9 2

Inflation-Adjusted Gold Price Reaches Record High Above $3,635

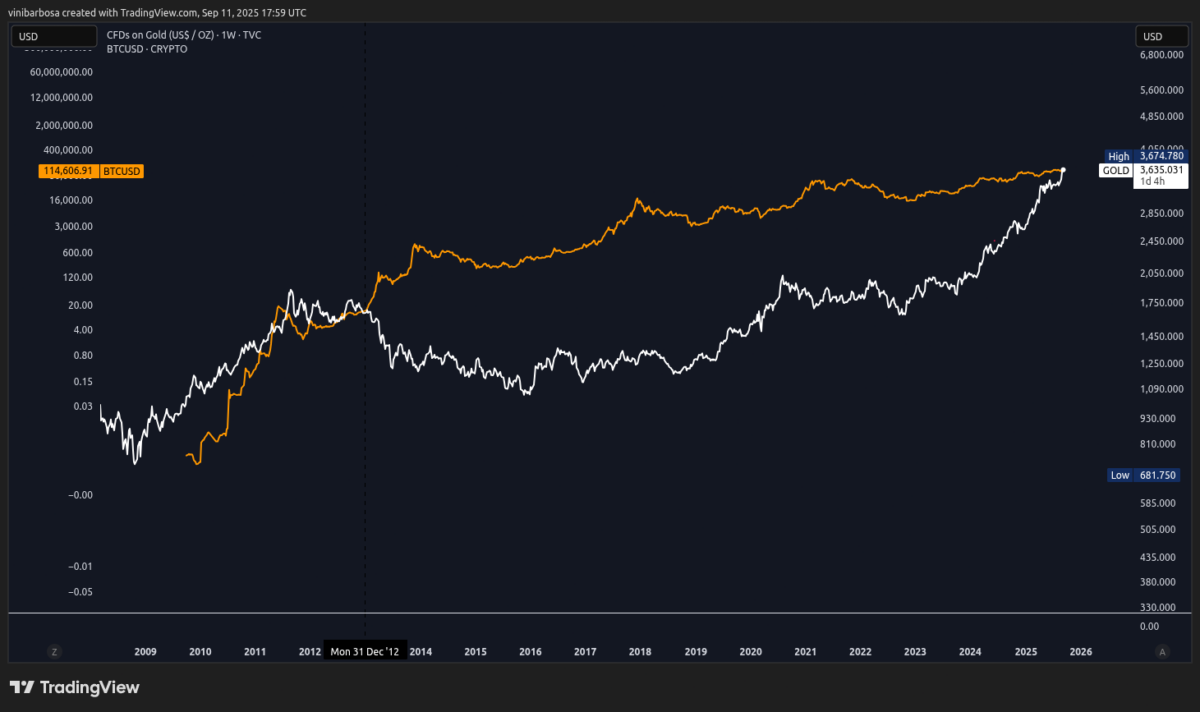

Gold and Bitcoin Reach New Highs Amid Economic Shifts

The inflation-adjusted price of gold has reached a record high, exceeding $3,610 per ounce, its highest since the 1980s. This surge is attributed to rising inflation and anticipated interest rate cuts, creating favorable conditions for gold and affecting Bitcoin's value.

- Inflation Impact: The US Consumer Price Index (CPI) rose to 2.9% in August, up from 2.7% in July, increasing the inflation adjustment on gold prices.

- Interest Rate Speculation: A lower-than-expected US Producer Price Index (PPI) suggests potential for a 50 basis-point interest rate cut at the Fed's upcoming meeting.

- Global Factors: Political instability, trade disputes, and a declining US Dollar Index have boosted gold as a safe-haven asset.

- Central Bank Activity: Emerging markets like China, India, Russia, and Turkey are increasing gold reserves to diversify from the US dollar.

Bitcoin and Gold Dynamics

- Price Levels: As of now, Bitcoin trades at approximately $114,600 per coin, while gold is at $3,635 per ounce.

- Historical Trends: Both assets show cyclical behavior, with Bitcoin historically outperforming gold but recently stabilizing against it.

- Market Signals: Recent minting of 2 billion USDT suggests potential momentum for cryptocurrencies, although still trailing behind gold's performance.

This period marks financial maturity for Bitcoin, balancing its growth with traditional commodities like gold, as both respond to economic indicators and global market conditions.