Solana Achieves New All-Time High of $262 After Three-Year Recovery

Solana (SOL) has reached a new all-time high (ATH) of $262, marking a significant recovery after experiencing a low of $8 during the FTX exchange collapse and subsequent crypto bear market.

Solana Makes Historic Recovery, Eyes USDT Flippening

Solana, often referred to as an “Ethereum killer,” is gaining attention once again. After its decline post-FTX collapse, SOL has shown considerable recovery over the past two years.

Currently, SOL ranks as the fourth-largest cryptocurrency, boasting a market cap exceeding $123 billion. It is only $8 billion short of surpassing Tether’s (USDT) market cap of $130 billion.

SOL requires a further 10% price increase to overtake USDT and become the third-largest cryptocurrency, following Bitcoin (BTC) and Ethereum (ETH).

Given its recent performance, SOL may surpass USDT's market cap before year-end, having surged 75% from $148 on November 4 to $259 recently.

The broader crypto market has gained momentum with the election of pro-crypto Republican Donald Trump, but attributing SOL’s rise solely to this would be misleading.

Memecoin Frenzy, Increased Network Activity, ETF Potential Helped SOL

Several factors have contributed to SOL's resurgence, particularly the ongoing memecoin frenzy, which has become a key narrative in the crypto sector.

Memecoins, especially those built on the Solana blockchain, have significantly influenced the market, with their total market cap surpassing $10 billion in October.

This trend has led to increased network activity for Solana, which saw a 42% month-over-month rise in active addresses between September and October, totaling approximately 123 million.

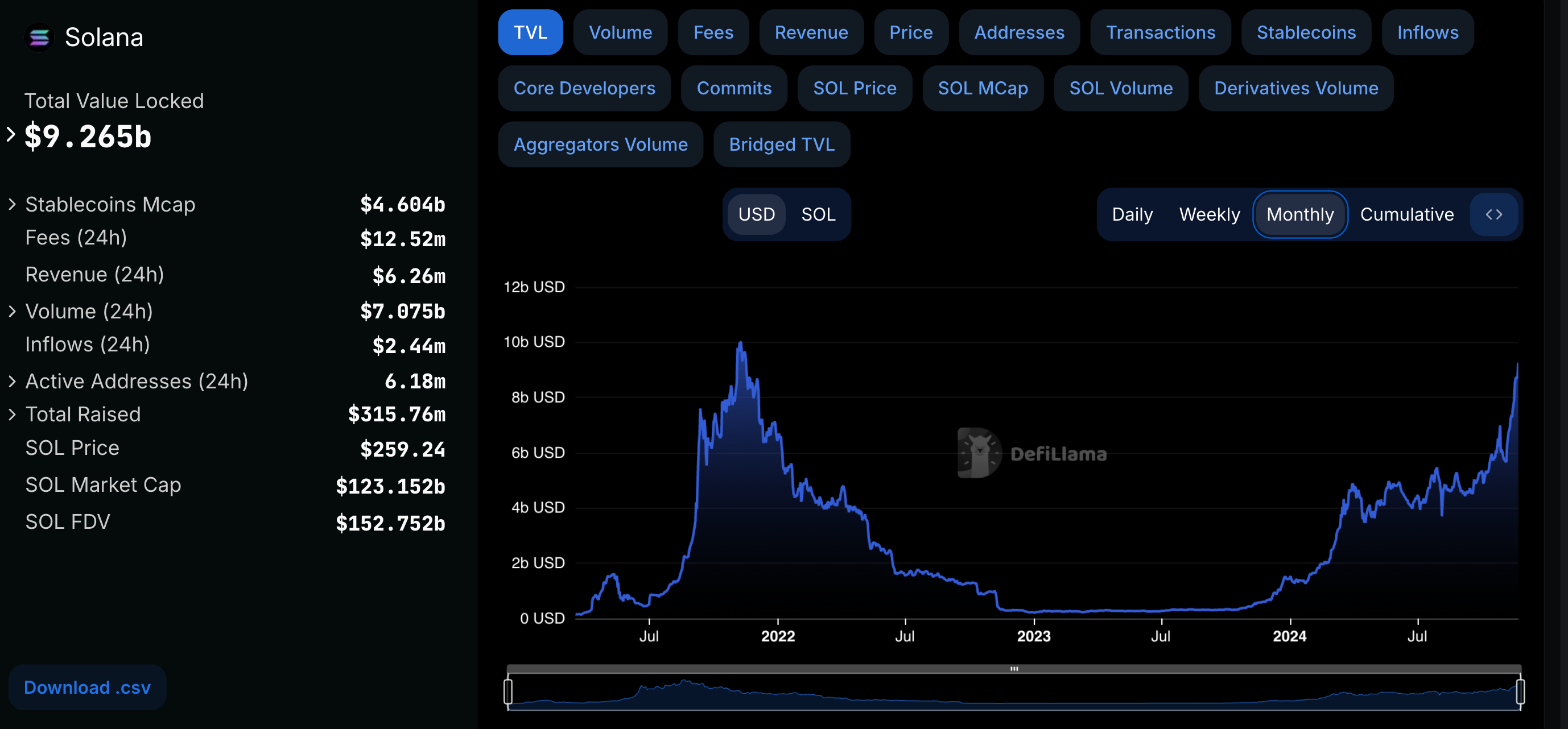

In addition to benefiting from the memecoin narrative, Solana has experienced heightened decentralized finance (DeFi) activity throughout the year. According to DefiLlama data, Solana hosts the second-largest DeFi ecosystem globally, with a total value locked (TVL) of $9.265 billion.

There are also increasing prospects for a Solana-based exchange-traded fund (ETF). Recent reports indicate that the US Securities and Exchange Commission (SEC) is in discussions with various asset managers regarding a potential spot Solana ETF.

While SOL reaching a new ATH is noteworthy, experts suggest there remains substantial growth potential. Currently, SOL trades at $259, reflecting a 6.2% increase over the past 24 hours.