Crypto Investment Products See Record $3.13 Billion in Net Inflows

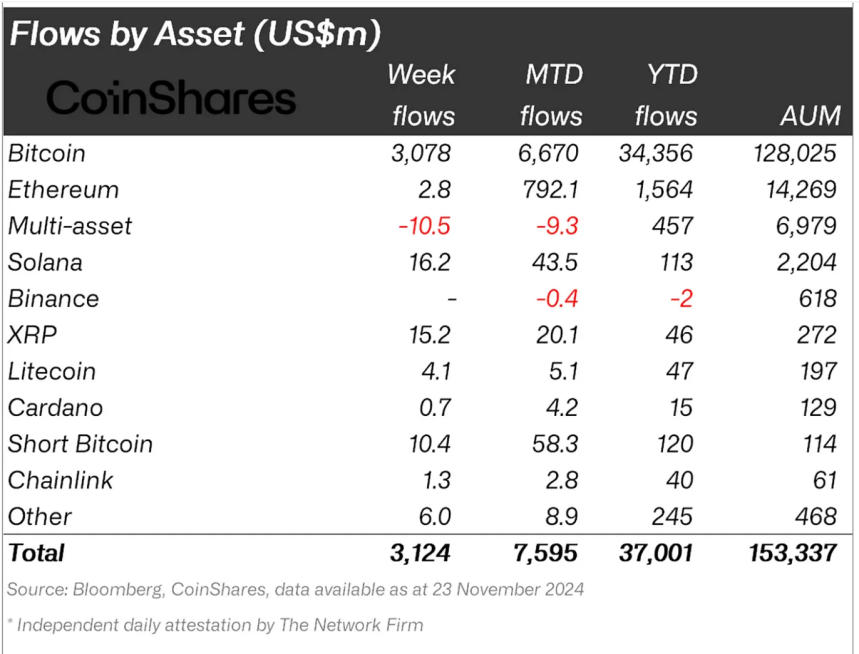

The crypto market achieved a significant milestone with approximately $3.13 billion in net inflows globally, driven mainly by US spot Bitcoin exchange-traded funds (ETFs), according to CoinShares. This growth indicates increasing institutional interest in the crypto sector, with year-to-date net inflows into crypto funds reaching $37 billion and total assets under management at $153 billion.

Bitcoin Takes The Lead, Altcoins Show Growth

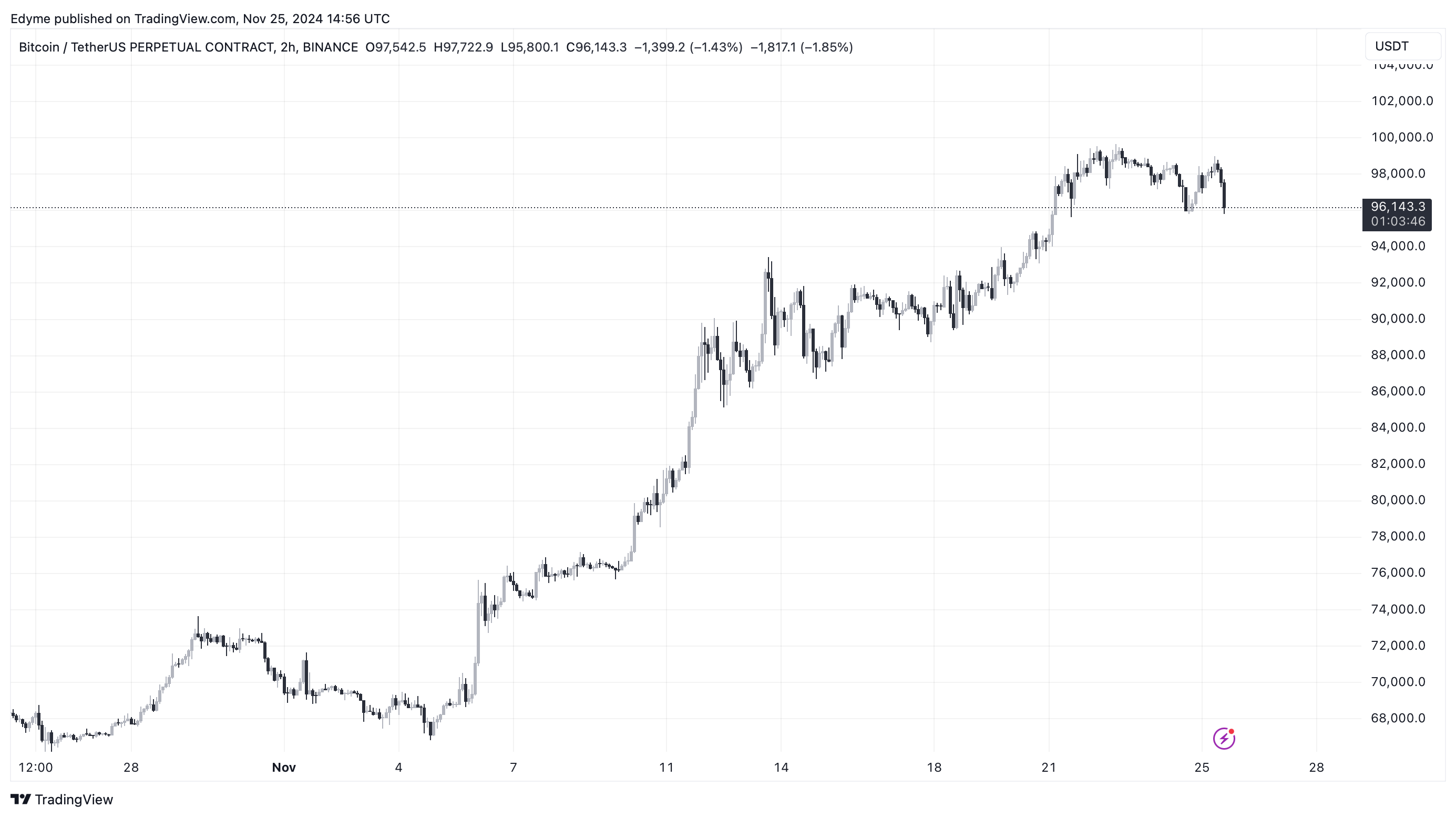

Last week marked the seventh consecutive week of positive inflows for global crypto investment products managed by firms such as BlackRock, Fidelity, Grayscale, and ProShares. BlackRock’s IBIT product contributed about $2.05 billion to these inflows, highlighting the dominance of US-based funds. Inflows from Bitcoin-based funds totaled $3 billion, coinciding with a price rally that attracted both institutional and retail investors.

Additionally, there was a $10 million inflow into short-Bitcoin products, bringing their monthly total to $58 million, the highest since August 2022. While Bitcoin led the inflows, altcoins also experienced notable investments. Solana recorded $16 million in net weekly inflows, surpassing Ethereum’s $2.8 million.

Other altcoins such as XRP, Litecoin, and Chainlink attracted inflows of $15 million, $4.1 million, and $1.3 million, respectively. These trends indicate growing confidence in the broader altcoin market, supported by price rallies and increased adoption.

Global Crypto Inflows And Regional Trends

US-based funds accounted for $3.2 billion in net weekly inflows, although this was partially offset by outflows from European markets, including $84 million from Sweden, $40 million from Germany, and $17 million from Switzerland. Despite these regional outflows, the overall trend remains bullish, largely due to institutional participation in the US market.

Continuous inflows reflect positive sentiment regarding the bull run and increasing acceptance of crypto as a legitimate asset class. The launch of spot Bitcoin ETFs provides institutional investors with regulated access to digital assets, facilitating a shift toward mainstream adoption.

Featured image created with DALL-E, Chart from TradingView