Bitcoin Market Leverage and Coinbase Premium Insights from Recent Analysis

Bitcoin is currently recovering from a downturn, indicating potential preparations for its next bull run. Market participants are analyzing trends in exchange leverage and liquidity, with CryptoQuant highlighting that leverage ratios on centralized exchanges have become a focus for assessing risks and opportunities within the crypto market.

CryptoQuant's recent data emphasizes the importance of these ratios for evaluating the financial stability of exchanges and their impact on trading dynamics.

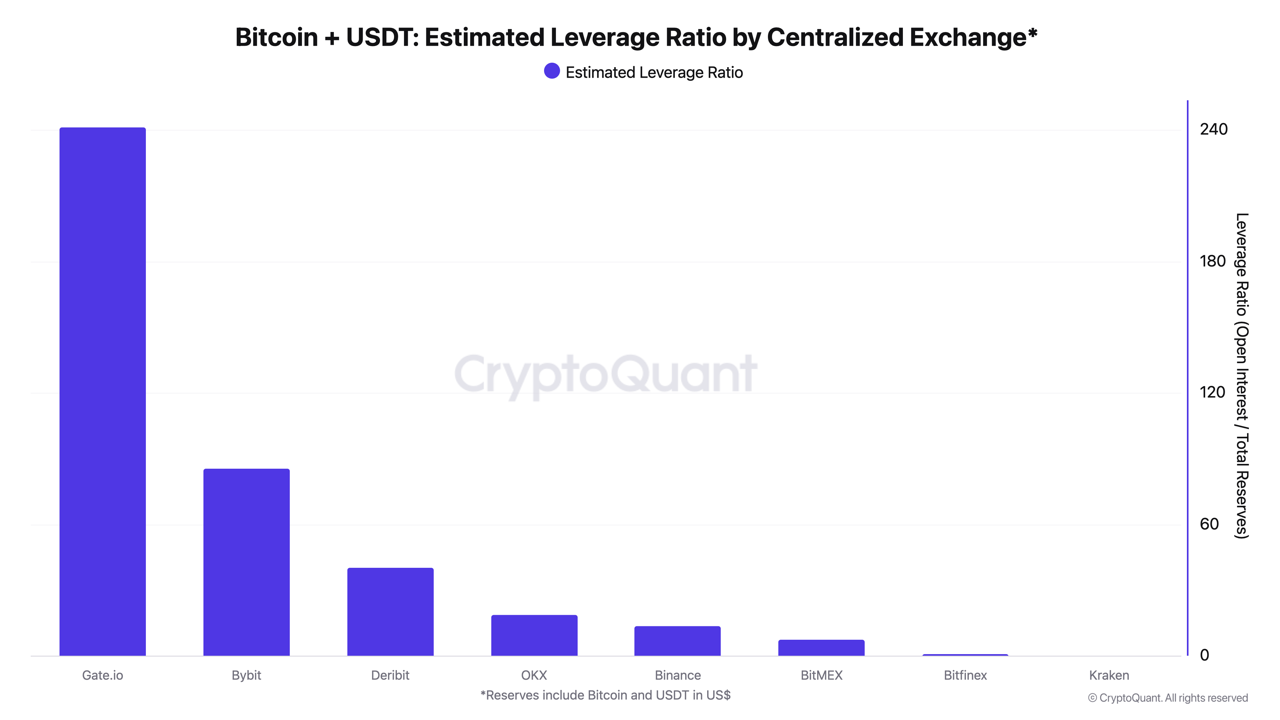

Leverage Trends And Exchange Stability

Analysis shows Binance has strong reserves relative to its open interest, indicating a robust ability to manage market volatility. In contrast, smaller exchanges like Gate.io and Bybit display higher leverage ratios, raising concerns about their capacity to withstand liquidity crunches.

Monitoring these metrics is critical, especially following events like the collapse of FTX in November 2024 due to insufficient reserves against high open interest.

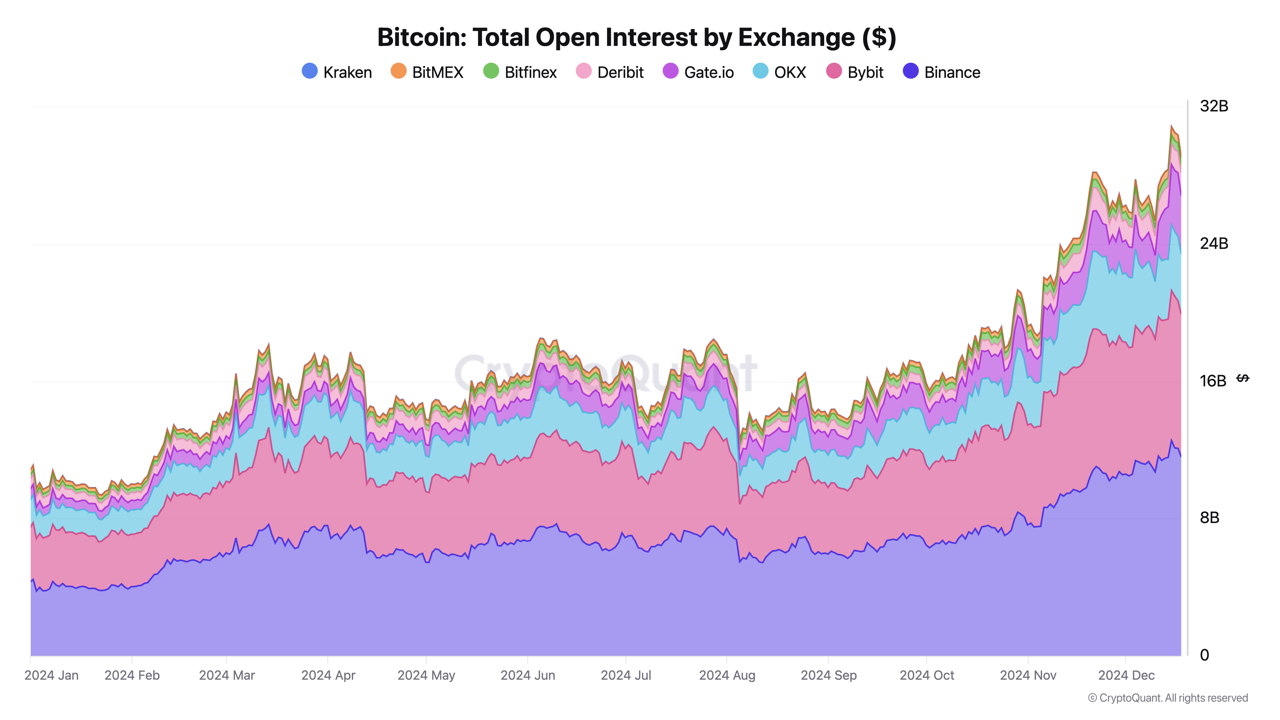

CryptoQuant's findings reveal that Binance leads in maintaining a stable leverage ratio while increasing its Bitcoin open interest from $4.45 billion in December 2023 to $11.64 billion in December 2024. Binance's Bitcoin, Ethereum, and USDT reserves consistently exceed its open interest, ensuring liquidity during volatile market conditions. Its leverage ratio increased modestly from 12.8 to 13.5 over the past year, remaining the lowest among its peers.

In contrast, Gate.io, Bybit, and Deribit show significantly higher leverage ratios of 106, 86, and 32, respectively. CryptoQuant noted:

These figures indicate that their Bitcoin open interest exceeds or approaches their reserves, with similar patterns seen for Ethereum.

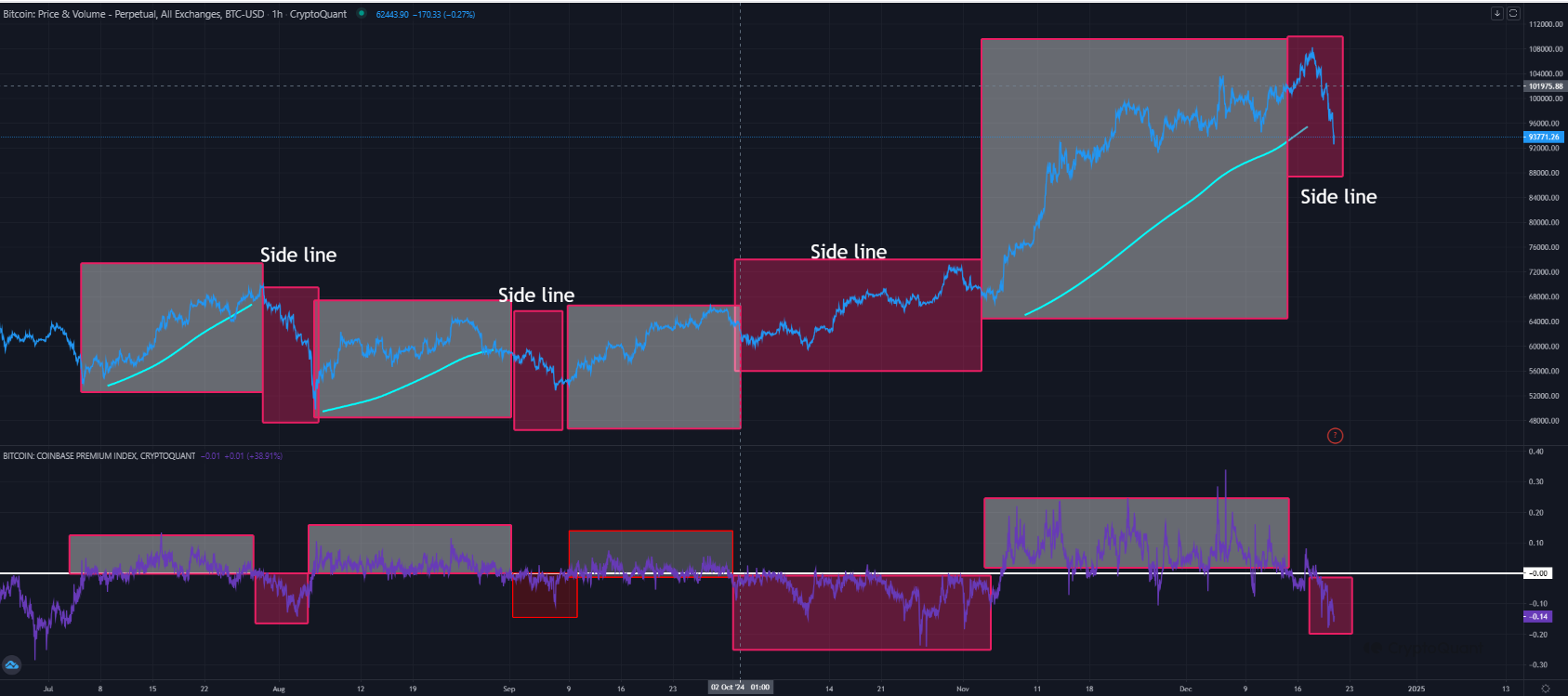

Coinbase Premium: A Key Indicator For Bitcoin Traders

Another important metric for Bitcoin market sentiment is the Coinbase Premium, which tracks the price difference between Bitcoin on Coinbase and other exchanges. It serves as an indicator of institutional demand and market trends.

A CryptoQuant analyst suggested that traders should be cautious based on Coinbase Premium signals: a negative premium may warrant staying on the sidelines, while a positive premium indicates strong demand, presenting a strategic entry point for traders seeking to capitalize on major market trends.

Current data shows this metric is on the negative side, suggesting caution. The analyst added:

This approach might lead to missing some small trends but allows participation in significant trends while avoiding losses during dips or downtrends.

Featured image created with DALL-E, Chart from TradingView.