Over $550 Million Liquidated in 24 Hours as Bitcoin Drops to $92,801

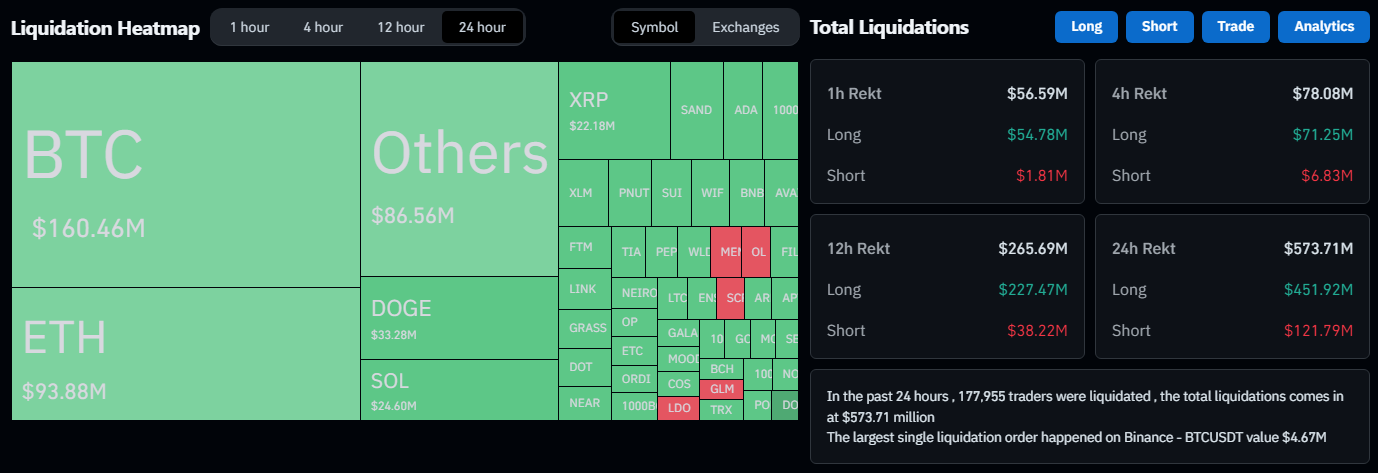

Recent developments in the cryptocurrency market saw over $550 million liquidated in just 24 hours. Bitcoin's drop to a weekly low triggered sell-offs, impacting approximately 170,000 traders.

Coinglass reports losses of $118 million in BTC longs, $54 million in ETH longs, and $25 million in Dogecoin long positions. This increase in liquidations, alongside decreased market capitalization and trading volume, highlights the volatility anticipated by traders, indicative of broader correction patterns following Bitcoin's recent rally near record levels.

Bitcoin Dominance & Liquidation Trends

Bitcoin maintains strong dominance with a market capitalization of $3.23 trillion, representing over 56% of the total crypto market. The largest liquidation recorded was a $4.67 million BTC/USDT exchange on Binance, reflecting the high stakes of leveraged trading.

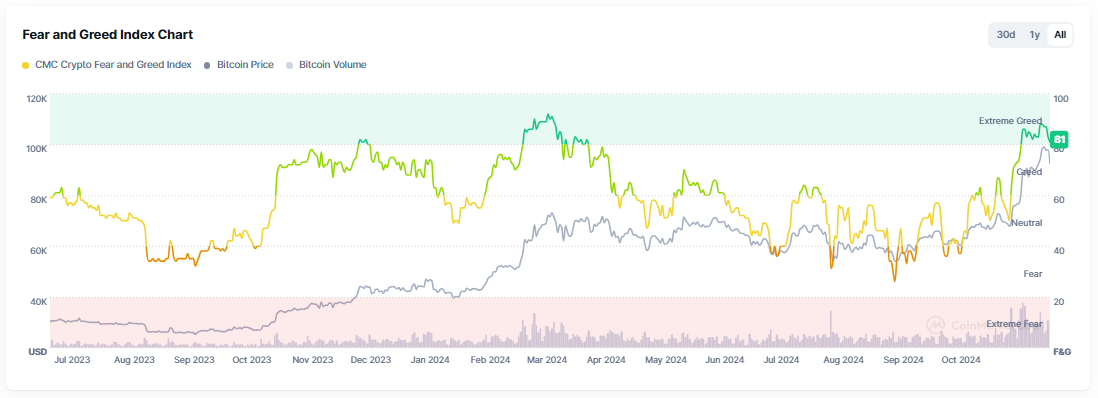

Smaller market cap altcoins also faced significant declines, contributing to a broader market loss of around $100 million. Analysts view this as a typical correction after Bitcoin's nearly 44% rise since early November. The current crypto Fear and Greed Index is at 82, indicating “Extreme Greed.”

Ethereum and Altcoins Maintain Their Poise

Ethereum shows resilience despite experiencing losses. The mixed sentiment around Ethereum is highlighted by both long and short liquidations in ETH positions.

Altcoins like Dogecoin, often driven by meme culture, also felt the impact of market corrections, serving as a warning to traders pursuing quick profits.

Analyst Miles Deutscher noted an uptick in wallet activity as more traders reactivate accounts after months of inactivity, spurred by interest in altcoins and Bitcoin's performance. This trend could lead to increased growth and volatility as the market follows its usual patterns.

The Road Ahead for Bitcoin

At $92,801, Bitcoin remains below its all-time high of $99,750 reached earlier this month. Analysts are divided on whether the market will consolidate before another surge past $100,000 or if over-leveraging may lead to heightened short-term volatility.

Investors are closely watching market sentiment and macroeconomic trends. While current conditions may foster bullish momentum, the crypto market's extreme price volatility and significant leverage risks underscore its unpredictable nature.

Featured image from DALL-E, chart from TradingView