5 0

Ethereum Attracts $2.87 Billion in Weekly Inflows, Surpassing Bitcoin

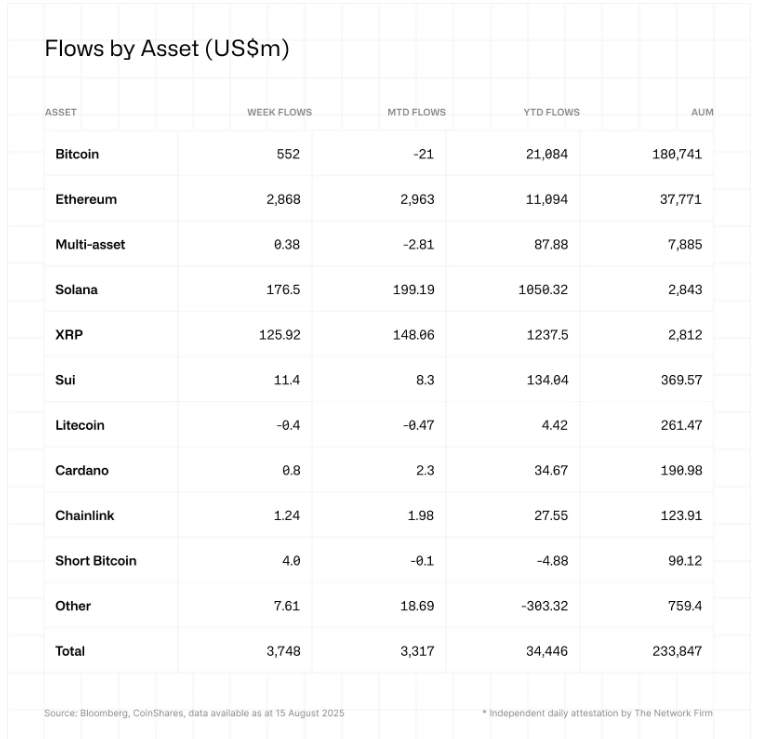

Digital-asset investment products saw inflows of $3.75 billion last week, increasing assets under management to $244 billion as of August 13.

Key Inflow Details

- The US accounted for $3.73 billion of the total inflow.

- Canada added $33.7 million; Hong Kong, $21 million; Australia, $12 million.

- Brazil and Sweden experienced outflows of $10.6 million and $50 million, respectively.

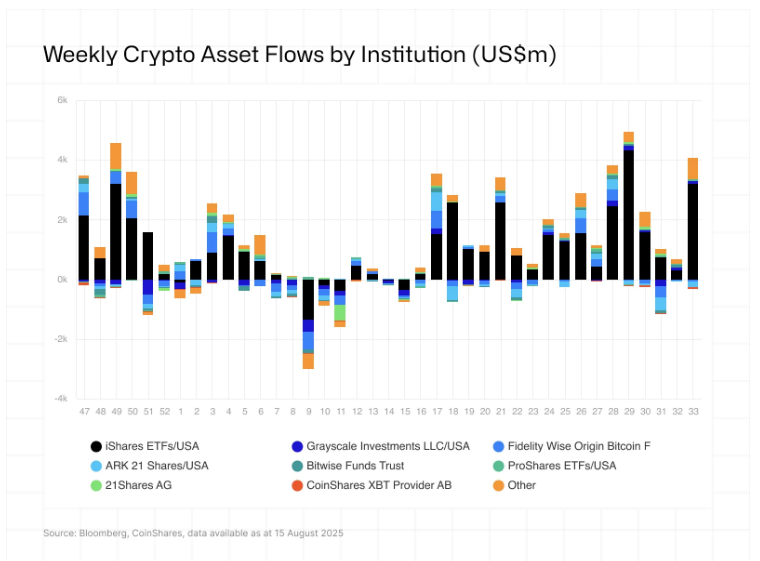

- Majority of inflows were attributed to a single iShares product.

Ethereum Inflows

- Ethereum attracted $2.87 billion (77% of total inflows), with year-to-date net inflows reaching $11 billion.

- Ethereum comprises nearly 30% of assets under management; Bitcoin accounts for 11.6%. Bitcoin’s weekly inflow was $552 million.

- Other notable inflows included Solana at $176.5 million and XRP at $126 million.

- Litecoin and Ton had small outflows of $0.4 million and $1 million, respectively.

Corporate Holdings

- Over 16 companies have added Ethereum to their balance sheets, holding approximately 2.45 million ETH valued at around $11 billion.

- These holdings are largely out of circulation due to being locked in treasuries or cold storage.

- Ethereum does not have a fixed supply; about one million ETH was added last year.

Market Dynamics

- Futures open interest is near $38 billion, indicating potential for rapid price movements.

- Large holders and shifts in futures positions can significantly impact prices.

- Current trends suggest flow-driven market activity rather than broad retail engagement.