7 0

Citi Predicts Stablecoins Could Drive Blockchain Adoption to $3.7 Trillion by 2030

Global bank Citi forecasts 2025 as a potential turning point for blockchain adoption, driven by stablecoins. Analysts compare this moment to AI's breakthrough with ChatGPT.

- Citi highlights stablecoins like Tether's USDT ($145 billion) and Circle's USDC ($60 billion) as key growth drivers.

- The bank predicts stablecoin market could reach $1.6 trillion by 2030 under favorable conditions, with an optimistic scenario of $3.7 trillion and a pessimistic case of $500 billion.

- A supportive U.S. regulatory framework, including a presidential executive order for digital assets, is seen as crucial for deeper integration into the financial system.

- Stablecoins expected to remain predominantly dollar-denominated, with 90% tied to the U.S. dollar by 2030.

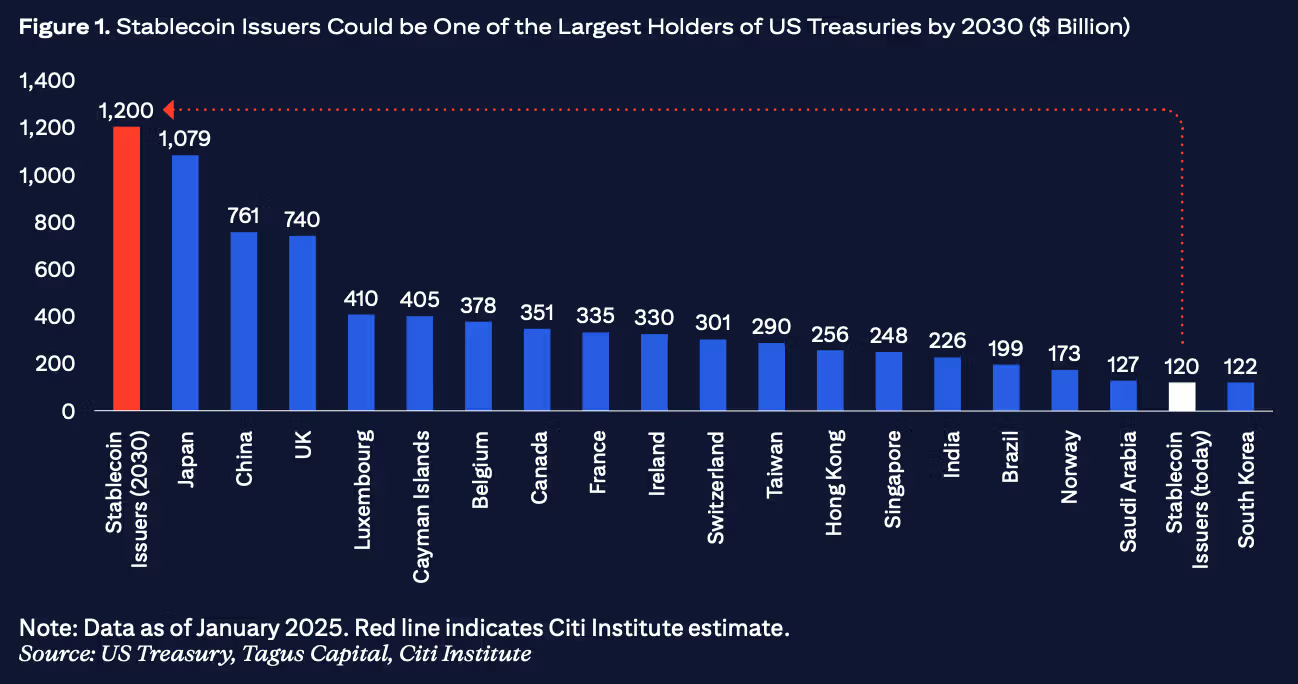

- Issuers may hold $1.2 trillion in U.S. Treasuries by 2030, potentially outpacing major foreign holders.

- European and Asian central banks are likely to promote their own Central Bank Digital Currencies (CBDCs).

- Risks include stablecoin de-pegging incidents, which occurred nearly 1,900 times in 2023, potentially disrupting liquidity and market stability.