4 0

Bitcoin On-Chain Metrics Indicate Potential Undervaluation According to Analyst

Bitcoin Valuation Insights

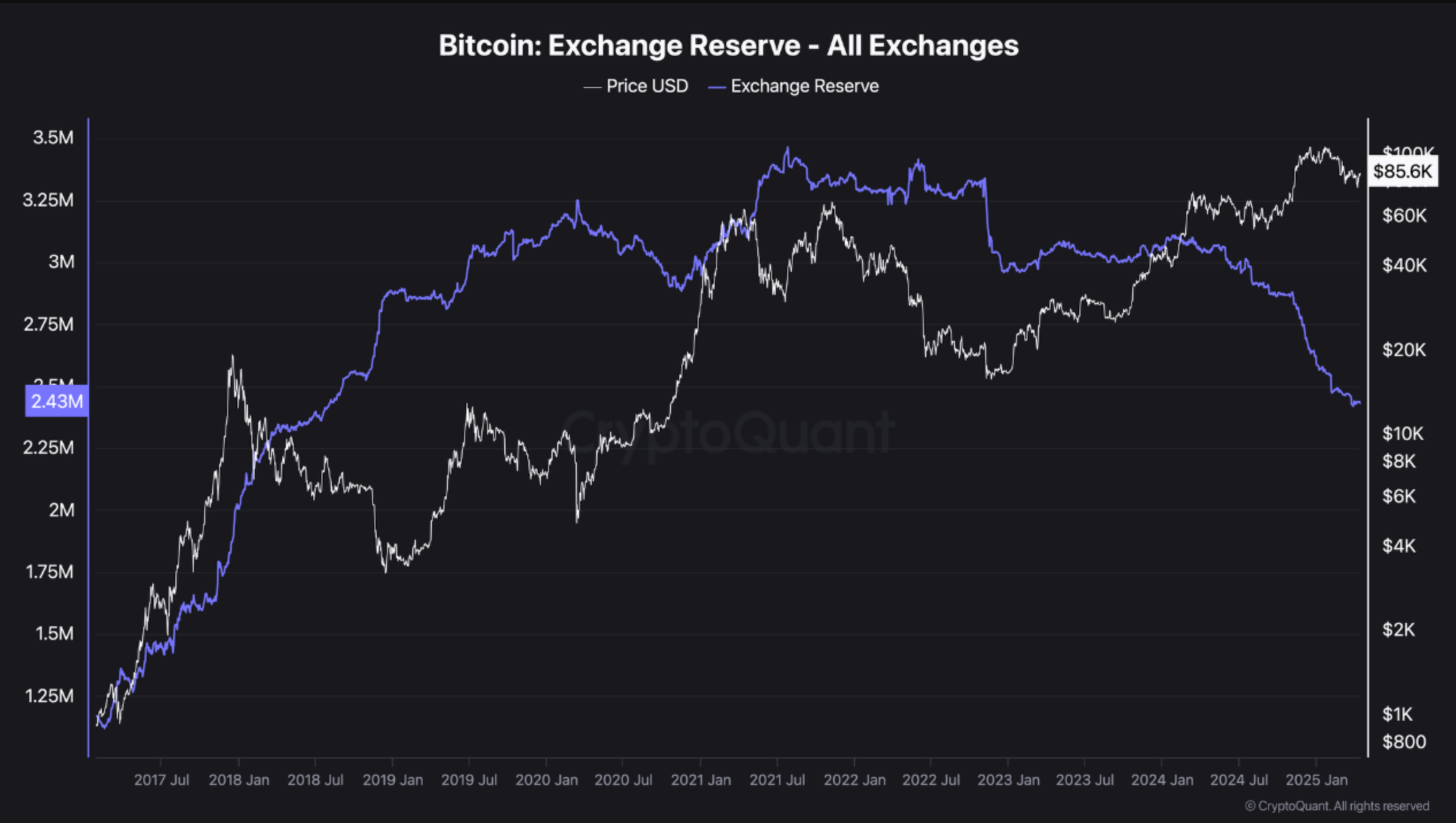

CryptoQuant analyst BorisVest indicates Bitcoin (BTC) may be undervalued based on on-chain metrics:

- Bitcoin exchange reserves are at 2.43 million BTC, down from 3.40 million BTC during the 2021 bull run.

- A decrease in available BTC suggests long-term holding, potentially supporting price increases as supply tightens.

- The Bitcoin Stablecoin Supply Ratio (SSR) is currently 14.3, indicating sufficient purchasing power to prevent significant price declines.

- The SSR has not reached its 2021 level of around 34, suggesting potential undervaluation for BTC.

USDT Dominance and Market Sentiment

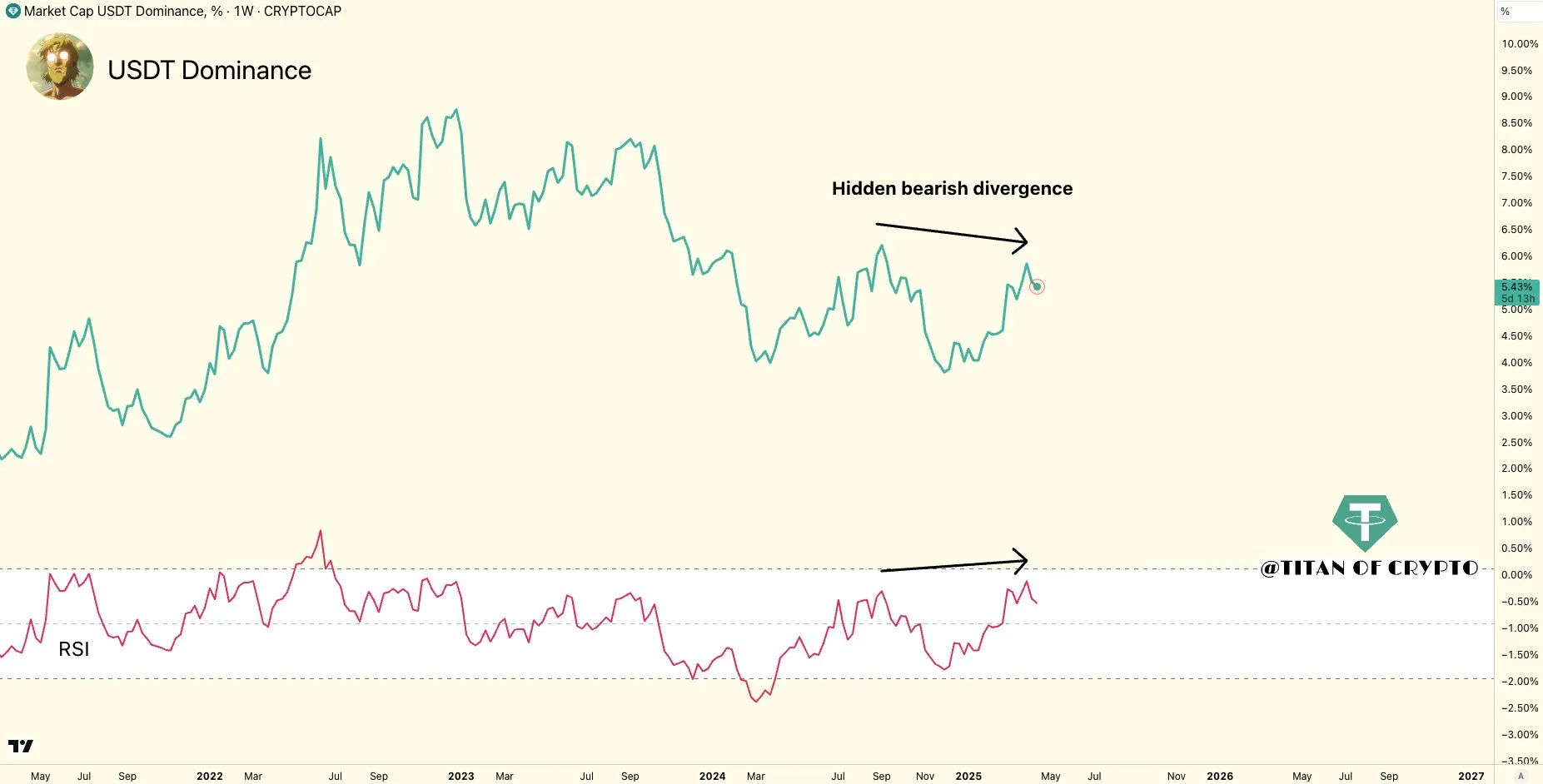

Analyst Titan of Crypto observed a possible bearish divergence in USDT dominance, signaling:

- Investors may be rotating out of stablecoins into risk-on assets like BTC and altcoins.

- This shift could indicate improving market sentiment and a potential bullish phase for crypto.

Additionally, the Bitcoin weekly Relative Strength Index (RSI) has broken its downtrend, raising expectations for a price recovery, with some analysts targeting prices above $100,000. Current trading price for BTC is $85,550, reflecting a 0.5% increase in the last 24 hours.