2 0

Monero plunges 17% amid market turmoil, remains 39% below peak

Monero (XMR) experienced a 17% drop in 24 hours, reaching $485.69, following a decline from its all-time high of $797.73 on January 14. The trading volume hit $322 million, and XMR is now 39% below its peak with a market cap of $8.95 billion, ranking it 21st among cryptocurrencies.

Exploit Context and Technical Breakdown

- A $282 million social engineering attack on January 10 resulted in the theft of 2.05 million LTC and 1,459 BTC, which were converted to Monero, causing a temporary price increase.

- Technical analysis indicates a loss of trend support around $560, signaling potential further corrections unless reclaimed soon.

Broader Market Conditions

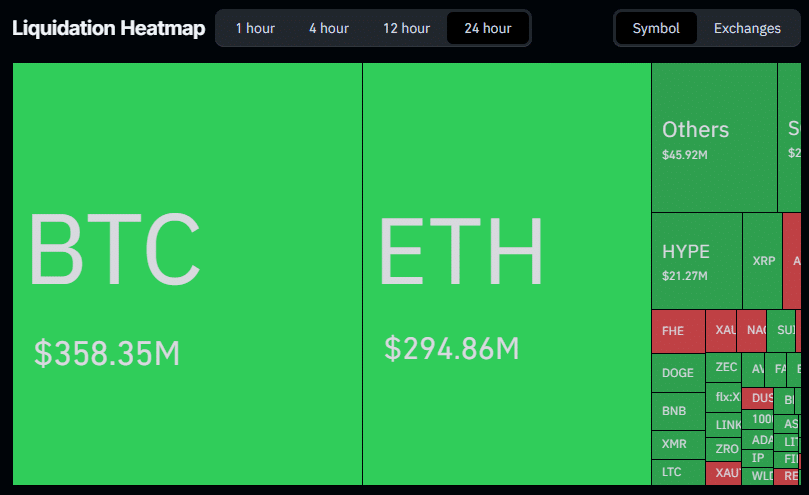

- Total crypto market liquidations reached $857 million, with longs accounting for $750 million.

- XMR derivatives activity decreased by 14.15% to $214.27 million.

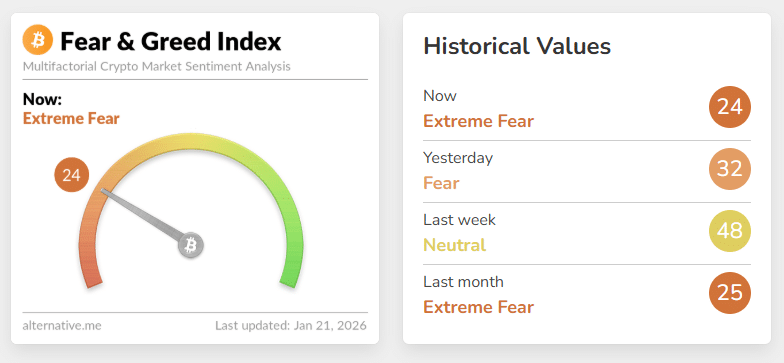

- The Fear & Greed Index fell to 24, indicating extreme fear, as the overall market capitalization declined to $3.09 trillion.

Despite recent volatility, Monero saw significant growth in 2025, gaining 129%, and was compared to historical breakout patterns by analysts. Earlier gains pushed the privacy coin sector's value above $20 billion.