50 44

Dogecoin’s 3.49% Annual Inflation Promotes Long-Term Stability

Dogecoin (DOGE) maintains a built-in inflation mechanism with an annual rate of about 3.49%, designed to ensure long-term network stability and sustainability. Analysts emphasize that this inflation is intentional, not accidental.

Key Points on Dogecoin’s Inflation Model

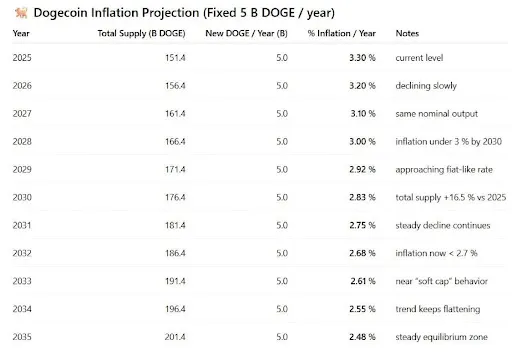

- Dogecoin's circulating supply will be approximately 151.36 billion DOGE by 2025, with 5 billion new coins added annually.

- The inflation rate is expected to decrease gradually, falling below 3% by 2030 and reaching around 2.48% by 2035.

- This model contrasts with Bitcoin's deflationary approach, where supply is limited.

- A steady or decreasing inflation rate encourages spending over hoarding.

Technical Analysis: Potential Bullish Pattern

- Trader Tardigrade identifies a "Bull Flag" pattern in DOGE's price action, suggesting potential for significant upward movement.

- If the pattern holds, Dogecoin could aim for prices around $0.43, significantly above its current level.

- Analyst Ali Martinez highlights $0.18 as a critical support level; maintaining above this may lead to targets of $0.25 and potentially $0.33.