7 0

BTC Drops 0.84% as Dollar Strength Dampens Crypto Appeal

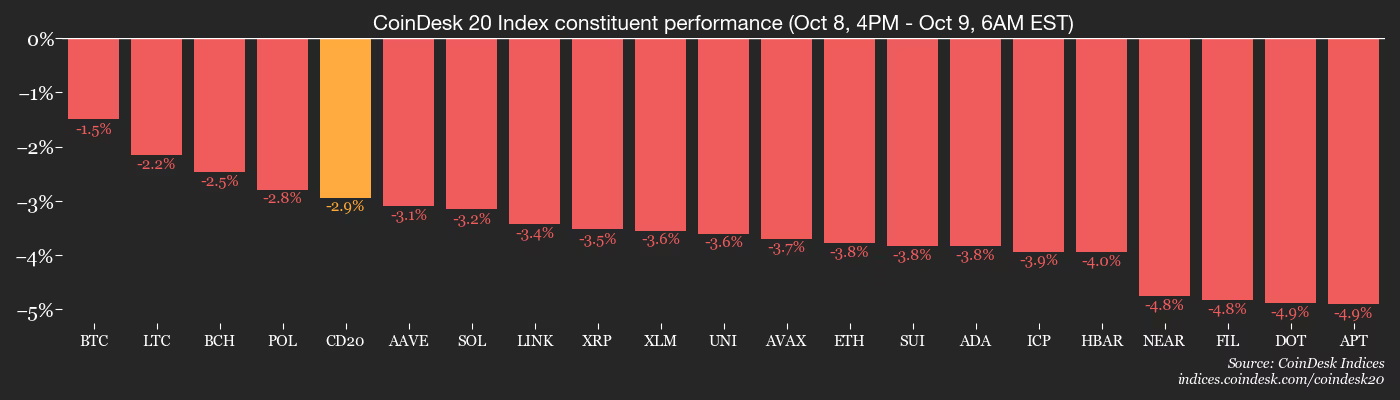

Recent market movements show a decline in BTC and the wider crypto market, influenced by a strong dollar despite Fed minutes indicating potential rate cuts. The BTC price decreased by 0.84%, and the CoinDesk 20 Index dropped over 1% to 4,163 points.

- The U.S. government shutdown continues, causing market uncertainty as traders await Fed Chair Powell's speech for policy direction.

- Solana's treasury company Helius plans to acquire 5% of Solana's supply, while Coinbase launched DEX trading for U.S. users, excluding New York.

- Gold remains above $4,000, but S&P 500 futures are flat. Concerns over a potential stock market drop were raised by JP Morgan's Jamie Dimon.

- Binance introduces Meme Rush to capitalize on the memecoin trend, leveraging BNB Chain's community launch hubs.

- In derivatives, OI in BTC and ETH has dropped by 1% and 3% respectively, with AVAX, ASTER, PUMP, and XPL leading declines in futures open interest.

Upcoming Events

- Oct. 9: Casper team hosting an Execution Engine update; Cronos team hosting an AMA.

- Oct. 9: Brazil and Mexico announce inflation rates; U.S. jobless claims report delayed due to the shutdown.

- Fed Chair Powell will speak at the Community Bank Conference in Washington, D.C.

- Decentraland DAO voting to replace its committee concludes on Oct. 10.

Market Data

- DXY unchanged at 98.90; Gold futures down 0.37% at $4,055.60.

- Nikkei 225 closed up 1.77%; Hang Seng down 0.29%; S&P 500 up 0.58%.

- BTC dominance at 59.38%; ETH to BTC ratio at 0.03568.

Technical Analysis

- ETH fell to $4,350 from $4,750, invalidating a bullish breakout, indicating a possible deeper pullback.

Crypto Equities

- Coinbase (COIN) closed at $387.27 (+3.06%), now at $381.07 (-1.6%).

- Circle Internet (CRCL) closed at $150.46 (+1.17%), now at $148.77 (-1.12%).

ETF Flows

- Spot BTC ETFs daily net flow: $440.7 million; cumulative: $62.53 billion.

- Spot ETH ETFs daily net flow: $69.1 million; cumulative: $15.11 billion.