13 0

Solana Stablecoin Supply Reaches $15B Amid Rising ETF Demand

Investors are increasingly engaging with Solana-linked products, boosting the network's profile.

Stablecoin Liquidity Milestone

- Solana's stablecoin supply reached approximately $15 billion, with USDC making up 75% of this amount.

- This concentration facilitates large transactions on Solana's chain more efficiently than some competitors.

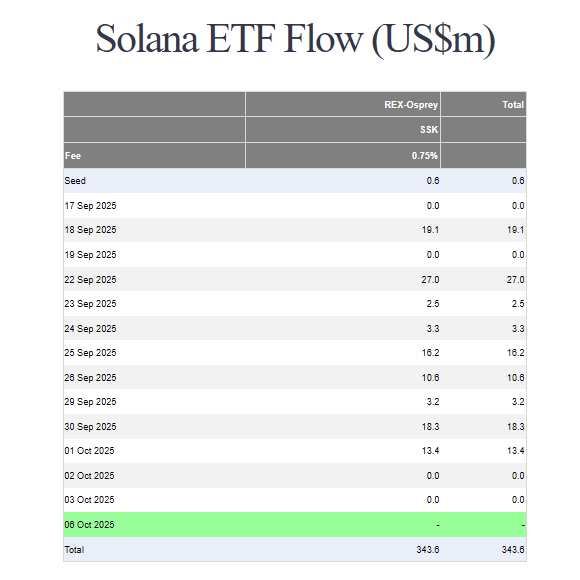

- US-listed ETFs tied to Solana have seen rapid uptake, providing institutions an easier entry point into the token market.

- The REX-Osprey SOL + Staking ETF quickly surpassed $100 million in AUM shortly after launch.

ETFs Increase Capital Flows and Visibility

- REX-Osprey’s crypto ETFs now manage over half a billion dollars combined.

- ETFs allow major investors to gain exposure without direct interaction with wallets or custody solutions.

Network Upgrades Enhance Attractiveness

- Recent upgrades aim to reduce delays and costs for traders using stablecoins like USDC on Solana.

- These technical improvements enhance the network's appeal for high-frequency trading and tokenized asset projects.

Regulatory Framework Impact

- US regulation and approvals influence Solana's institutional appeal.

- Multiple firms have updated their ETF filings as they await SEC approval.

- US political context continues to affect institutional demand dynamics.