ParaFi Predicts Tokenized Assets Will Surpass Digital Asset Value by 2030

The holidays provide an opportunity to reflect on the past year and forecast future trends. ParaFi discussed significant predictions for 2030 in the Empire podcast, focusing on tokenized real-world assets (RWAs) and stablecoins.

Tokenized Real-World Assets

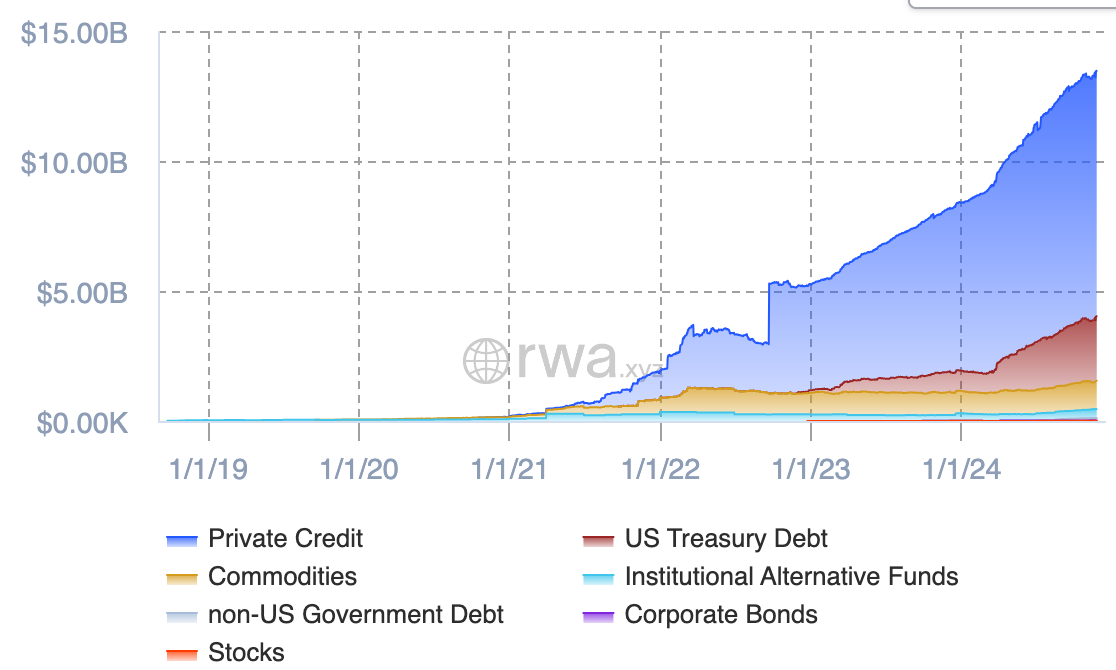

Excluding stablecoins, the total value of RWAs has reached nearly $13.5 billion. While the current crypto market cap is around $3.4 trillion, RWAs have increased over 50% in value over the past year. Ben Forman from ParaFi highlighted that the financial sector remains outdated, lacking modern experiences similar to Amazon's impact on retail. Tokenization enables programmability in assets, reducing reliance on traditional legal and administrative frameworks.

Currently, tokenized treasuries comprise 62% of this market. When combined with stablecoins, the total market cap approaches $200 billion.

Stablecoins

ParaFi forecasts that by 2030, stablecoin supply could reach 10% of the M2 money supply in the US, currently at about 1%. The potential for fintech companies to adopt stablecoins without legacy system constraints supports this projection. Kevin Yedid-Botton noted possibilities for yield-bearing reserves backing stablecoins.

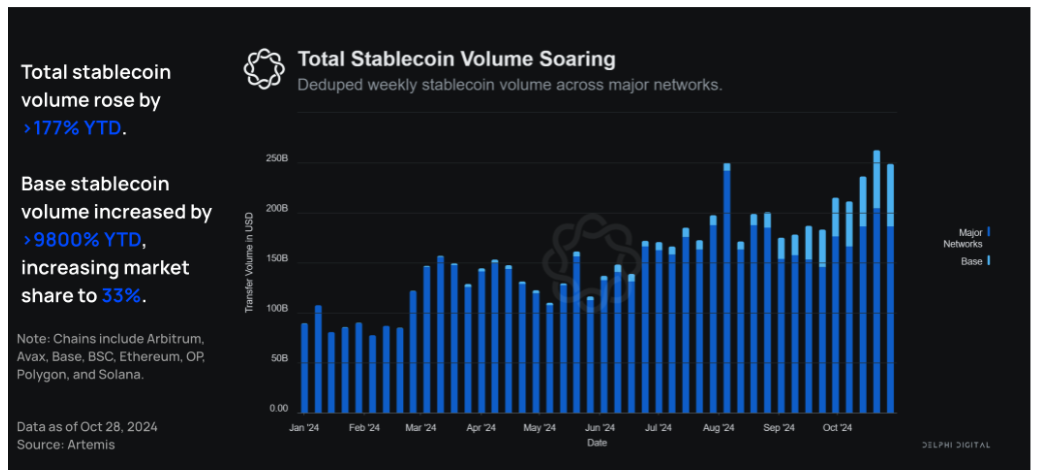

A recent Delphi Digital report indicated weekly stablecoin transfer volume reached $302 billion, a 235% increase year-to-date, suggesting stablecoins are integral to a growing global digital economy.

These predictions indicate strong growth potential for both RWAs and stablecoins moving forward.