8 1

Bitcoin Pulls Back to $95,000 Amid Strong ETF Inflows and Fed Week

The cryptocurrency market shows bullish signs despite a recent pullback in Bitcoin's price. Key developments include:

- Bitcoin (BTC) dropped to $95,000 from highs above $98,000; total market cap fell below $3 trillion.

- U.S.-listed spot bitcoin ETFs reported a net inflow of $1.8 billion last week, equating to over 18,500 BTC, significantly exceeding the mined amount of 3,150 BTC.

- Active BTC addresses surpassed 800,000, indicating increased on-chain engagement and renewed market demand.

- Wrapped Bitcoin (WBTC) transactions in DeFi have doubled since January, reflecting rising investor interest.

- Long-term holders may begin selling as prices approach $100,000, which could slow price increases.

- Ethereum (ETH) accumulation addresses grew by 22% to 19.04 million ETH ahead of the upcoming Pectra upgrade on May 7.

- The Federal Reserve's interest rate decision is expected this Wednesday, with potential implications for market volatility.

What to Watch

- Key crypto events:

- May 5: Kaspa network upgrade.

- May 6: Casper Network 2.0 mainnet launch.

- May 7: Ethereum Pectra hard fork activation.

- May 8: Sentencing of Celsius founder Alex Mashinsky.

- Macro data releases scheduled for May 5-7, including U.S. PMI and the Federal Reserve interest rate announcement.

- Upcoming earnings reports from major companies like Coinbase and CleanSpark on May 8.

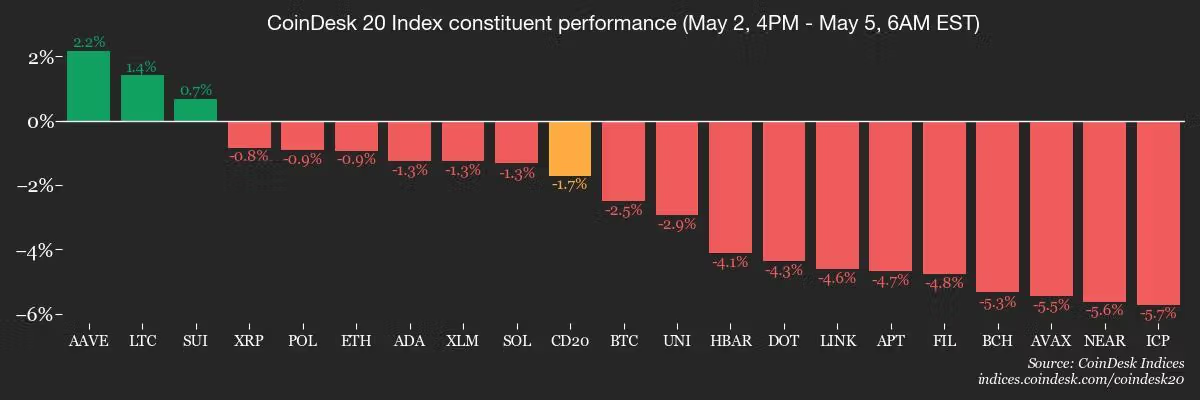

Market Movements

- BTC price down 1.27% at $94,447.49

- ETH price down 0.77% at $1,819.25

- CME BTC futures open interest at $14.01 billion.

- Spot BTC ETFs saw daily net flow of $674.9 million, with cumulative flows reaching $40.20 billion.

Technical Analysis

- Monero (XMR) futures market shows overheated conditions, risk of price pullbacks.

- BTC futures show increasing open interest, while ETH remains flat.

Overall, investors should monitor ETF inflows and macroeconomic indicators as they navigate the evolving crypto landscape.