Hyperliquid (HYPE) Prepares for Bullish Trend Amid Whale Purchases

Bitcoin (#BTC) is currently attempting to recover from the $94,000 support level, while Hyperliquid (#HYPE) is poised for a bullish cycle.

Hyperliquid is a crypto-derivatives trading platform utilizing its proprietary HyperBFT consensus. It enables gas-free perpetual futures trading on its blockchain.

Hyperliquid has experienced a 2.91% increase in the last 24 hours and aims to sustain its 30-day bullish trend of 785% as New Year’s Eve approaches.

Hyperliquid (HYPE) Prepared for Growth

The HYPE token is currently priced at $28.31, showing an intraday increase of 1.37%. The 4-hour chart indicates a rising channel pattern in HYPE price action.

The token trades near a local support trend line. With intraday recovery and lower price rejection, HYPE may target resistance at $29.49, bolstering chances for a bullish recovery.

The MACD and Signal lines are nearing a bullish crossover, while the 4-hour RSI line is recovering towards the halfway mark.

These momentum indicators suggest a potential trend shift, with a breakout rally possibly reaching the previous peak of $34.48. This could lead to testing the overhead resistance trend line around $38.22. Conversely, if HYPE closes below the local support trend line, it may retest crucial support near $21.84.

Whale Activity Indicates Confidence in HYPE

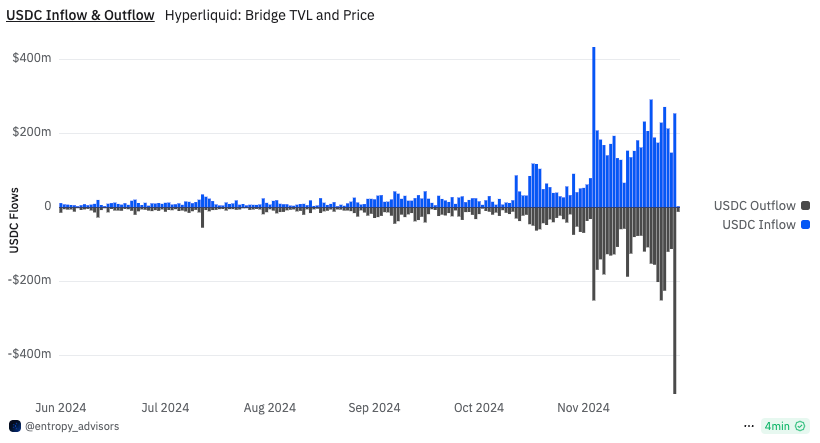

A significant purchase was detected, with a whale creating a new wallet and bridging 18.3 million #USDC to Hyperliquid to acquire HYPE tokens.

Over the past year, this whale has spent 12.22 million USDC to acquire 4,428,867 HYPE tokens, averaging approximately $28.5 per token.

Potential for Increased Short-term Volatility

Despite the whale's confidence suggesting a bullish trend for HYPE into 2025, the Hyperliquid network recorded a net outflow of $256k in the last 24 hours.

This outflow correlates with reports of North Korean hackers operating on the platform, who have exploited nearly $1.34 billion in the crypto market within the year. The significant outflow appears to be a precautionary measure against potential losses linked to these security threats.