8 0

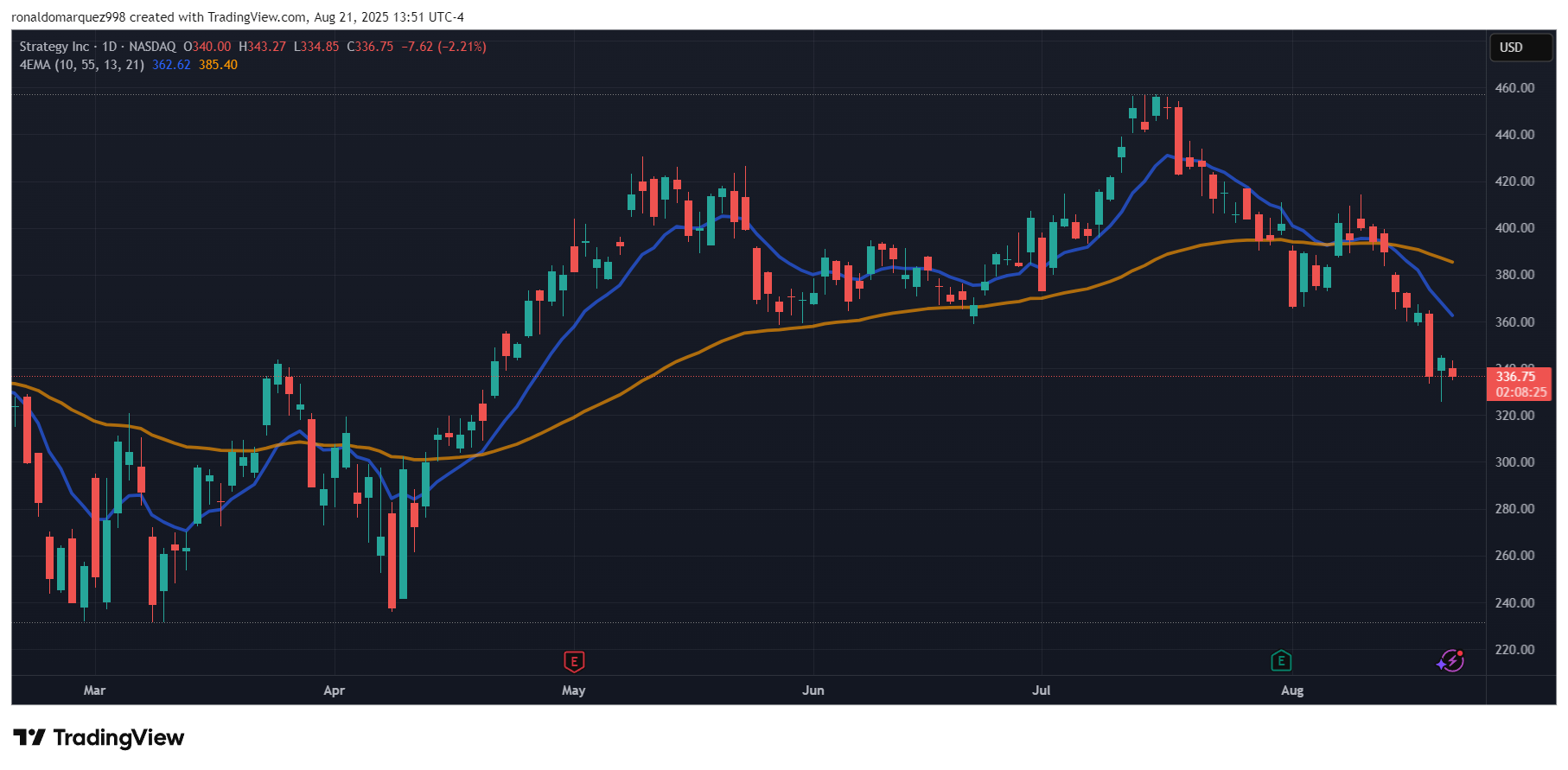

Strategy (MSTR) Stock Falls 19% Amid Bearish Analyst Forecasts

Strategy's stock (MSTR) has declined nearly 20% since last month amid a broader market correction. Analyst Gus Galá from Monness, Crespi, Hardt maintains a Sell rating with a price target of $175.

Analyst Cautions Against Long Positions In Strategy

- Shares fell 2.4% on Thursday, closing at $336.48.

- The company is the largest corporate holder of Bitcoin, holding over 600,000 BTC.

- Despite a 140% increase in stock value over the past year, the volatility of Bitcoin poses risks.

- Galá notes that a sustained bull run in Bitcoin is necessary for stock recovery.

- Current market cap-to-Bitcoin ratio is 1.34-to-1; caution advised against both short and long positions.

- Skepticism exists regarding the sustainability of the market cap multiple due to credit concerns related to Bitcoin acquisitions.

Crypto Stocks Suffer Setbacks

- Credit agencies unlikely to grant investment-grade ratings to Strategy due to reliance on unrealized Bitcoin gains.

- Stable Bitcoin perception needed for favorable debt terms.

- Bitcoin valuation has dropped 9% from recent highs, currently consolidating between $112,000 and $113,000.

- Circle’s shares fell 4% post-IPO excitement.

- Coinbase’s shares approached $300 support, down 2.5% from Wednesday.