6 1

Pundits Claim Bitcoin, Ethereum, Dogecoin Prices Manipulated by Exchanges

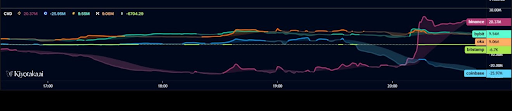

Crypto analyst NoLimit suggests recent price fluctuations in Bitcoin, Ethereum, and Dogecoin are due to manipulation.

- NoLimit claims Binance is buying while Coinbase is selling large amounts of Bitcoin, leading to price drops.

- A notable spike in Binance's CVD and a drop in Coinbase's CVD were observed simultaneously, indicating coordinated trading activities.

- The sharp decline in Bitcoin's liquidity contributed to a thin order book and volatile prices.

- NoLimit asserts these actions may be strategic moves involving hedging, arbitrage, or direct manipulation.

Another analyst, Vivek, also points to manipulation, highlighting Bitcoin's repeated round-trip between $94,000 and $88,000, which led to liquidations exceeding $200 million.

- These movements are seen as deliberate efforts to affect both leveraged long and short positions.

- Bull Theory accuses Jane Street of manipulating prices to purchase Bitcoin at lower values, noting consistent declines at market open followed by recoveries.

Both analysts emphasize the importance of monitoring these market activities for potential implications on future price movements.