BTC Rises Above $110K, ETH Crosses $4K Amid Fearful Sentiment

Crypto markets experienced a modest rebound on Friday:

- Bitcoin (BTC) rose above $110,000.

- Ethereum's ether (ETH) increased by 3.8% to surpass $4,000.

- Dogecoin (DOGE) gained 3.4%.

- Solana (SOL) added 2.5%.

The movement coincided with inflation data aligning with predictions, as the Personal Consumption Expenditures (PCE) index rose 2.7% year-over-year in August. Core PCE, excluding food and energy, climbed 2.9%. This data supports the Fed's narrative of easing price pressures while balancing inflation and labor market conditions.

Fabian Dori from Sygnum Bank noted that lower inflation trends could support risk assets if the Fed continues its easing cycle. However, unexpected data increases might delay rate cuts, affecting equities and boosting the U.S. dollar.

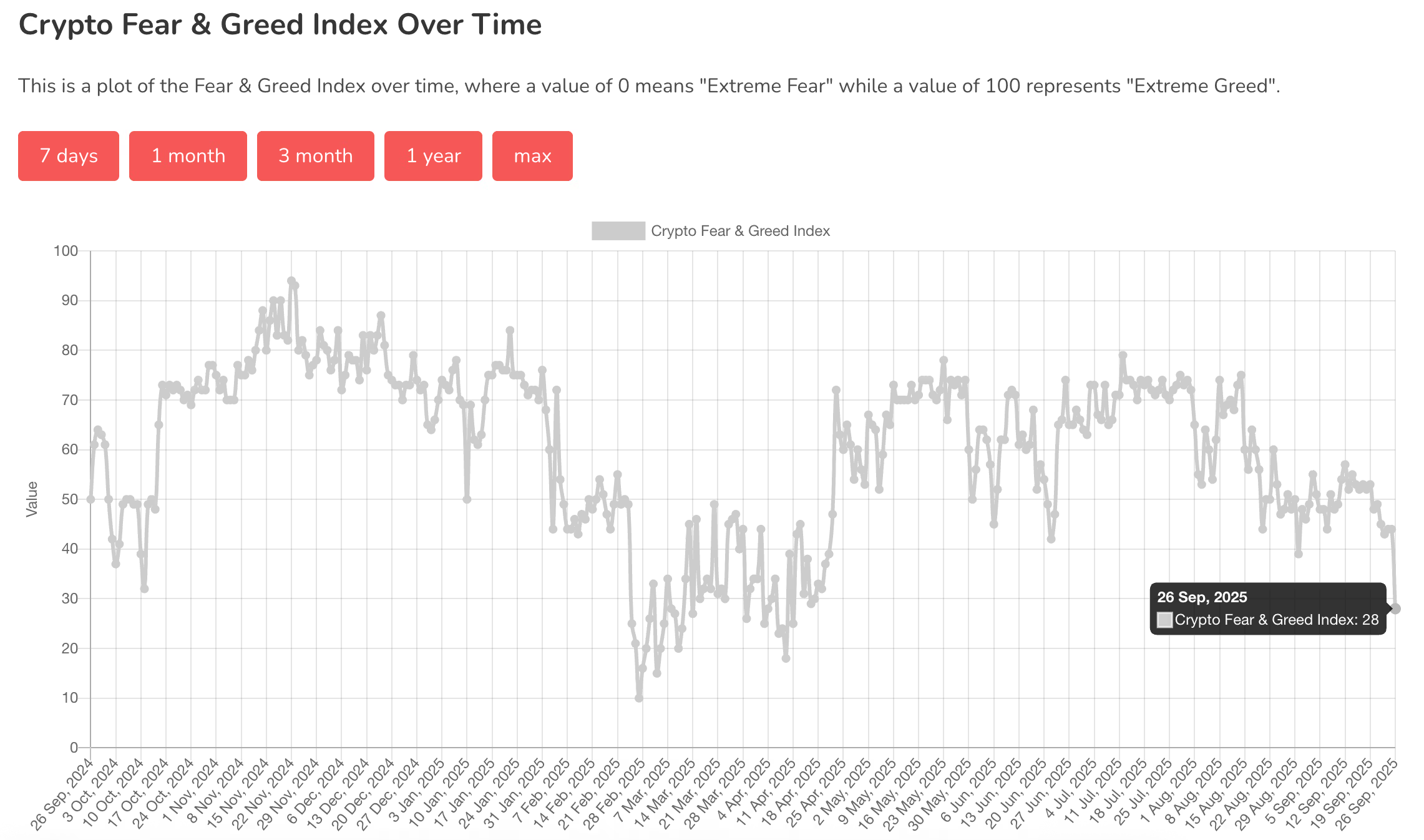

Crypto Sentiment Remains Fearful

The Fear & Greed Index dropped to 28, indicating "fear" among traders following a $1.1 billion liquidation wave wiping out leveraged long positions. This led to a bearish sentiment with tokens like BTC, SOL, and DOGE showing a one-to-nine long-to-short ratio.

Matt Mena from 21Shares sees potential for a short squeeze given this setup. Conversely, Paul Howard from Wincent warns of a possible market decline before stabilization, as BTC dips below its 100-day moving average and total crypto market cap falls under $4 trillion. Howard considers the correction healthy but questions if crypto will revisit record highs by 2025.