17 0

Stablecoin Payment Volumes Expected to Exceed $1 Trillion by 2030

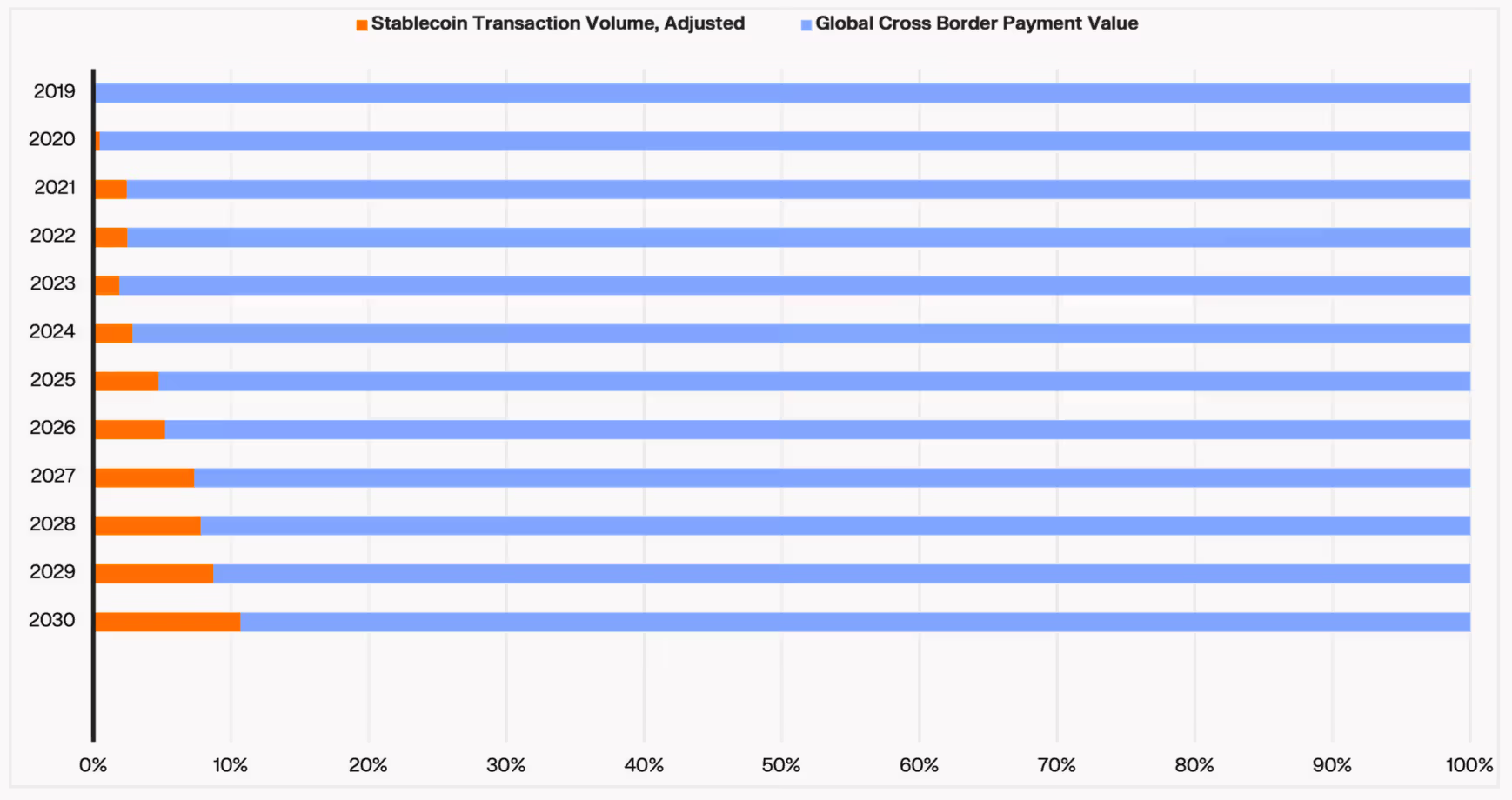

Stablecoin payment volumes are expected to exceed $1 trillion annually by 2030, as reported by Keyrock and Bitso. The growth will be fueled by institutional adoption in B2B, P2P, and card payment sectors.

Key points from the report include:

- Stablecoins outperform traditional payment methods in speed and cost.

- A $200 bank transaction may incur fees up to 13% and take days, while stablecoins can process transactions in seconds at lower costs.

- The $7.5 trillion daily FX market mainly settles on a T+2 basis; on-chain FX with stablecoins could enable instant settlements and reduce counterparty risks.

- With regulatory clarity and increased liquidity, stablecoins might handle 12% of cross-border payment flows by 2030.

- Major fintech firms are predicted to integrate stablecoin infrastructure, similar to the adoption of SaaS tools.

- Current stablecoin market cap stands at $260 billion; it could reach 10% of U.S. M2 money supply, influencing Federal Reserve interest rate management.