Bitcoin Futures Volume Reaches $129 Billion as Binance Leads Trading

Bitcoin has maintained its bullish momentum, reaching a new all-time high on November 13, prompting increased activity in the cryptocurrency market.

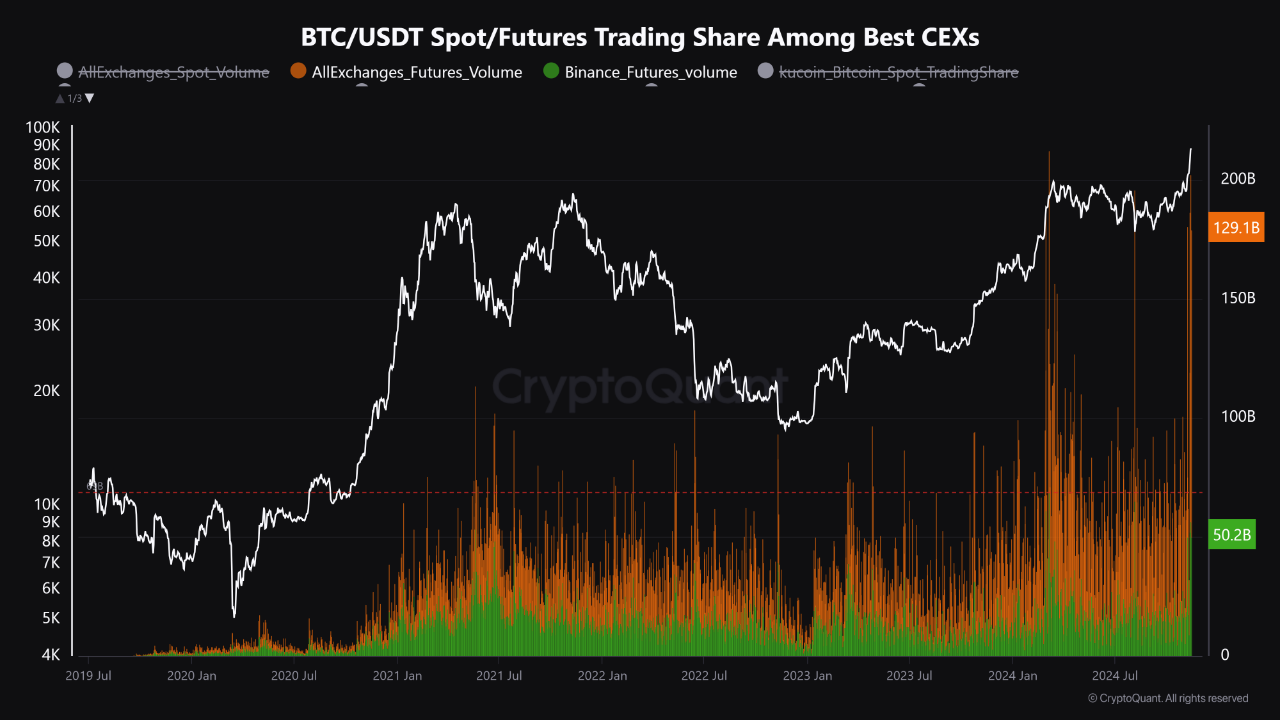

The futures market experienced significant changes, particularly with a surge in trading volume for the BTC/USDT pair. Leading exchanges, notably Binance, have been central to this trading increase.

Record Trading Volumes and Market Volatility Risks

A CryptoQuant analyst identified as Crazzyblockk noted that the Bitcoin futures market is "exceptionally overheated." Trading volumes have surged across both spot and futures markets on major centralized exchanges.

The cumulative trading volume for BTC/USDT across all major platforms has reached approximately $129 billion, with Binance contributing about $50.2 billion. This increase in futures trading raises concerns about market stability and potential volatility. Crazzyblockk explained that rapid growth in Bitcoin's derivatives market generally leads to increased market fluctuations.

"While this can briefly boost demand, it often leads to minor pullbacks and sharp fluctuations."

The analyst cautioned that the "overheated" state of the market requires careful consideration from investors and traders, advising against hasty speculation until price stability returns.

Outlook on Bitcoin

Bitcoin is currently experiencing a decline in price, having dropped by 6.1% within the last day to a trading price of $87,977 after recently surpassing $93,000.

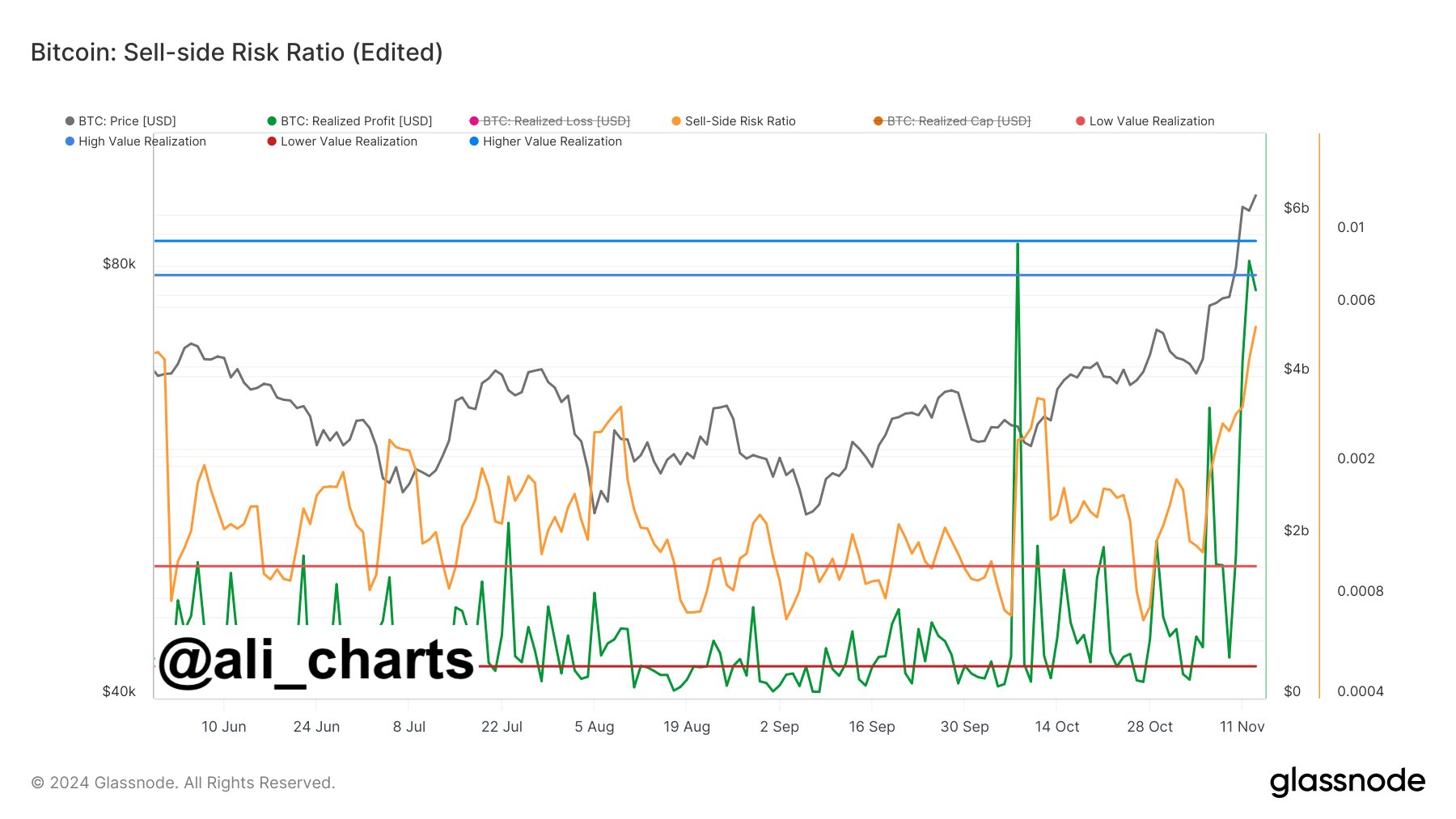

With BTC now trading below $88,000, it has decreased 5.9% from its peak. The cause of this correction remains uncertain, but analyst Ali highlighted that approximately $5.42 billion in Bitcoin profits have been realized, raising the asset's sell-side risk ratio to 0.524%. Ali advised to "stay alert and proceed with caution."

Another analyst, Javon Marks, noted ongoing upward momentum for Bitcoin and set a target of $116,652, anticipating that this may occur more rapidly than previous movements.

Some of the greatest, most precise, and simplistic analysis that you will probably see on #Bitcoin (BTC) and Crypto!

December 2022 @ ≈$16,782, we noticed bullish signals as well as a price breakout holding which signaled to us the $67,559 target which at the time was over… https://t.co/qrJv2WPwnG

— JAVON MARKS (@JavonTM1) November 13, 2024

Featured image created with DALL-E, Chart from TradingView.