9 0

Stablecoin Transactions Surge in May as Supply Reaches $244 Billion

May experienced a significant rise in stablecoin transactions, establishing them as the primary method for on-chain payments. This shift reflects increased reliance on dollar-pegged coins for value transfer.

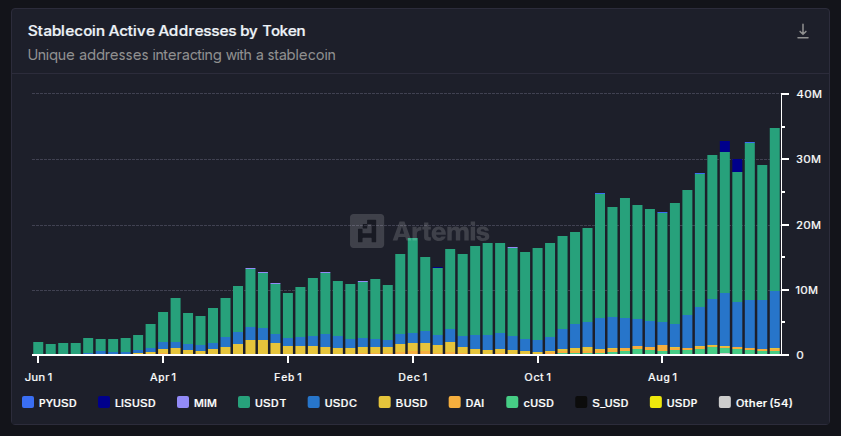

Spike In Wallet Activity

- Over 33 million wallets engaged with stablecoins in May, indicating a notable increase.

- Traders and DeFi users preferred stablecoins to maintain USD value amidst a recovering market.

Shift To Faster Networks

- BNB Smart Chain recorded over 10 million active wallets for stablecoin transactions in early May.

- TRON followed closely with over 9 million active wallets.

- Users favored these networks for lower fees compared to Ethereum.

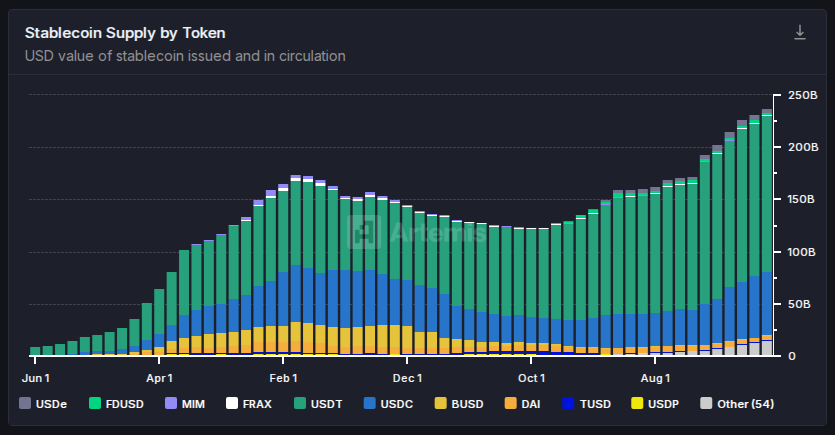

Stablecoin Supply Growth

- Total stablecoin supply reached $244 billion, up nearly 3% in one month.

- Tether's USDT grew by almost $4 billion, dominating the supply at over $153 billion.

- Most new USDT was issued on TRON, which holds nearly $78 billion, compared to Ethereum’s $73 billion.

- USDC supply slightly decreased due to outflows but remains around $60 billion across all chains.

Payments And Bridges Overtake Cards

- Stablecoins facilitated over $2 trillion in payments, surpassing Visa's transaction volumes.

- USDC’s cross-chain transfers increased significantly, with the CCTP bridge handling $7.7 billion, an 83% month-on-month rise.