5 0

Bitcoin and Ether Prices Increase Following Court Ruling on Tariffs

Bitcoin BTC increased after a U.S. court invalidated Trump's tariffs, while stock index futures also rose. Positive sentiment followed Nvidia's strong earnings.

Key updates include:

- Large wallets holding over 10,000 BTC shifted to selling, indicating potential price consolidation.

- Options market data suggests volatility is expected ahead of Friday's monthly settlement.

- Ether ETH rose to $2,780, its highest since February, with significant inflows into U.S.-listed spot ether ETFs totaling $84.89 million.

- Sol Strategies filed for up to $1 billion to invest in the Solana ecosystem; SOL remains stable around $170.

- TON, PEPE, and FLOKI led gains, while FARTCOIN, PI, and JUP faced losses.

- Circle froze wallets related to the Libra token containing USDC. Metaplanet issued $21 million in bonds for Bitcoin purchases.

What to Watch

- May 30: Second round of FTX repayments begins.

- May 31 (TBC): Mezo mainnet launch.

- June 6: U.S. SEC Crypto Task Force Roundtable on DeFi.

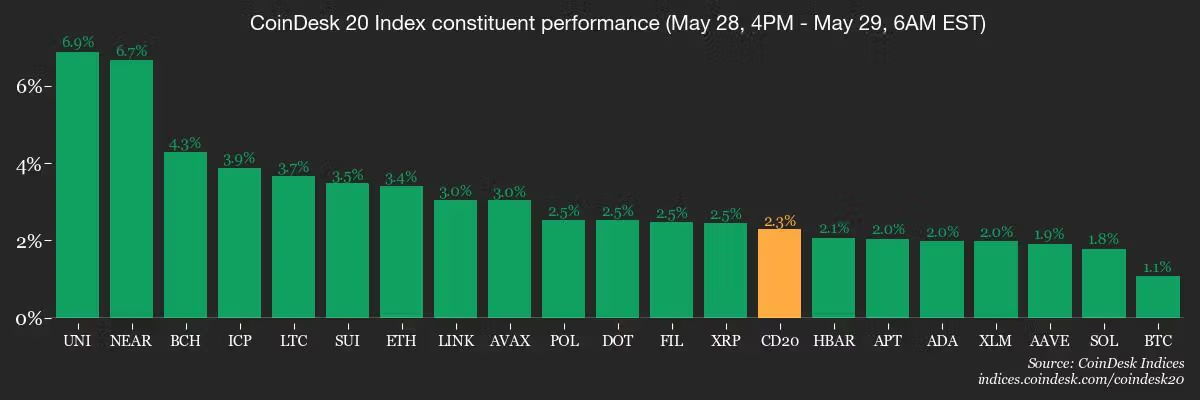

Market movements:

ETF flows show:

- Spot BTC ETFs had a daily net flow of $432.7 million.

- Spot ETH ETFs recorded a net flow of $84.9 million.

Technical Analysis

- The VIRTUAL token broke above key resistance levels, potentially inviting more buyers.

Derivatives market shows:

- Increased open interest in major cryptocurrencies.

- Funding rates indicate bullish sentiment, particularly in Ethereum.

In Summary

Overall, the crypto market is experiencing upward momentum, driven by favorable macroeconomic news and institutional interest, particularly in ETH. Investors should monitor large wallet trends and upcoming events for potential market shifts.