Bitcoin Price Falls to $91,800 Amid Profit-Taking and Economic Concerns

Crypto prices are declining due to negative U.S. macroeconomic data and profit-taking.

Current Market Status

Bitcoin (BTC) has decreased 1.8% in the past 24 hours, trading at $91,800, marking a decline of over 14% from its December 17 record of $108,278. Ether (ETH) fell 0.7% to $3,320, now 17% below its December highs and not surpassing its 2021 peak of $4,820. Solana (SOL) shows slightly better performance with the SOL/BTC ratio up 0.35% today.

CoinDesk 20 Index Performance

The CoinDesk 20 index has dropped 3.74%. Ripple (XRP) and Stellar (XRM) experienced significant losses of 6% and 6.3%, respectively. Litecoin (LTC) remains more resilient, down 1.9%.

Impact on Crypto-Related Stocks

Stocks of crypto-related companies also declined, with MicroStrategy (MSTR) and Coinbase (COIN) falling 7% and 5.3%, respectively. Major bitcoin mining firms like MARA Holdings (MARA) and Riot Platforms (RIOT) have dropped over 7%.

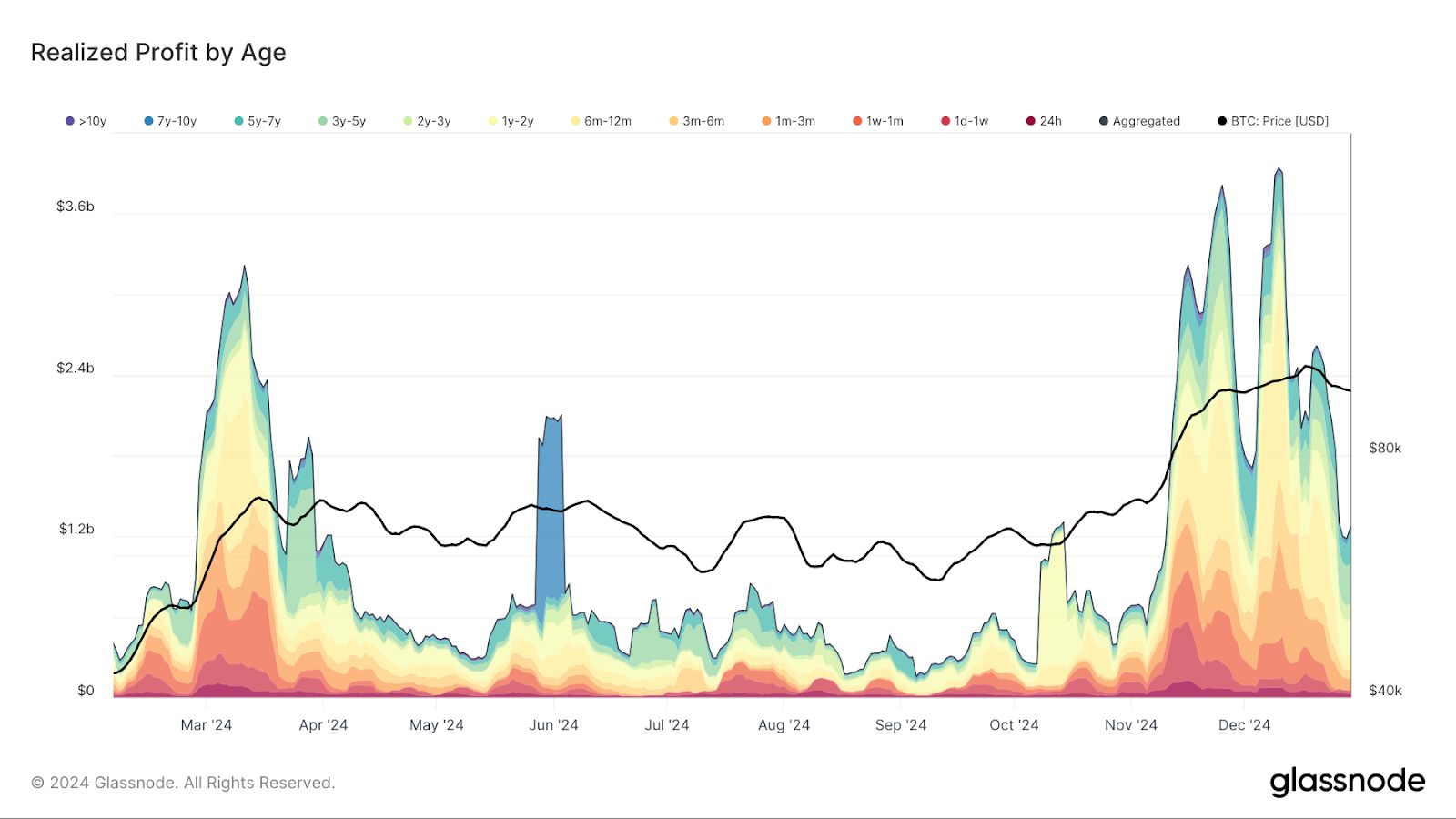

Profit-Taking Trends

Profit-taking is prominent as investors cash out following Bitcoin's rise exceeding 117% this year. Current profit-taking exceeds $1.2 billion on a seven-day moving average, significantly lower than the December 11 peak of $4.0 billion but still above typical levels. Most profits are taken by long-term bitcoin holders.

Macroeconomic Factors

The U.S. Chicago PMI indicates the lowest reading since May, suggesting an economic slowdown. Uncertainty around the Federal Reserve’s interest-rate policy, with indications of pausing rate cuts until at least March, adds to market pressure. The upcoming inauguration of President-elect Donald Trump may also influence sentiment. The S&P 500, Nasdaq, and Dow Jones are all down over 1%.

Market Outlook

Joe Carlasare, partner at Amundsen Davis, stated that while 2024 exceeded expectations, signs of exhaustion indicate a need for consolidation. He expressed optimism for 2025 but anticipates divergence from consensus trends. Continued growth in bitcoin adoption could lead to favorable performance if the U.S. avoids a significant growth slowdown, though volatility may increase compared to 2024.