6 0

Stablecoin Market Cap Nears $310B at Record Highs Despite Crypto Crash

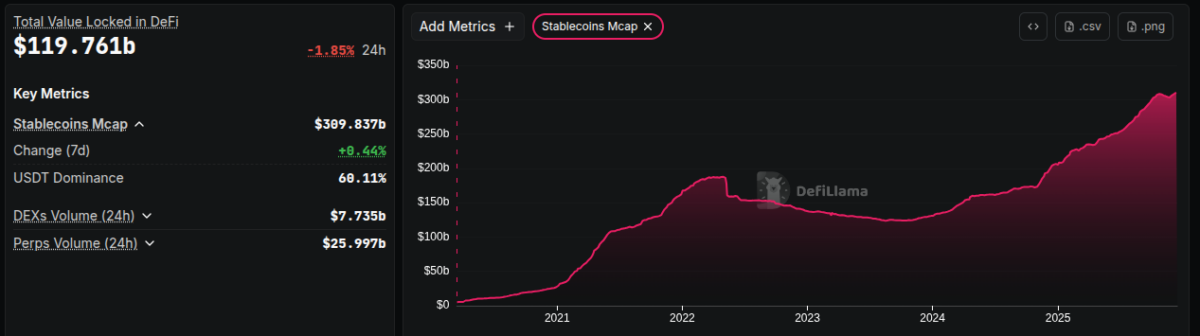

The stablecoin market capitalization is nearing $310 billion, reaching an all-time high amid challenging market conditions with crashing cryptocurrency prices and significant liquidations from leveraged positions.

- As of December 15, the stablecoin market cap reached $309.83 billion, marking a 0.44% increase in 24 hours.

- Tether dominates the stablecoin market with a 60% share.

- This represents a 50.95% year-to-date growth from $205.24 billion on January 1, 2025.

This growth indicates capital inflow into stablecoins, suggesting interest in crypto products remains despite volatility. Capital is not exiting crypto markets but shifting towards stablecoins.

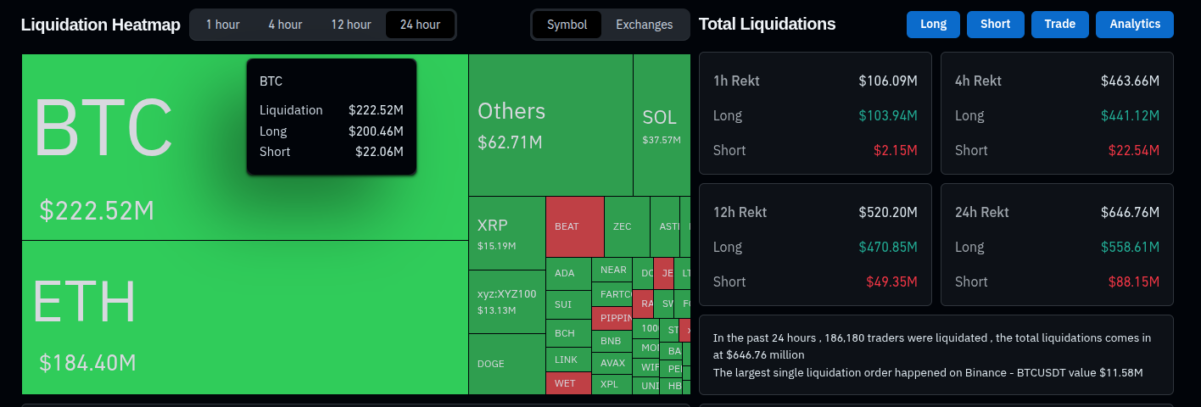

Crypto Market Crashes: Over $600M Liquidations

- On December 15, over 185,000 traders faced a crash leading to $650 million in derivative market liquidations, primarily from long positions.

- Bitcoin accounted for $222 million in daily liquidations, with $200 million from long positions.

Despite the downturn, significant capital moves into stablecoins, indicating potential future buying opportunities as investors may seek to re-enter the market at favorable conditions.

- BTC attracted $522 million in investment product inflows, and XRP followed with $245 million.

- BitMine Immersion expanded its Ethereum holdings with a $320 million purchase.

- Visa announced a stablecoin advisory practice for financial institutions, promoting asset class adoption.