4 0

Bitcoin Surges Past $91,000 Amid Trade Optimism and Investor Interest

Bitcoin (BTC) rose to $91,700, up nearly 5%, driven by renewed investor optimism and potential easing of U.S.-China trade tensions. Key points include:

- Ethereum (ETH) increased by 8% to over $1,700.

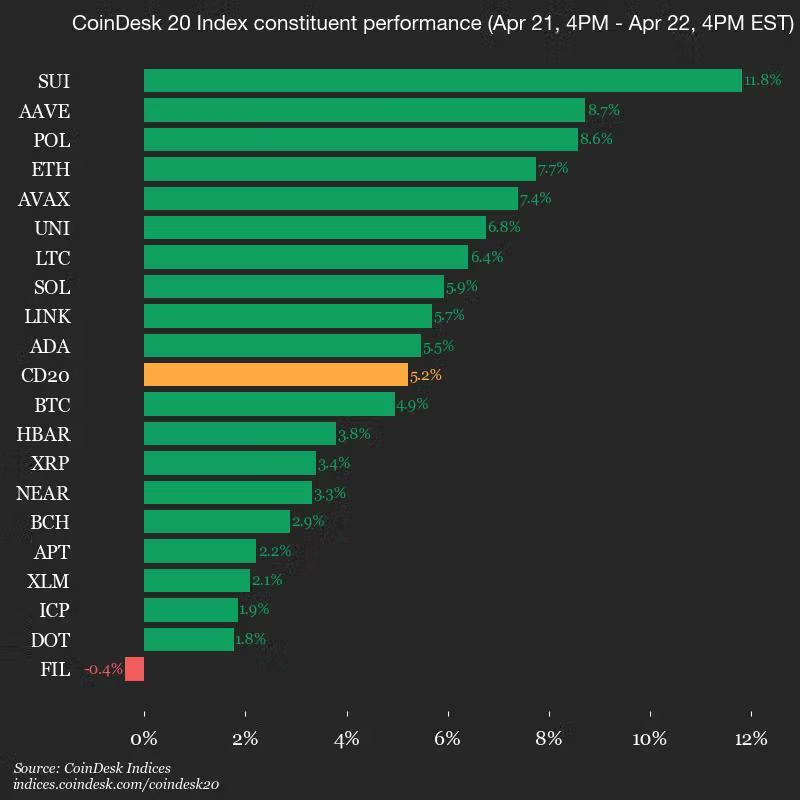

- Other altcoins like Dogecoin (DOGE) and Sui (SUI) gained 8.6% and 11.7% respectively.

- The CoinDesk 20 Index advanced by 5.2%.

U.S. Treasury Secretary Scott Bessent indicated a possible de-escalation in trade tensions, though comprehensive agreements may take years. Stock markets also rebounded, with the S&P 500 and Nasdaq rising by 2.5% and 2.7% respectively.

Analysts noted that BTC and gold are benefiting from shifts toward safe-haven assets. Spot U.S.-listed BTC ETFs saw significant inflows, totaling over $381 million on Monday.

However, caution persists:

- Bitcoin demand decreased by 146,000 BTC over the last month, indicating underlying fragility.

- Market liquidity remains soft, with USDT's growth below historical rally thresholds.

- Bitcoin faces resistance between $91,000 and $92,000, which has previously acted as a barrier during bearish trends.

CryptoQuant classified the current market as bearish, suggesting a potential pause or pullback could occur if sentiment weakens.