8 0

Bitcoin Steady, Bitfinex Warns of Risks Amid Potential U.S. Shutdown

The crypto market saw limited movement on Tuesday as the U.S. government faced a potential shutdown.

- Bitcoin (BTC) slightly rose to $114,300 after a 2% drop earlier.

- Ether (ETH) fell by 1.3%, trading just above $4,100.

- Avalanche (AVAX), Uniswap (UNI), and Near (NEAR) led losses in the CoinDesk 20 Index.

Traditional markets saw positive movements, with gold increasing by 0.5% and both Nasdaq and S&P 500 closing higher.

- The U.S. government shutdown could halt non-essential activities, affecting regulatory efforts for crypto by agencies like the SEC and CFTC.

- ETFs tied to cryptocurrencies such as Solana (SOL) and Litecoin (LTC) may face delays.

- Congress' work on crypto legislation is delayed, with some hearings postponed or rescheduled.

Implications of the U.S. Government Shutdown

- Bitfinex warns that a shutdown could stop the release of key economic indicators, increasing volatility in crypto markets.

- Data delays might complicate Federal Reserve monetary policy decisions, potentially reducing U.S. investment appeal globally.

- Confidence erosion and data blind spots pose immediate risks, not systemic financial instability.

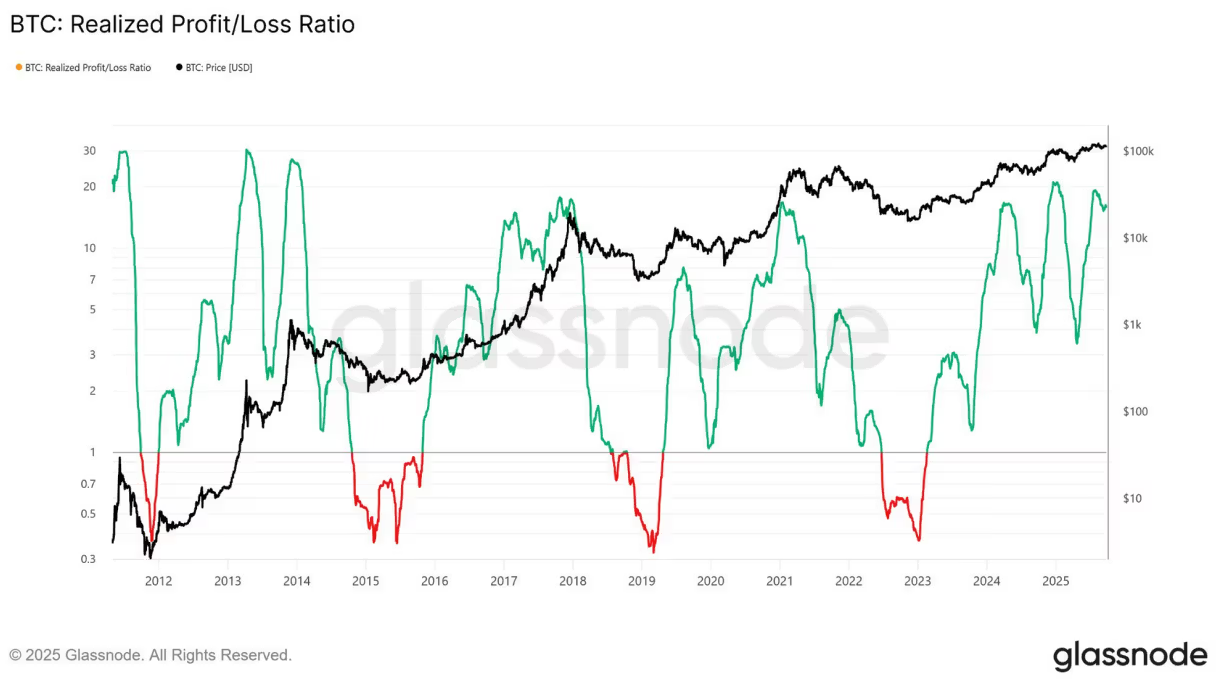

- Bitcoin remains in a corrective phase post-Fed's interest rate cut, exhibiting three distinct multi-month surges followed by profit-taking.

- Bitfinex analysts suggest further consolidation amid deep political polarization, rising fiscal deficits, and global economic fragility.