4 0

Bitcoin Falls Below $95,000 Mark as Short-Term Investors Sell at Loss

Bitcoin has fallen below $95,000, experiencing a 10% drop from its highs of $102,760 over the past three days. Currently, it appears to have established a support level around $91,150, a critical threshold not breached since November 15.

Key points:

- The Spent Output Profit Ratio (SOPR) is at 0.987, suggesting short-term investors are selling at a loss.

- A SOPR below 1 historically indicates potential price increases following such conditions.

- Current market dynamics provide accumulation opportunities for investors as prices may decline further.

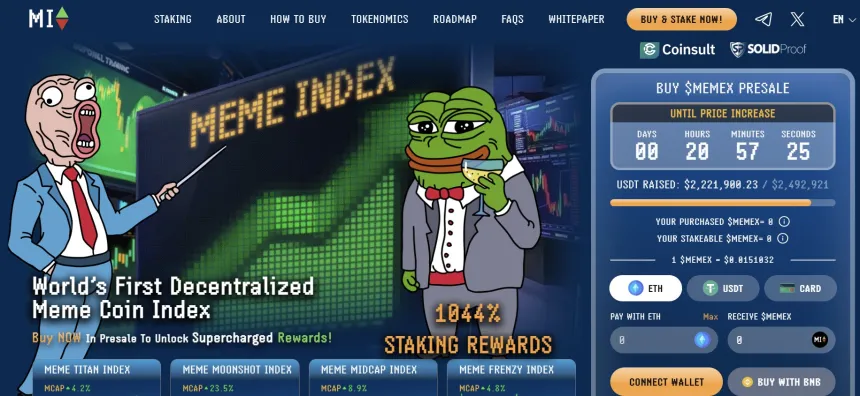

Investors may consider this period favorable for purchasing Bitcoin as prices stabilize. However, diversification options like Meme Index ($MEMEX) are available for those seeking reduced risk across various assets.

Meme Index offers four investment baskets based on risk tolerance:

- Meme Titan: Established meme coins with market caps over $1B

- Moonshot: Meme coins poised for top 10 rankings

- Midcap: Coins with market caps between $50-250M, higher volatility

- Meme Frenzy: High-risk, high-reward meme coins

$MEMEX tokens are priced at $0.0151032 each, with ongoing presales raising $2.2 million and an engaged community of 19K followers on X.