Crypto Investment Products Experience $584 Million Outflow in One Week

Crypto asset investment products faced capital outflows for the second week, with $584 million exiting in the latest report from CoinShares. Cumulative outflows over two weeks reached $1.2 billion.

This trend is attributed to investor uncertainty regarding potential interest rate cuts by the US Federal Reserve. James Butterfill from CoinShares noted skepticism about macroeconomic policy shifts affecting market sentiment. Global exchange-traded product (ETP) volumes fell to $6.9 billion, the lowest since the launch of spot Bitcoin ETFs in the US.

Bitcoin and Ethereum Bear the Brunt of The Crypto Outflows

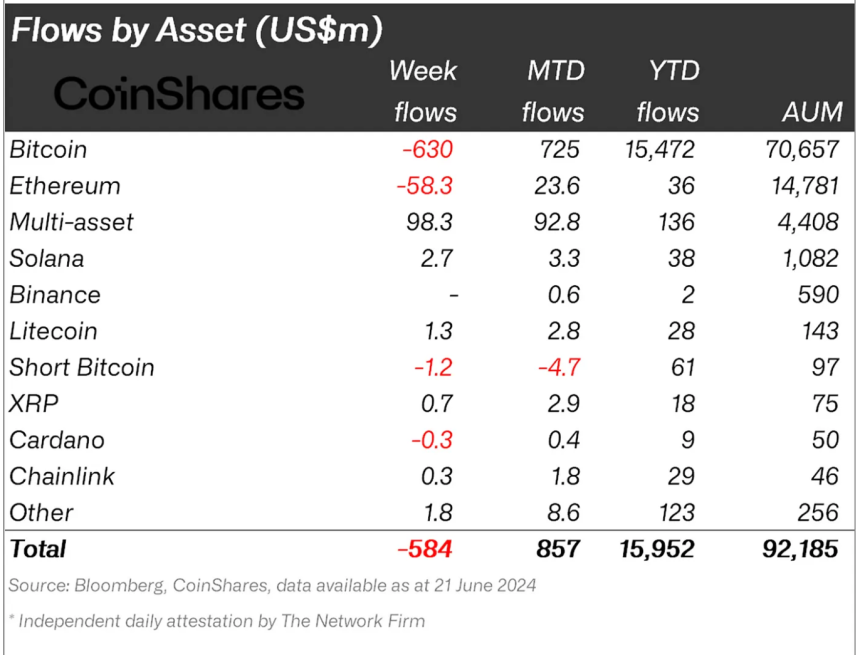

- Bitcoin saw $630 million in outflows from investment products.

- Short Bitcoin products recorded outflows of $1.2 million.

- Ethereum experienced $58 million in outflows.

- Investor activity suggests caution amid market uncertainties.

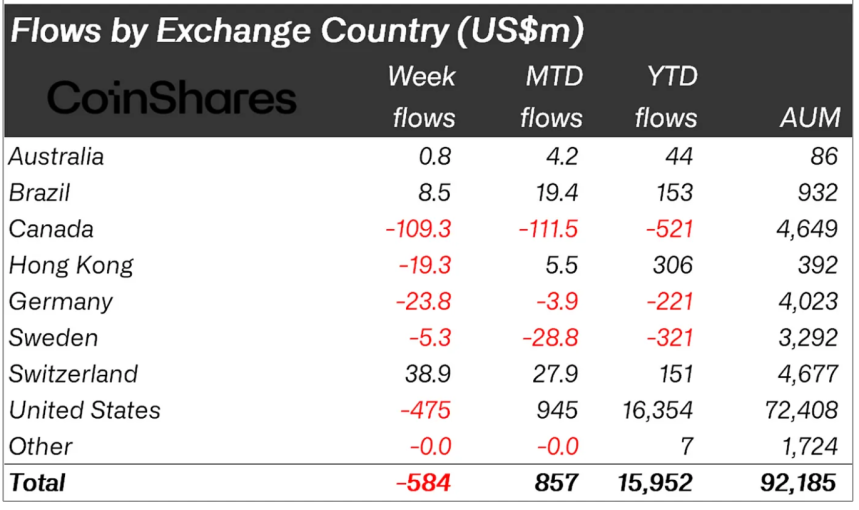

- The US led with $475 million in outflows, followed by Canada ($109 million), Germany ($24 million), and Hong Kong ($19 million).

Switzerland and Brazil reported net inflows of $39 million and $48.5 million, indicating differing regional investment behaviors.

Altcoins Draw Selective Support

- Some altcoins like Solana, Litecoin, and Polygon gained $2.7 million, $1.3 million, and $1 million, respectively.

- Multi-asset investment products saw inflows of $98 million.

The divergence in fund flows reflects complex investor sentiment influenced by macroeconomic factors and regional trends. Digital asset markets remain sensitive to global monetary policy and evolving strategies among investors.