5 0

Ethereum Approaches Critical Cycle Peak Amid Price Rally

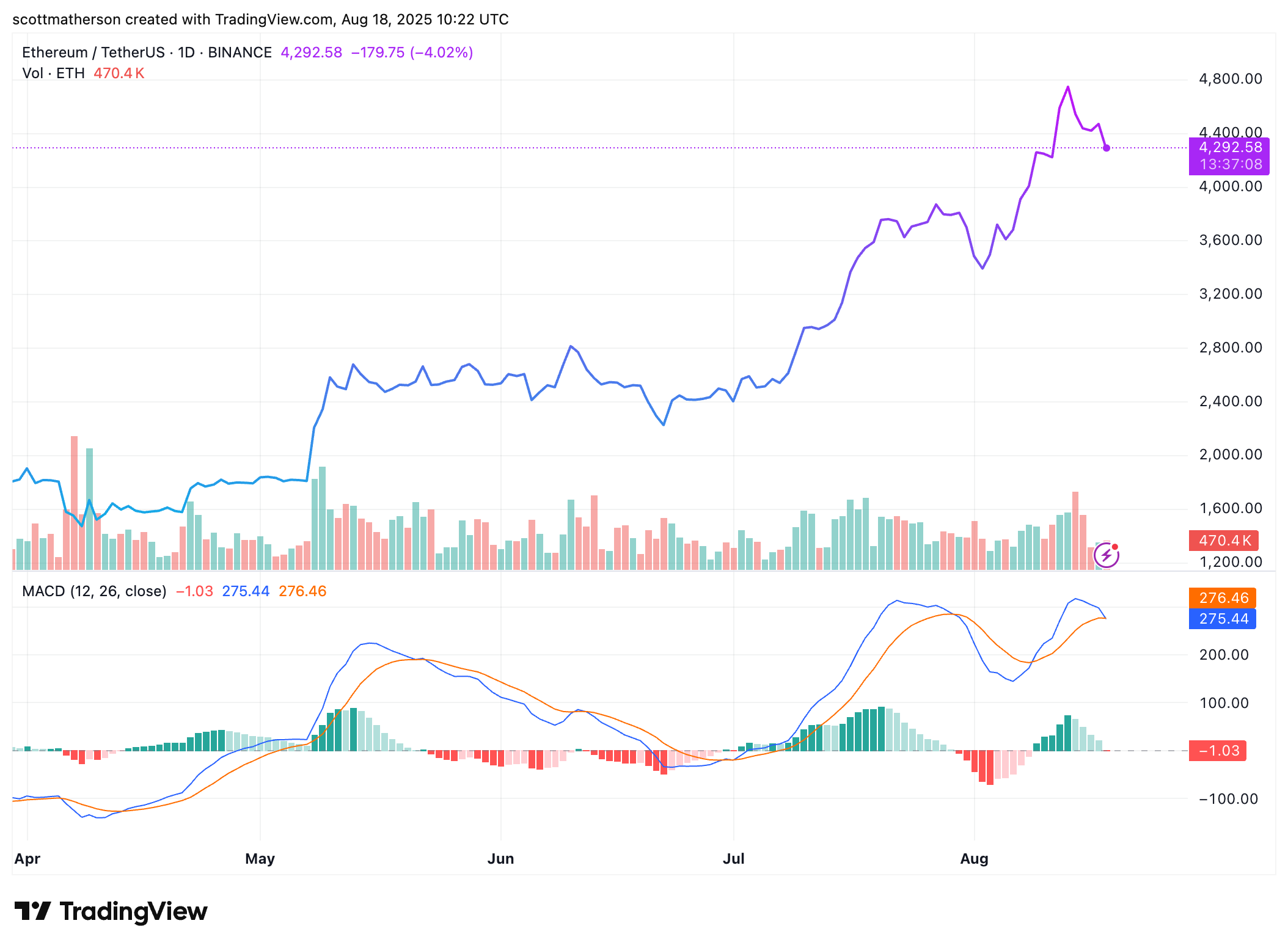

Ethereum (ETH) is experiencing a price rally, prompting discussions about a potential market turning point. Analysts examine previous cycles to determine if current trends signal an impending cycle peak, suggesting it may be time for investors to consider selling.

Key Insights on Ethereum’s Market Cycle

- Analyst Jackis indicates ETH's recent price movements reflect patterns from earlier cycles.

- Past major tops occurred in January 2018 and November 2021, both followed by significant corrections.

- This time, ETH has not yet reached a new all-time high but is approaching critical resistance levels.

- The four-year cycle theory suggests ETH could peak within weeks, particularly in September.

- Jackis advises investors to reassess risks and potentially sell during this period.

Despite ETH's strength, many altcoins are underperforming relative to their past peaks, with prices significantly lower than in 2021. Jackis believes ETH should trade around $2,200 based on current market conditions, while Bitcoin continues to show bullish patterns since late 2022.

Panic Selling or Pre-Breakout Opportunity?

- Ether Wizz notes current panic selling mirrors mistakes made by Bitcoin traders in previous cycles, underestimating institutional demand.

- A recent rebound above the 50-week Simple Moving Average (SMA) could indicate the start of a new rally.

- Similarities exist between Ethereum's current chart and its breakout in 2017.

- Wizz suggests a possible short-term correction of 5% to 10%, but maintains that ETH is in early stages of a move toward a potential all-time high of $10,000.