Updated 21 December

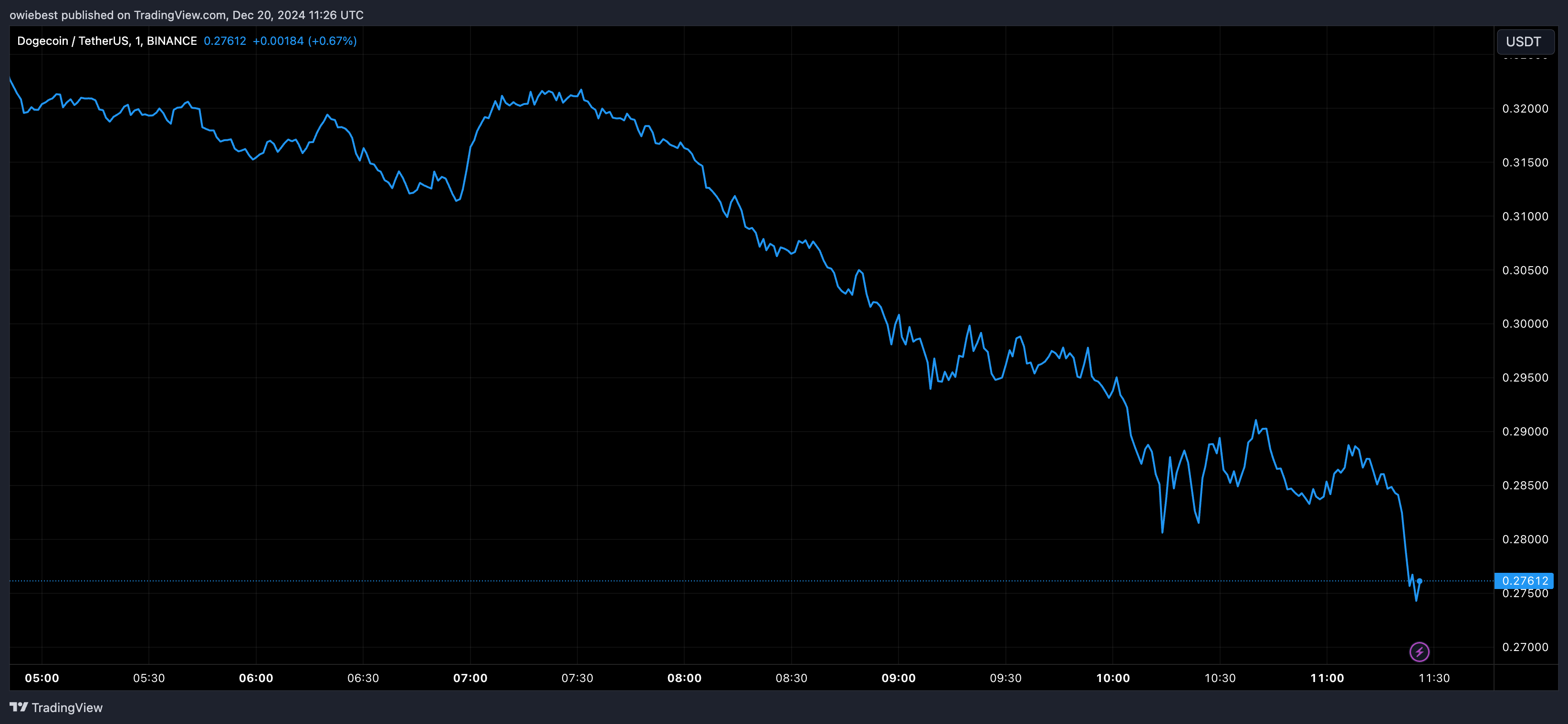

Dogecoin Price Drops to $0.31 Amid Market Correction

The cryptocurrency market has experienced a significant decline in the past 24 hours, primarily driven by Bitcoin falling below the $100,000 price level. Dogecoin also saw a nearly 15% decrease, dropping below $0.31. Technical analysis indicates that this decline aligns with Dogecoin's current trajectory and is part of a broader bull cycle.

Weekly Golden Cross and Its Implications for Dogecoin Price

Crypto analyst Kevin (Kev_Capital_TA) noted the importance of Dogecoin’s weekly golden cross amid the market downturn. This event occurred in early November, coinciding with the US election period and historically signals strong bullish momentum. Kevin observed that past patterns show significant corrections followed golden crosses, with Dogecoin previously experiencing three separate 50% corrections before reaching cycle highs. The recent drop to $0.31 is viewed as a typical bull market pullback necessary for maintaining bullish structure.

Support Levels and the Golden Pocket Zone

Kevin's analysis identifies key support levels for Dogecoin, including the macrostructured support zone and the Fibonacci retracement zone, known as the golden pocket. A 45% correction from Dogecoin’s recent high of approximately $0.48 could align with these support levels, potentially enabling a resumption of the uptrend. Maintaining above the $0.26 level on a weekly basis is crucial; failure to do so may negatively impact Dogecoin's price trajectory.

Currently, Dogecoin is trading at $0.3179, reflecting a 12% decline in the last 24 hours and a 22% drop over the past week. This positions Dogecoin at its lowest since early November, having broken below the $0.35 threshold for the first time in over a month. The $0.26 support level will be critical in assessing the validity of Dogecoin's ongoing bull run.