13 1

Bitcoin Market Cap Dominance Exceeds 64% Amid Bullish Options Activity

Bitcoin (BTC) has been trading in a narrow range of $106,600 to $111,700 since May 22, despite positive developments such as Trump Media's plan to raise $2.5 billion for a bitcoin treasury strategy. U.S. equity markets are up 22% since April lows, but BTC is consolidating while the S&P 500 remains 4% below its all-time highs.

Key points:

- Bitcoin market cap dominance exceeds 64%, indicating increased influence.

- BTC trades approximately $14,000 above its 200-day moving average of $94,500.

- Ether (ETH) and Solana (SOL) struggle with resistance at their respective 200-day moving averages.

- Bitcoin options show strong call interest at $110,000 with bullish sentiment for June and July expiries at $115,000 and $120,000.

- Circle updated its IPO filing, aiming to raise $600 million at a $5.4 billion valuation.

Upcoming Events

- May 30: Second round of FTX repayments begins.

- May 31: Mezo mainnet launch (TBC).

- June 6: U.S. SEC Crypto Task Force Roundtable on DeFi.

Market Overview

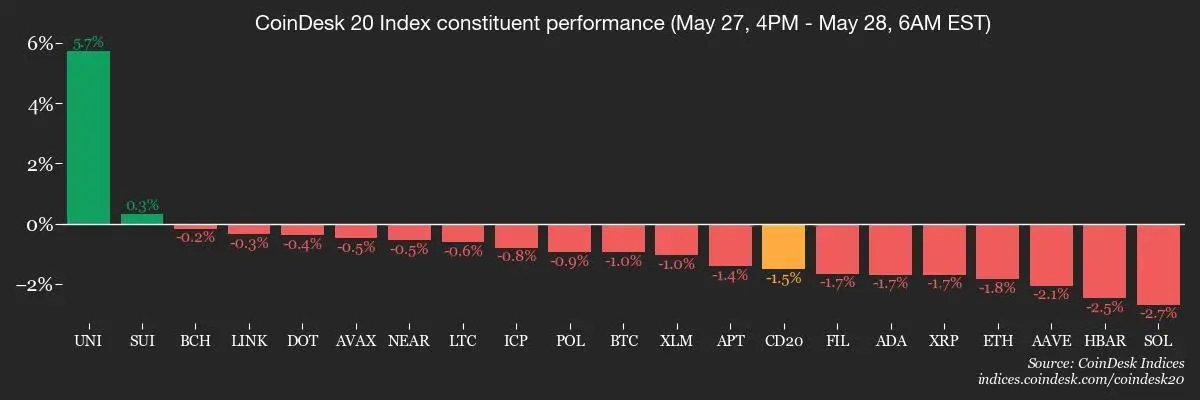

- BTC down 0.71% at $108,821.26; ETH down 1.54% at $2,628.1.

- CoinDesk 20 index down 1.35% at 3,245.33.

- Bitcoin funding rate at 0.0023% on Binance.

Derivatives Insights

- CME Bitcoin futures volume rose to $15.96 billion; open interest near $17 billion indicates paused inflows.

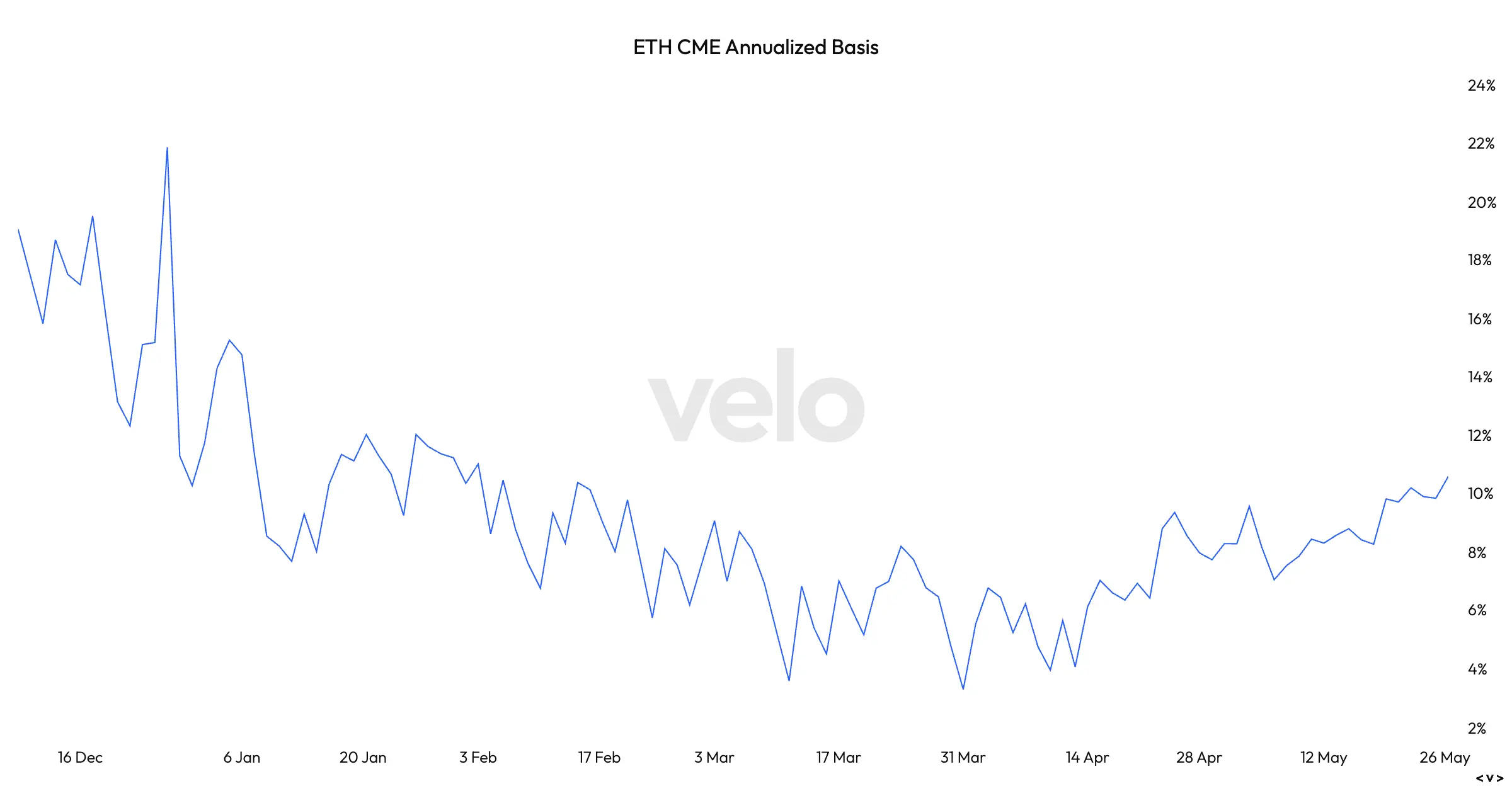

- ETH CME futures volume reached a three-month high of $3.15 billion.

Technical Analysis

- Bitcoin may break below a key trendline from early April, potentially leading to profit-taking.

Crypto Equities Performance

- MSTR closed at $372.2, COIN at $266.4, GLXY at C$29.97.

ETF Flows

- Spot BTC ETFs saw daily net flows of $385.4 million; total holdings ~1.20 million BTC.

- Spot ETH ETFs had daily net flows of $38.8 million; total holdings ~3.55 million ETH.

Chart of the Day

The annualized premium in ether CME futures has surpassed 10%, signaling bullish sentiment among market participants.