Exchanges Risk Obsolescence as Decentralization Efforts Intensify

The exchanges are decentralizing.

Kraken is launching its Ethereum layer-2, Ink, designed to onboard new users into DeFi, leveraging its existing customer base.

Coinbase’s blockchain, Base, encourages extensive on-chain development, as noted by Ink founder Andrew Koller during an Empire podcast.

Ink focuses on specific DeFi use cases rather than general applications. Koller stated the goal is to transfer centralized order book experience to on-chain environments, enhancing user experience, reducing clicks, and increasing security.

"Sequencer-level security" aims to eliminate risks associated with rug pulls and draining contracts, emphasizing a strong commitment to DeFi.

This could blur the lines between centralized finance (CeFi) and DeFi, potentially allowing Kraken users to utilize their centralized exchange (CEX) balances as collateral in DeFi lending applications on Ink.

Coinbase has already shifted USDC deposits to Base, increasing stablecoin supplies from under $1 billion to nearly $4 billion.

The question arises: Could exchange chains become so successful that they make their parent exchanges obsolete?

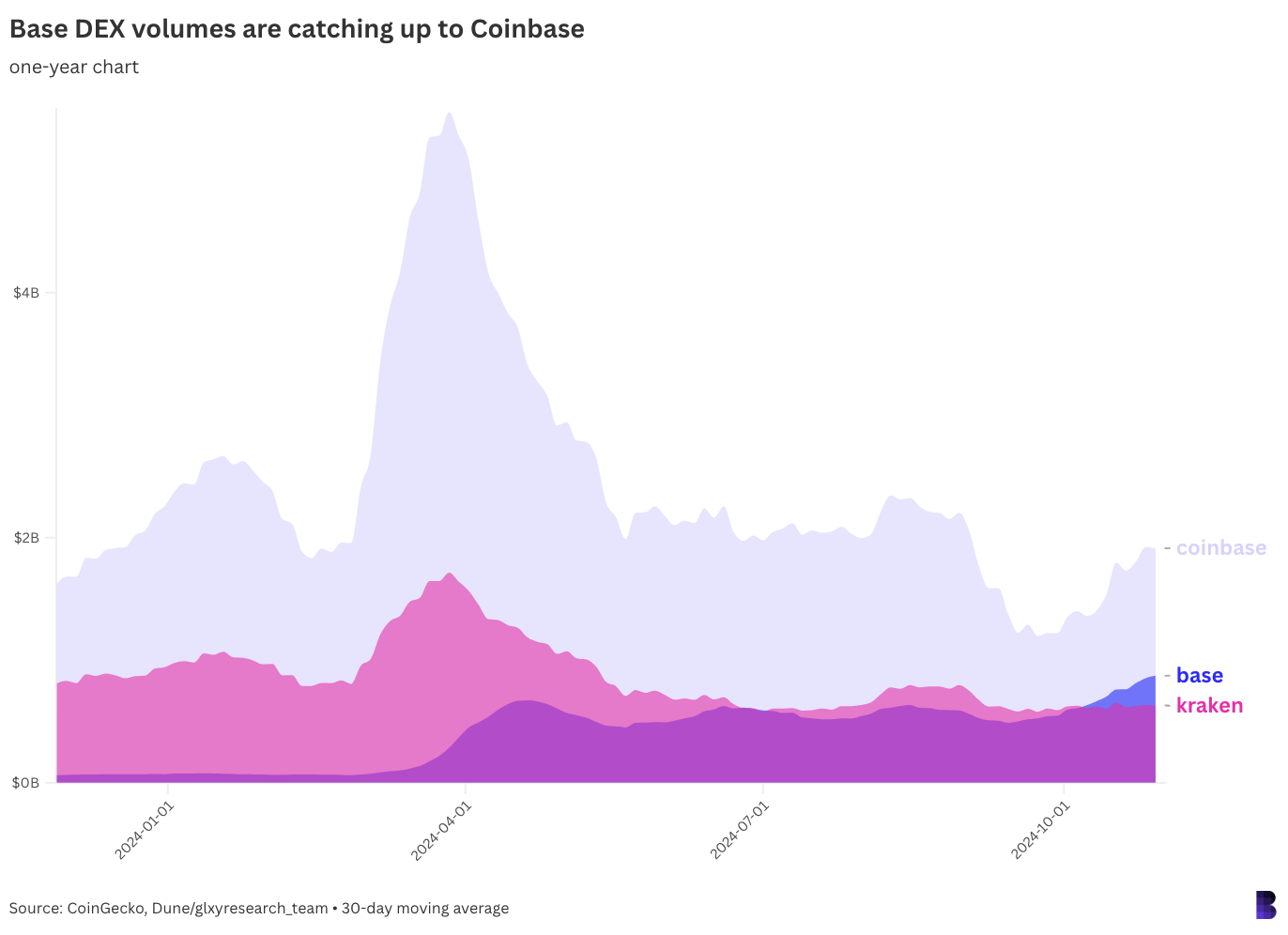

Data shows Base DEX volumes, primarily from Aerodrome and Uniswap, have surpassed Kraken's, with a 30-day moving average of about $873 million compared to Kraken's $630 million, according to CoinGecko.

However, trading volumes on low-cost chains like Base may be influenced by wash trading, which one study estimated at $27.5 billion on Uniswap v2 and v3 pools.

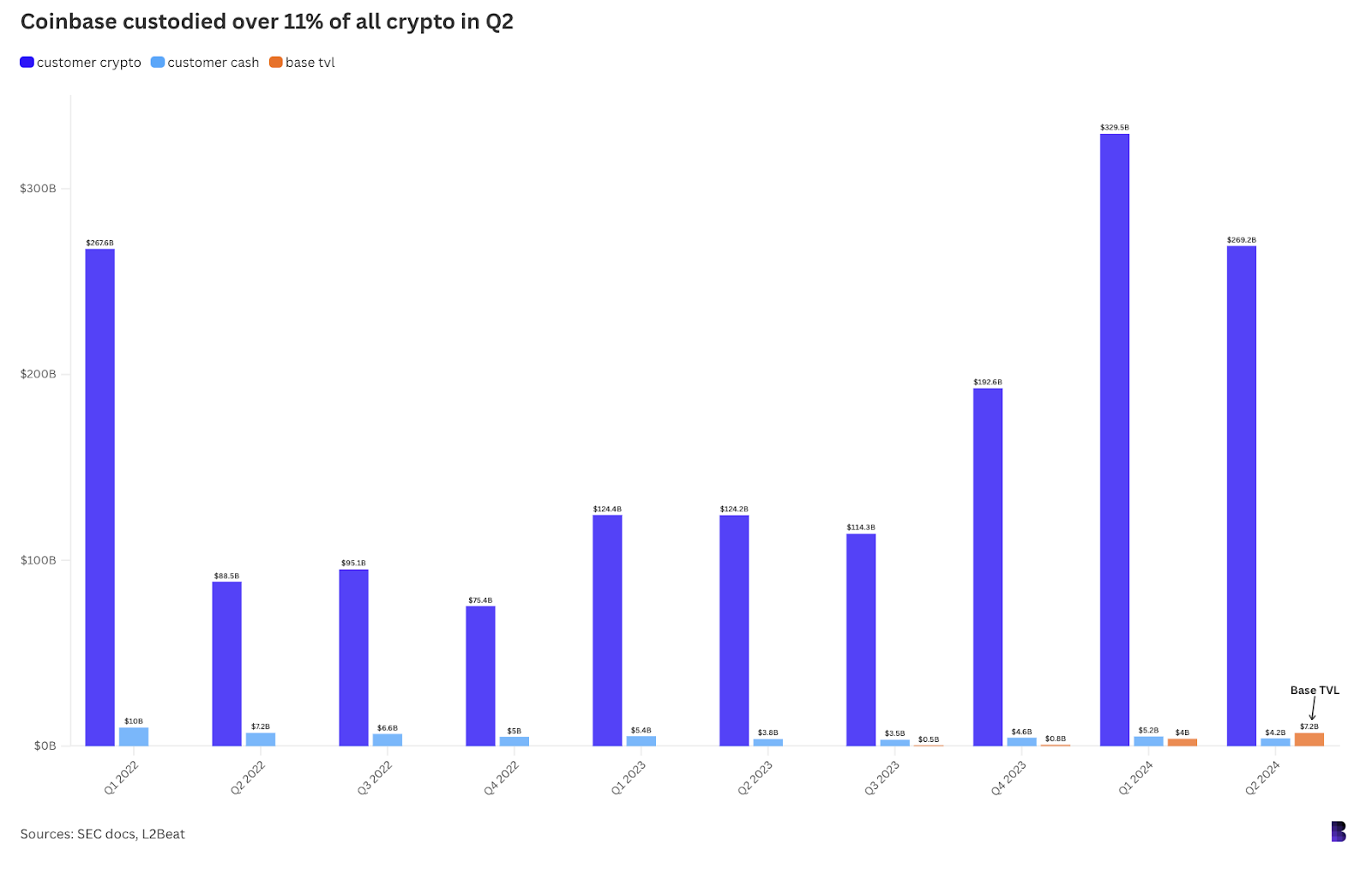

User assets present another consideration. Kraken's custody details remain unclear pending a potential public offering. In contrast, SEC filings reveal Coinbase safeguarded over $273 billion in user assets as of June, with $4.2 billion in cash and the rest in digital assets, representing over 11% of all cryptocurrency at that time.

Base currently holds $7.2 billion in economic value on-chain, exceeding Coinbase's user cash but less than 3% of its crypto holdings. Transferring all Coinbase user crypto to Base is impractical due to significant amounts held in Bitcoin, Ether, and other layer-1 assets.

However, the gap between these platforms may narrow quickly, especially with renewed competition from Kraken. Success for either could render centralized exchanges as outdated as Web2 technologies.