pressures.

- Upcoming Fed meeting will discuss potential rate cuts amidst ongoing government shutdown.

Crypto Stocks Affected:

- Strategy (MSTR) fell 7%, Coinbase (COIN) dropped 4%.

- Bitmine Immersion (BMNR) and Sharplink Gaming (SBET) both declined 3% and 7%, respectively.

- Bitcoin miners saw losses: MARA Holdings fell 4%, Riot Platforms (RIOT) dropped 3%, and Hut 8 (HUT) decreased by 2%.