12 2

Fidelity Investments Plans to Launch New Stablecoin Amid Market Growth

Fidelity Investments plans to launch a stablecoin through its digital assets division, potentially backed by US Treasurys. This move comes as regulatory risks for crypto assets decrease and competition in the stablecoin market intensifies.

Key points include:

- A bill for stablecoin legislation is expected to be introduced in the House today.

- World Liberty Financial announced the USD1 stablecoin, backed by short-term US T-bills and dollar deposits, custodied by BitGo.

- USD1 will not offer yield, contrasting with yield-bearing stablecoins becoming standard in DeFi.

- Stablecoins from regulated entities may avoid yield-bearing features to sidestep security classifications.

- WLF may use business development deals to attract deposits for USD1.

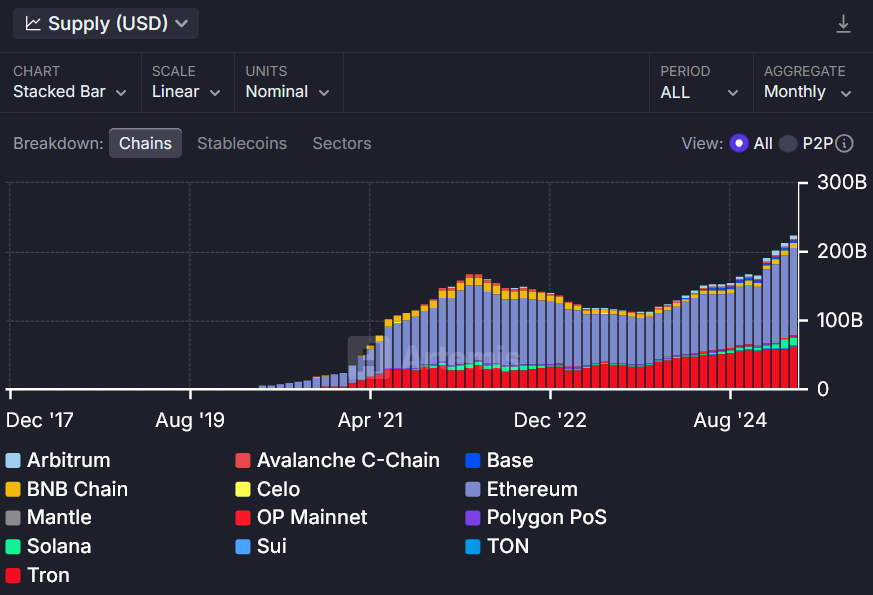

- The total on-chain stablecoin market cap reached $225.9 billion, with 56.5% on Ethereum.