47 1

Bitcoin Whale Nets $197M Profit, Sparks Speculation of New Short

Bitcoin is currently trading around $112,500, experiencing ongoing volatility following a recent significant market crash. Short-term holders are under pressure, with many reacting emotionally to price changes and selling in panic.

- The STH realized price suggests that recent buyers are affected by the volatility.

- A notable Bitcoin whale closed short positions, securing over $197 million in profits, marking a successful trade.

- Market sentiment is divided between fear-driven sellers and investors taking advantage of potential opportunities.

Bitcoin Whale Activity Sparks Speculation

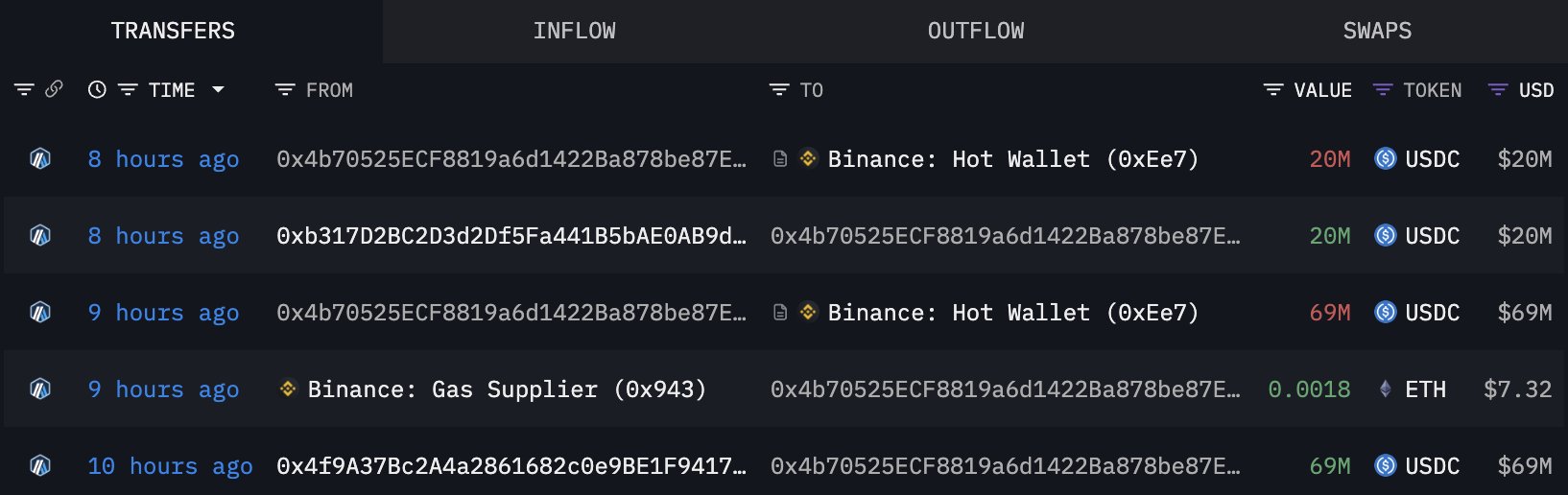

- Lookonchain tracked moves by the trader known as BitcoinOG, who closed BTC short positions with significant profits.

- The trader transferred $89 million USDC to Binance, raising speculation about reopening short positions.

- Bitcoin open interest on Binance surged shortly after this deposit.

- Analysts are uncertain if this signals more shorting or capital repositioning for strategies like hedging or arbitrage.

BTC Consolidates Below Key Level

- Bitcoin trades around $112,500, just above its short-term support zone.

- It is trapped between the 50-day moving average (~$115,000) and 200-day moving average (~$108,000).

- The $117,500 level acts as a key supply zone, with repeated rejections confirming its significance.

- Bulls struggle to regain control after a sell-off, and failure to hold above $110K could lead to further declines.

- Holding above this range may stabilize sentiment, allowing a potential retest of $115K–$118K.