8 0

Crypto Investment Products Face $1.73 Billion Outflows, Led by Bitcoin

Crypto Investment Outflows Surge

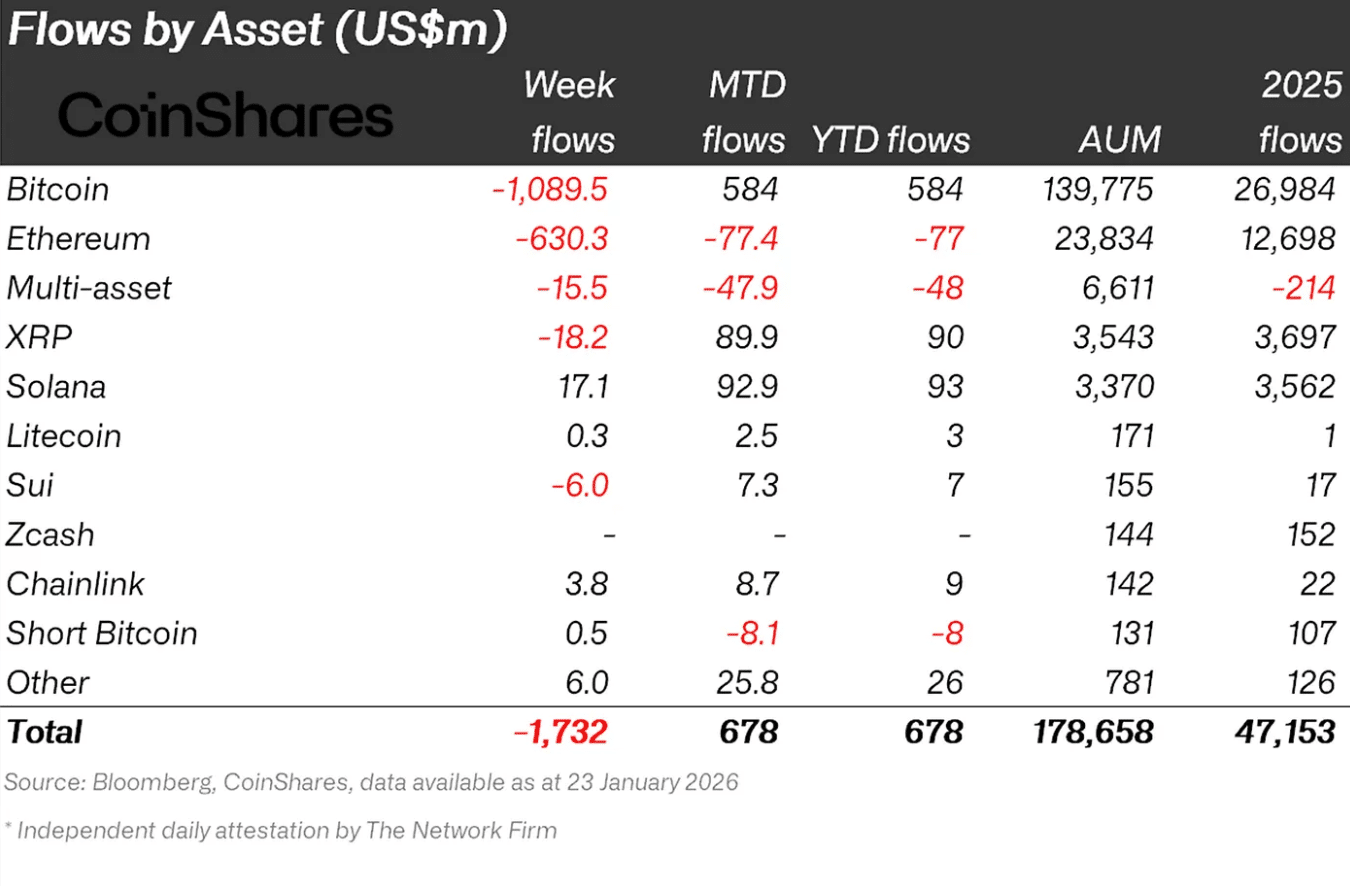

Recent data indicates a significant withdrawal from crypto investment products, with CoinShares reporting $1.73 billion in net outflows last week, marking the largest since mid-November 2025.

- Total assets under management fell to $178 billion from $193 billion the previous week.

- The outflows are attributed to diminishing expectations for interest rate cuts and weak crypto price performance.

Major Outflows in Bitcoin and Ethereum

- Bitcoin experienced $1.09 billion in outflows.

- Ethereum saw $630 million withdrawn.

- XRP recorded $18.2 million in outflows.

- SUI noted $6 million in withdrawals.

Notable Inflows and Regional Differences

- Solana registered $17.1 million in inflows.

- Binance-linked products gained $4.6 million, and Chainlink added $3.8 million.

- Short-Bitcoin products saw $500,000 in inflows.

Regional Trends

- The US accounted for nearly $1.8 billion of total outflows.

- Sweden and the Netherlands had smaller outflows of $11.1 million and $4.4 million.

- Switzerland, Canada, and Germany reported inflows of $32.5 million, $33.5 million, and $19.1 million, respectively.

Issuer-Level Insights

- BlackRock's iShares led issuers with $951 million in outflows.

- Fidelity and Grayscale followed with $469 million and $270 million in outflows.

- Volatility Shares and ProFunds Group noted inflows of $83 million and $37 million.

Binance Exodus

- Binance recorded its largest weekly net outflows since November 10, 2025.

- Bitcoin saw $1.97 billion leave the exchange.

- Ethereum's outflow was $1.34 billion.

- ERC20-based USDT faced $3.11 billion in net outflows, while USDT on Tron had a $905 million inflow.